Getty Images/iStockphoto

Avaya looks ahead with acquisition, cloud CX, RingCentral deal

Rumors of Avaya's demise have been greatly exaggerated, CEO Alan Masarek assures longtime customers while making acquisitions, partnership deals and building a SaaS CX stack.

Fueled by the determination of its CEO, Avaya plans to move full speed ahead on enabling its customers to modernize their tech stacks and integrate with other vendors while releasing its own cloud CX stack for contact center environments.

This week, Avaya released several integrations and partnerships that showed how the company plans to catch up to a market that is pushing contact centers into generative AI for agent assistance, customer self-service and workflow automation.

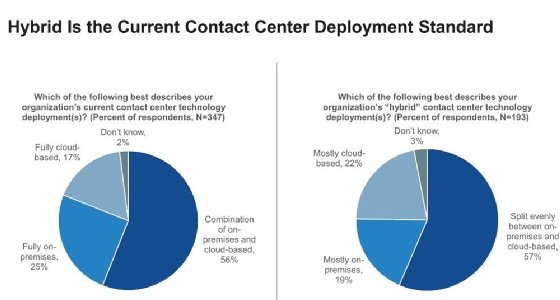

The first wave of capabilities are configurations that support flexibility to accommodate different vendors on the Avaya Experience Platform (AXP) and to better support hybrid on-premises and cloud customer service. AXP will include a bring-your-own-bot framework, which lets users use self-service bots or engage with other vendors for those operations.

Avaya Agent Assist is packaged as a service that can be used on-premises or in the cloud. Workforce management analytics company Calabrio -- a longtime Avaya partner -- is now built natively into AXP.

Playing to existing Avaya users is a good strategy for CEO Alan Masarek, said Dan Miller, founder of Opus Research. He recognizes that his company's customer base is hanging in and not eroding as fast as some experts had predicted. Opening Avaya's products to leading customer service and unified communications cloud collaboration tools will sustain the company while it gets back on track.

"It's a ready-made market across the entire communications, collaboration, and contact center sides," Miller said. "I think Masarek is honor-bound to deliver the most modern solutions he can…It's the sustainability strategy that has the highest probability of success."

Edify acquisition speeds journey management additions

Avaya's contact center as a service (CCaaS) competitors, such as Genesys and Nice CXone, have added customer journey management -- sometimes called journey orchestration or channel routing -- features to their platforms.

These tools help contact centers keep track of their customers as they move through digital and phone channels and automate pathways to solve their problems efficiently. Journey analytics typically examine customer flow through those channels to identify bottlenecks and determine methods of improving service.

Avaya will soon enhance its journey management and analytics capabilities in AXP through last week's acquisition of Edify for an undisclosed sum. Masarek said the restructuring of Avaya's debt -- what he terms the financial transformation -- is over, and it has enabled the company to pursue "strategic transformation" opportunities such as expanding its CX offering through acquisition.

Edify gives Avaya low-code technologies to build journey management workflows and a combined CPaaS, CCaaS and UCaaS platform. Moreover, it was a talent buy too.

"Edify is a technical jumpstart," Masarek said. "The folks who built Edify have some really good engineers that we're popping into Avaya, which gets us to jump forward fast.

Full speed to 2028

After making it through the second of two bankruptcies in a decade and restructuring debt, Avaya has headroom to grow, Masarek said. Some $800 million will come due in 2028, but Avaya counts some heavyweight organizations among its bedrock customers, including the U.S. Internal Revenue Service, U.S. Army and several large banks.

Masarek has reshaped Avaya's approach to servicing its customer base by expanding hybrid cloud and tools to encourage cloud migration while partnering with vendors to expand Avaya users' configuration options.

One example of that roadmap came this week when Avaya expanded its partnership with RingCentral. Avaya Aura customers retain their telephony while using Ring's collaboration technologies. Avaya customers can also access the RingSense AI generative AI platform features, such as live transcription and closed captioning as well as video summaries and highlights.

Another example was a Zoom partnership launched earlier this year. Others include partnerships with conversational commerce vendor LivePerson and electronic medical records giant Epic Systems, revealed this week.

Masarek believes these partnerships and the Edify acquisition will ultimately pay off and encourage the largest longtime customers to hold on to their existing, stable Avaya communications hardware and software.

"The way I like to say it is, if you're a 50-person SMB, you'll rip anything out and go to the next thing. Who cares? It's a little bit of change management," he said. "If you're 50,000 people, it's a really big deal, and you run the risk of really screwing yourself up.

"All we're saying is, don't rip it out. Build on top of it. Get immediate value. Get to the stuff that's the sexy, good stuff immediately without going through that disruption curve."

Avaya released its CX tools in conjunction with its Engage user conference this week in Denver.

Don Fluckinger is a senior news writer for TechTarget Editorial. He covers customer experience, digital experience management and end-user computing. Got a tip? Email him.