Getty Images/iStockphoto

How to start a FinOps career in cloud

FinOps is an integral part of many organizations' cloud strategy. Do you have what it takes to land a FinOps job? Explore the benefits and requirements to help jump-start your career.

Cloud computing can be an expensive endeavor. While the notion of computing as a service is compelling, it can be challenging to architect and maintain a cloud computing environment that scales and performs in predictable and affordable ways for a business. Correlating cost to business value can be almost impossible without careful control.

FinOps has emerged as a vital means of understanding, accounting for and managing cloud costs. Although the benefits of FinOps and the need for skilled practitioners are clear, its unique blend of financial acumen, cloud technology knowledge, education and experience can make FinOps careers challenging.

Learn more about the concept of FinOps, as well as the job functions and responsibilities of FinOps professionals, and review a list of popular FinOps careers.

What is FinOps?

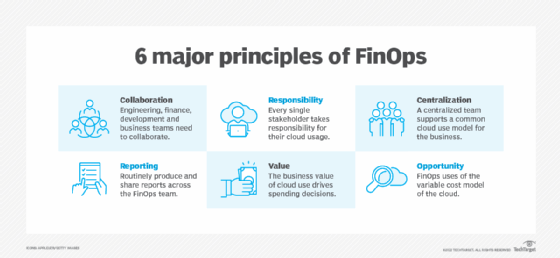

FinOps -- a blend of the terms finance and DevOps -- is not a single thing, but rather a broad set of practices used to gain financial control and predictability of cloud usage across a business. It emphasizes communication among business, development and other engineering teams. FinOps often starts with a centralized group dedicated to understanding cloud costs and establishing cloud best practices. Ultimately, FinOps seeks to manage cloud spend and meet requirements for cloud business value.

FinOps is represented by the FinOps Foundation, which developed the following six key principles:

- Collaboration.

- Value focus.

- Accountability.

- Visibility.

- Centralization.

- Optimization.

A career in FinOps

FinOps has emerged as a challenging and rewarding career path for professionals that possess a wide range of technical and business skills, and businesses are quickly recognizing the value of FinOps practices -- and practitioners. FinOps can be a meaningful career for professionals that can apply technical savvy to manage the volatile value proposition of rapidly expanding cloud adoption and ever-changing cloud services.

What is driving FinOps careers?

Consider that numerous factors are driving FinOps career growth, including the following:

- Cloud growth. The public cloud market is growing substantially. Gartner forecasted that cloud end-user spending will reach a value of $723 billion in 2025, up 21.5% from last year. This incredible growth in adoption requires professionals capable of managing cloud costs and optimizing cloud value for businesses.

- Expansion of use cases. The public cloud has become more than just a place to deploy applications -- it's a proving ground and incubator for powerful new technologies. Consider that new applications are built for the cloud -- using microservices and other cloud-first architectures -- and there are countless new services, such as machine learning (ML) and AI, which can use new cloud services and serve as the foundation for new business tools. These all demand diligent cloud design and careful spend.

- Business value. FinOps is far more than just cost-cutting. Successful FinOps practitioners can optimize value to provide the business with the best possible outcomes for data and workloads. Companies that rely on cloud infrastructure and services cannot be left to grapple with unexpected costs and unsteady performance -- both of which can harm the business. FinOps focuses on balancing cost and performance to optimize outcomes.

Further, FinOps is far more than an industry fad or buzzword. As large enterprises, such as AWS, Microsoft and Google, join the FinOps Foundation, FinOps concepts can become validated practices that often lead to broader adoption and standardization. In turn, this drives the demand for FinOps professionals in the workplace.

What experience do you need to start a FinOps career?

So, what kinds of background and experience are needed to start a FinOps career? There is no universal list of requirements, but there are some solid skills, including the following:

- Technical knowledge. FinOps practitioners typically start with an IT infrastructure background, which can help them understand varied and nuanced cloud resources, services and applications. Some experience using the public cloud to deploy and manage enterprise workloads is highly useful.

- Financial knowledge. Successful FinOps practitioners match their IT knowledge with broad financial savvy, including financial principles, cost accounting, budgeting practices and a comprehensive knowledge of cloud platform -- AWS, Azure and Google -- pricing models and cost optimization strategies.

- Analytical ability. FinOps professionals must be able to follow complex cloud invoices and use various cloud-native and third-party tools to analyze cloud spend data, recognize major cost drivers, follow cost trends over time and forecast resource needs and costs.

- Problem-solving. Coupling public cloud capabilities with business requirements can present challenges for cloud cost management. FinOps professionals must see cost and performance challenges and be able to implement effective solutions that maintain the expected value.

- Collaboration. FinOps is a team sport that requires the participation of -- and expects accountability from -- cross-departmental teams. Effective communication and collaboration are essential across diverse teams, including finance, engineering and business.

The mix and emphasis on each of these basic skills depend on the unique needs of the specific employer. It's always a good idea to review FinOps employment opportunities regularly -- through common resources, such as LinkedIn and Indeed -- and gauge changes in requirements over time.

What education do you need for a FinOps career?

Similarly, there are few educational requirements that denote a capable FinOps practitioner. A conventional degree in IT or a related field can be a good baseline, but there are several additional FinOps certifications, ranging in skill level, that can help a candidate stand out, such as the following:

- FinOps Certified Practitioner, or FOCP.

- FinOps Certified Engineer, or FOCE.

- FinOps Certified Professional, or FCP.

