andranik123 - stock.adobe.com

Holiday e-commerce set to surge

Adobe looks at e-commerce trends to predict holiday buying, while Salesforce surveys thousands of B2B buyers and consumers about what motivates their buying choices.

Two new reports address the short- and long-term future of digital commerce: Adobe predicts an unprecedented holiday e-commerce surge, and Salesforce examines changing customer attitudes and what will drive purchasing in the future.

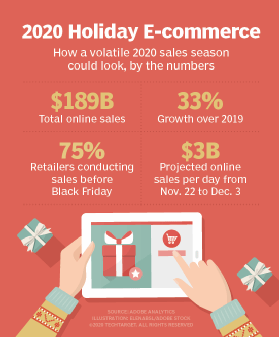

U.S. holiday e-commerce will surge to $189 billion, up 33% from last year, predicts Adobe Analytics, which looked at transaction data for 1 trillion items from 80 of the top 100 U.S. web retailers, and also surveyed 1,000 U.S. consumers in October. For most of November and December, total e-commerce sales will likely hit $2 billion a day, and is expected to top $3 billion per day during the span of Nov. 22 to Dec. 3.

Pandemic life will drive this trend, according to Adobe, as consumers avoid or limit in-store visits. Buy online, pick up in store and curbside pickup will be the preferred methods for big sales, as well as for shoppers who procrastinate until December 21. Interestingly, the U.S. election on Nov. 3 will slow shoppers down for a few days, but Adobe Analytics predicts $16.3 billion total online spend for the week of Nov. 1.

Overall annual retail sales growth barely registers at 1% - 1.5% growth, according to Adobe's predictions, but e-commerce growth is preventing big losses.

The holiday e-commerce boom will not be distributed evenly, IDC analyst Jordan Jewell said. Companies that invested -- or at least started -- digitizing sales processes are poised to perform better than those that waited for the pandemic and lockdowns to overhaul their e-commerce experiences.

"Companies need to deliver better experiences online -- and frictionless commerce -- because everyone's expectations are high now," Jewell said.

Salesforce takes pulse of B2B and B2C buyers

In its fourth annual "State of the Connected Customer" report, Salesforce delves into how business buyers and consumers think about the companies they buy from. The double-blind survey polled 3,600 business buyers worldwide and 12,000 consumers.

Customers -- 85% of B2B respondents, 79% of consumers -- indicated that the experience a company provides is as important as the goods or services they've bought. A majority of respondents indicated that businesses need to improve their trustworthiness and environmental responsibility, which ranks higher than customer service and the products and services themselves.

IDC's Jewell confirmed that consumers and investors are supporting companies that practice environmental stewardship and sustainable business practices, noting the growth in popularity, as well as the performance of sustainable index funds prior to the pandemic.

"Consumers are starting to put dollars with companies they feel good about buying from," Jewell said. "I kind of wondered with COVID if people's priorities are going to change. You're buying toilet paper and you're not caring where it's coming from -- that sort of thing. But this survey indicates that still kind of prevailed in 2020."