carloscastilla - Fotolia

Oracle Cloud Infrastructure seeks a spot in the IaaS market

Don't count out Oracle IaaS before knowing what it has to offer. Learn where Oracle Cloud Infrastructure excels and what to expect from this public cloud offering.

Oracle is best known for its databases, but it wants to be a major player in cloud infrastructure -- a goal the enterprise software giant hopes to achieve with Oracle Cloud Infrastructure, its second swing at IaaS.

The top three cloud players -- AWS, Google and Microsoft -- all have their strengths, which makes it difficult for other companies to compete in a meaningful way. "[For Oracle,] it's difficult to break into that trifecta because they don't have first or second mover advantages and were, in fact, late to the game," said Torsten Volk, managing research director at Enterprise Management Associates.

As a result, most developers don't immediately think of Oracle when they consider public cloud options.

However, the vendor does have database expertise, as well as infrastructure that can support particularly demanding requirements, which is attractive to some users. There's also a recent partnership with Microsoft that might boost Oracle's appeal as a cloud provider and signal a push to a more streamlined approach to IaaS.

Performance

Since the start of its foray into public cloud, Oracle has focused on high-performance infrastructure.

"You could get more cores, higher speed and better networking than what was available from other cloud providers at the time," said Dave Bartoletti, vice president and principal analyst at Forrester Research. While the competition has emulated similar capabilities since then, Oracle continues to emphasize this area as one of its strengths.

In October 2018, Oracle released its Advanced Micro Devices (AMD) EPYC processor-based E-series compute instances, which provide a higher core count than previous generations and match the largest available instances from AWS and others. Oracle was also one of the first public cloud providers to have a bare-metal offering with AMD EPYCTM processors.

"One of the criticisms of using an AMD processor has been its performance in terms of memory bandwidth, but the AMD EPYC can deliver greater than 269 Gbps," said Roy Illsley, an analyst at Ovum. "This makes it a very good general-purpose processor, as well as meets the needs of big data analytics -- which is a memory bandwidth intensive operation."

The AMD instance also features the 1-, 2-, 4- and 8-core VM shapes. These instances are generally available in Oracle Cloud Infrastructure's U.S. East-Ashburn region and will be available in other U.S. and European regions by the end of 2019.

Other high-performance-focused efforts include instances powered by Nvidia's Tesla V100 GPUs and a clustered network that provides access to a low-latency, high-bandwidth remote direct memory access network. This type of networking is ideal for HPC, databases, big data and AI workloads, Illsley said.

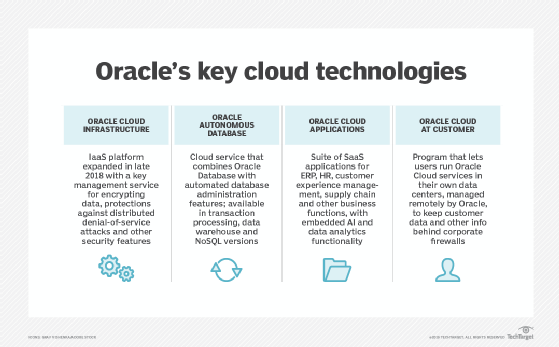

Oracle has also emphasized its Oracle Autonomous Database Cloud. Autonomous Database uses AI and machine learning and is designed to improve availability and reduce asset management costs. Initially, Autonomous Database is available for data warehouse deployments, and it will be expanded to cover online transaction processing and NoSQL databases.

Security

In the future, the cloud will host more mission-critical systems -- such as ERP, CRM and databases -- according to Ovum's ICT Enterprise Insights survey. This fits with Oracle's strategy, as Oracle Cloud Infrastructure is differentiating itself with its cloud architecture and capabilities. "[Oracle is] meeting the exact requirements for running these mission-critical workloads," Illsley said.

Most cloud architectures are challenged by their multi-tenant focus. While this approach can support more customers and scale as demand dictates, it doesn't address all of the potentially serious security issues. However, Oracle Cloud Infrastructure doesn't allow its control plane to co-exist alongside the user's data, which creates an air-gap between the vendor and its customers.

This data separation provides two key security benefits. For one, Oracle cannot see customer data and cannot access it without the customer's permission. In addition, with the provider's control data on a separate set of servers, if a malicious attacker get access to a customer's data, they cannot reach other customers or the provider's control plane.

"This level of security is precisely what is needed when the cloud begins to be used for more of the mission-critical and core business applications," Illsley said.

The Microsoft connection

In June 2019, Microsoft and Oracle announced a cloud interoperability partnership that enables customers to migrate and run enterprise workloads across Microsoft Azure and Oracle Cloud. Customers will be able to connect services, such as Azure Analytics and AI, to Oracle Cloud services, such as Autonomous Database.

Oracle doesn't want to be considered a legacy vendor, and neither company wants customers to migrate away from their clouds or products. "The collaboration gives Microsoft these ERP workloads, databases and enterprise applications, even if Oracle keeps their databases on their cloud," Volk said. Microsoft wants its 200 cloud services to grow faster than AWS' or Google's, so leaving databases to Oracle is a small price to pay.

Existing customers and the long view

Long term, the core of any organization is its corporate data, and the majority of this data is held in databases. However, these data repositories are complex and expensive assets to manage, which makes it difficult to ensure data is both secure and available.

As organizations adopt more public cloud resources, CIOs increasingly consider moving these corporate repositories to the cloud, Illsley said. Currently, cloud providers enable organizations to migrate their databases to a cloud-native model such as Amazon Aurora, but these managed cloud databases are still comparatively rudimentary in terms of the capabilities offered.

And while Oracle has been accused of being slow to move, the pace is understandable, as the vendor didn't want to reduce the quality of these complex offerings as it transitioned to the cloud, Illsley said. And for some potential customers, Oracle's edge in performance and security could sway users to consider Oracle Cloud Infrastructure, particularly when paired with Azure.

"The long and the short of it is that for an Oracle customer, the Oracle Cloud Infrastructure can be a good alternative to use," said Greg Schulz, senior advisory analyst at StorageIO.