georgejmclittle - Fotolia

Niche cloud providers take on market giants

Choose the cloud that best fits your enterprise's needs. While one of the Big Three may seem like the most logical choice, a niche vendor might actually serve your needs better.

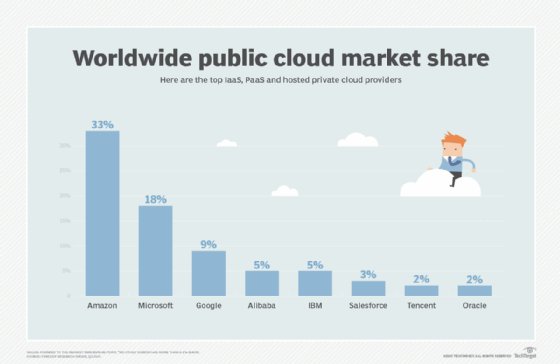

AWS, Microsoft and Google dominate discussions about the top cloud platforms, but an enterprise might find its needs are better met by a niche cloud provider.

IBM, Oracle, DigitalOcean and Alibaba are among those vying for greater presence in the public cloud market. These niche cloud providers come from varying technical and corporate backgrounds -- which is reflected in their current approaches -- but they're each trying to find a foothold that makes them a more viable alternative to the so-called "Big Three." For example, long-established IT vendors IBM and Oracle primarily target their existing enterprise customer base, while relative newcomer DigitalOcean focuses on a streamlined experience for developers.

"In general, each of the smaller players is trying to carve out its own niche, while also providing enough table stakes capabilities to serve clients' minimum needs," said Blair Hanley Frank, principal analyst at Information Services Group, a technology research and advisory firm.

Niche cloud provider considerations

An enterprise's IT and business leaders need to do their due diligence before opting for one of these smaller cloud providers. It might make sense to bet on a smaller provider if that vendor's unique approach to the cloud market meshes with an enterprise's needs, Frank said. For example, businesses that extensively use the Oracle database will benefit from at least evaluating Oracle Cloud as a home for those workloads.

However, businesses often struggle to justify the cost of going with a smaller player if they don't think that vendor can provide enough usability, onboarding and support, according to Zach Busch, a research analyst at G2, a peer-to-peer review site. The smaller cloud providers can't match the hyperscale providers in those areas and will continue to face headwinds.

"On the other hand, I think the idea of cloud is shifting more to multi-cloud and using what vendors offer to having a best-of-breed approach," Busch said. "That can save people money and gets the best performance for what you are trying to do."

An enterprise needs to look at all of its workloads and consider how its specific applications might best fit in a given cloud. While you may receive a decent deal by going with all-encompassing platform, such as AWS, Azure and Google Cloud Platform, you might get better functionality and resources from a niche cloud provider, Busch said.

Compare the key niche players

Because the niche cloud providers approach the cloud in different ways and with distinct corporate personas, it's difficult to do an apples-to-apples comparison. Instead, let's take a look at these vendors' recent cloud updates to assess the strengths and weakness of each platform.

IBM

IBM has struggled to truly break through in the cloud market, despite years of trying. Still, IBM does have an advantage in its long-established relationship with large enterprises in several verticals, including finance and manufacturing.

IBM's VMware offerings make it easier for clients to adopt hybrid and multi-cloud, and large organizations can integrate IBM Watson and other IBM tools with other public clouds, according to Pedro L. Bicudo Maschio, research analyst at ISG. "IBM's strengths are the people, global presence, comprehensive portfolio -- and Watson," he said.

IBM continues to add global regions and expand its support for containers and microservices, and its Z15 mainframe with encryption everywhere could persuade cloud-averse clients to move mission-critical workloads there.

However, IBM needs to attract young developers and offer more competitive pricing. "It is working on these fronts, but new developers see it as 'old' while AWS and GCP are 'new,'" Bicudo Maschio said.

Red Hat, which IBM acquired in 2019, could address these issues and drive momentum for IBM Cloud, he said.

Oracle

Oracle's strength is its database technology. Competitors push lower-cost, open source database options to convince clients to move away from Oracle, but its system cannot be easily replaced, Bicudo Maschio said.

Oracle also has patented software for big data and analytics, retail, supply chain, and sales and operations. These algorithms run on top of Oracle's database. "These patented specialized tools provide superior business performance, so [going with Oracle] is a business choice and not a cloud IaaS decision," said Bicudo Maschio.

Recent key improvements to Oracle's cloud offerings include more secure infrastructure services, AI-powered tools -- such as its self-healing database -- along with expanded SaaS offerings.

However, Oracle still needs to improve its relationship with the ecosystem of partners and competitors. "It should make it easier for clients to use Oracle rather than forcing a decision to choose me or leave me," Bicudo Maschio said.

DigitalOcean

DigitalOcean recently added Managed Databases for PostgreSQL and Redis, which has reduced the troubles of maintaining PostgreSQL and Redis databases. It's also worked to close the skills gap needed by developers who want to work with Kubernetes and microservices, and it has a predictable pricing model that is favored by CIOs, said Shashank Rajmane, lead analyst at ISG.

But since DigitalOcean focuses on niche developers who want to set up infrastructure, its reach remains limited, said Dave Bartoletti, a Forrester analyst.

"No one in an enterprise purchasing department will have heard of DigitalOcean," he said.

Alibaba

Alibaba is a "head scratcher" because of its uneven global presence, according to Greg Schulz, senior advisory analyst at StorageIO.

"It is a Tier One player in China, but in terms of market share [in the U.S.] it is barely Tier Two," he said.

Still, a recent Gartner report ranked Alibaba Cloud higher than IBM Cloud in developer services, DevOps enablement and management tools. Similarly, Oracle Cloud and Alibaba Cloud are ranked the same for developer services. Those would seem to suggest the possibility that Alibaba will play a much more active role in the U.S. market in the future -- but for now, its profile remains low.

Alibaba's more immediate target might be Europe, where no major public cloud providers are headquartered. That region is shaping up to be a battleground between the American Big Three and China's Alibaba, Bartoletti said.

"There is a hefty dose of concern in Europe about letting an American company handle your data -- but the same concern applies to China," he said. That also leaves an opening for both IBM and Oracle, which have strong enterprise relationships in place on the continent, he said.