FinOps job functions and responsibilities

FinOps jobs span various levels -- from analysts and consultants to engineers, architects and managers. Although specific FinOps tasks can vary between levels and businesses, there are common functions and responsibilities for every FinOps professional, including the following:

- Cloud strategy development. FinOps professionals play a central role in cloud strategy. FinOps practitioners can have a direct role in cloud architecture design and implementation or work in collaboration with cloud architects and engineers to facilitate cloud implementation that adheres to FinOps policy and practice.

- Cost management. Another central responsibility for many FinOps roles involves cost management. This translates complex cloud billing from cloud providers into tangible cost data that reflects the organization's cloud usage, such as by department or workload. Cost management enables businesses to see how the cloud is being used, see how those costs break down across the organization, and negotiate and implement cloud discounts with providers.

- Performance management. Although FinOps practitioners aren't typically responsible for workload performance -- that's a matter for cloud architects and engineers -- FinOps can be directly involved in monitoring workload performance or accessing performance data. Performance data can then be correlated against cloud costs to determine cloud value to the business, which can affect cloud strategy development.

- Optimization. FinOps practitioners look for ways to optimize cloud spend on resources, services and applications. This includes right-sizing cloud resources to reduce costs, while maintaining desired business value, eliminating wasted resources (cloud sprawl) and applying cost-saving measures, such as reserved instances and committed use discounts, to lower costs.

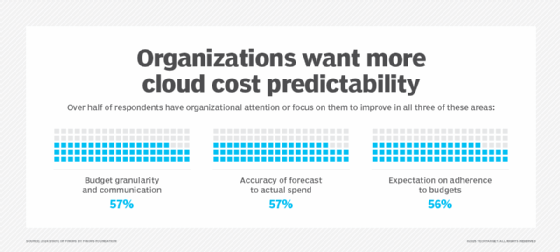

- Budgeting. FinOps practitioners routinely use cost data gathered over time to provide forecasting and budgeting recommendations for ongoing cloud use. This involves close collaboration with finance and workload teams to establish realistic workload operational budgets.

- Tool selection. FinOps involves collecting and analyzing a considerable amount of data, from cloud billing statements to usage and performance analytics. This means FinOps teams must select, master and maintain a variety of cost analysis and optimization tools to achieve the necessary level of visibility and data correlation. FinOps professionals might use a mix of cloud-native and third-party tools for these tasks.

Types of FinOps jobs

There are thousands of FinOps jobs available, but job seekers must exercise great care with their search. FinOps jobs are difficult to categorize, expertise can vary, and roles and responsibilities can vary greatly depending on specific business needs. This means job seekers must read each job listing carefully and ensure their skills and interests match each opportunity. Many FinOps jobs can be broadly categorized into the following four.

FinOps specialist

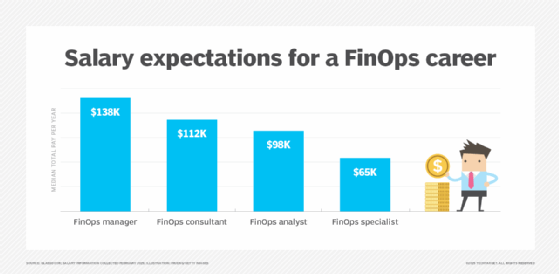

Specialists are often just that -- FinOps practitioners with unique or specific knowledge that offer value to a business. Examples include defense, digital banking and money transfer specialists. These experts couple FinOps knowledge with industry and associated regulatory expertise. Salary ranges can be impossible to detail, and job availability is limited. At time of writing, Glassdoor estimated a median salary as $65,000.

FinOps analyst

Analysts are the foundation of cloud FinOps and are routinely responsible for financial tasks, such as budgeting, forecasting, cost optimization and financial reporting. Candidates have strong backgrounds in cloud financial management, analytical skills and a detailed understanding of cloud economics. This role averages $98,000.

FinOps consultant

There are several variations to a consultant role. A consultant can assume more of a specialist role, focusing on FinOps tasks, such as performance optimization or cost-cutting. A consultant can also provide a broader set of FinOps services as an outside contractor, working with client organizations to identify and implement FinOps practices for clients. A third variation of the consultant role is in sales, helping potential customers use and benefit from commercial FinOps tools and services. Roles that identify as FinOps consultants have a median total pay of $112,000, though there is wide variation depending on expertise, experience and location.

FinOps manager

A manager has strong cloud technical knowledge and experience in finance and cloud data. They understand numbers, analyze data and communicate effectively. Managers must delve into cost drivers, analyze variance root causes, and then collaborate with technology and business stakeholders to understand cloud consumption, drive cost efficiencies and align cloud spend with business goals. This includes monitoring cloud usage and spending data to find cost-saving and optimization opportunities. These roles offer a median total pay of $138,000. Managers can also be responsible for other FinOps team members, and the role might be dubbed cloud FinOps team lead.

There are also existing cloud roles that can emphasize FinOps practices, such as the following.

Cloud FinOps engineer

Engineers are typically implementers and supporters, often adding expertise to design needs. Cloud FinOps engineers collaborate with other engineers, analysts and architects to build and maintain cloud infrastructures. Engineers offer comprehensive knowledge of AWS, Azure and Google and possess a detailed understanding of how cloud services are deployed, utilized and modified for optimal cost efficiency.

Cloud FinOps architect

Architects are often the designers and optimizers of cloud infrastructure. They compose resources, services and applications for efficiency, resilience, performance and cost. Architects are responsible for collecting and analyzing financial information related to cloud expenses, reporting on cost trends and tracking anomalies at a granular level. Architects review cost data to improve the accuracy of budgets and forecasts for different workloads and build financial models for engineering projects and market decisions. The line between engineers and architects can blur, but architects are typically the more experienced and high-level role.

Stephen J. Bigelow, senior technology editor at TechTarget, has more than 30 years of technical writing experience in the PC and technology industry.