What is a records retention schedule?

A records retention schedule is a policy that defines how long paper and electronic content must be kept and provides disposal guidelines for how those items should be discarded.

It is a crucial tool for organizations to manage their records systematically, ensuring that they comply with legal, regulatory and business requirements.

Records retention schedules, also called data retention schedules, are determined by the record type and the business, and legal and compliance requirements associated with the data. Retention schedules establish guidelines regarding how long important information must remain accessible for future use or reference as well as when and how the data can be destroyed when it is no longer needed.

This not only helps in maintaining compliance but also in optimizing storage resources by eliminating unnecessary data.

Why are records retention schedules important?

Retention schedules are established based on data type and ownership as well as aspects such as the data's business value and regulatory compliance mandates. The schedules outline the business reason for retaining specific records and designate what should be done with the data when it's eligible for disposal.

Adherence to these schedules ensures that organizations can respond efficiently to audits, legal holds and other compliance-related inquiries.

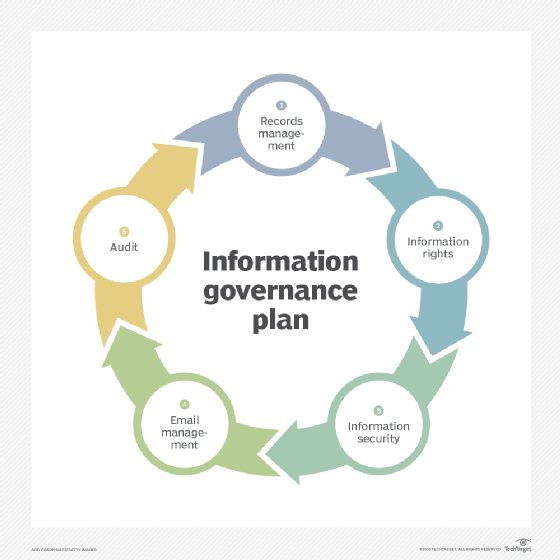

Records retention schedules are designed to help maintain information governance-related regulatory compliance. They also ensure record disposal processes are legally defensible. Certain types of records, such as financial records, are subject to more stringent retention requirements.

Failing to adhere to these requirements can result in legal penalties, financial loss and damage to the organization's reputation.

As data volumes continue to grow at many businesses, records retention schedules help reduce records management and storage costs by disposing of data that is no longer relevant to business processes. General records retention schedules are often part of a data retention policy, an established protocol for retaining information based on business needs.

Incorporating automation in the records retention process can further enhance efficiency by systematically managing data throughout its lifecycle.

Who uses a records retention schedule?

Once the schedule has been completed and approved, it gets shared with employees based on their needs. The groups that typically need access to the records retention schedule include the following:

- IT management.

- Data storage team.

- Data and information management teams.

- Legal and audit departments.

- Outside compliance auditors.

- Department heads.

- Records management officers.

How to develop a records retention schedule

The most important element in a records retention schedule is to determine how long records are to be held before going to an archive or other long-term storage system or being destroyed. The schedule should specify the following:

- The type of record to be retained.

- The amount of time each type of record must be retained.

- Where the record is to be stored.

- How records move through various retention stages.

- Whether the policy applies to both electronic records and non-electronic records.

- Any retention requirements for specific document types.

- How revisions to records and possibly related records are indicated.

The process requires close coordination with an organization's audit and legal staff, as they will be tasked with examining retention schedules periodically. Attention to the requirements of industry and government regulations, laws, and other statutes is essential. In some cases, customer requirements come into play.

It's important to ensure that the schedule is regularly updated to reflect any changes in regulations or business practices.

It's also essential to identify all requirements before developing a schedule because each compliance element will likely have a specific time frame for records storage and some records might have to comply with more than one regulation specifying a length of time for retention.

Conducting a comprehensive risk assessment can help identify these requirements and avoid potential compliance issues.

If IT isn't creating the records retention schedule, it must have a significant input in it. IT is likely to be responsible for how and where records are stored. Depending on the specific compliance requirements, IT can arrange different storage resources, such as hard disk drives, tape storage, solid-state disks and cloud storage. IT support is also necessary when defining how data is to be retrieved for use and disposed of when it is no longer needed.

Government agencies have additional rules and regulations to adhere to when dealing with public records. This would include federal and state agencies as well as local governments. These agencies often follow specific retention schedules mandated by law, which may differ significantly from those used in the private sector.

A standard spreadsheet can be used to prepare a basic records retention schedule. Records management programs that offer retention scheduling tools are also available. Automating this function makes it easier to change schedules when rules change or when a record moves from active use to archival storage. Retention programs also make it easier to share the schedule among all interested parties.

Advanced records management systems can provide more sophisticated features such as automated reminders, compliance tracking and integration with other enterprise systems.

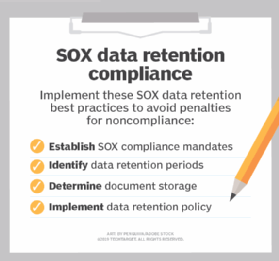

For instance, specific industry regulations like the Sarbanes-Oxley Act impose strict requirements for the retention of financial documents, requiring companies to follow precise retention guidelines.

Storage retention schedule example

The following table shows storage retention periods prescribed by the Sarbanes-Oxley Act for specific documents.

| Record type | Retention period |

| Employment applications | Three years |

| Invoices and purchase orders | Five years |

| Accounts receivable and payable ledgers, employee time cards, product inventories, expense records, audit paperwork | Minimum of seven years |

| Bank statements, leases and contracts, payroll records, legal correspondence, collective bargaining agreements | Permanently |

These retention periods are just examples and may vary depending on the specific requirements of your industry and jurisdiction.

Standards and good practices for records retention

The following organizations guide records retention issues and are good to reference when preparing a records retention schedule.

ARMA International coordinated the group that developed the Generally Accepted Recordkeeping Principles -- also known as the Principles -- a framework of eight records management principles, one of which addresses retention.

The International Organization for Standardization (ISO) developed the following records management standards and guidelines under the title Information and Documentation -- Records Management:

- ISO 15489-1 Information and Documentation -- Records Management -- Part 1: Concepts and Principles.

- ISO 22310 Information and Documentation -- Guidelines for Standards Drafters.

Adhering to these standards can help organizations ensure that their records retention practices are comprehensive, legally compliant and aligned with industry best practices.

Download our free data retention and destruction policy template. Explore examples of records management and the differences between records vs. document management and information governance vs. records management. Learn about the stages of enterprise content lifecycle management. Also, read about the ways AI influences the data management landscape and importance of ethics in information management.