Nightman1965 - Fotolia

Analyze Google's cloud computing strategy

After a few false starts, Google has taken a different, more open approach to cloud computing than AWS and Azure. Let's take a look at this strategy and roadmap to date.

In the world of cloud computing, Google represents a dichotomy. As a technology company and innovator, it was in many ways a pioneer. But as a services provider, it has always been playing catch-up.

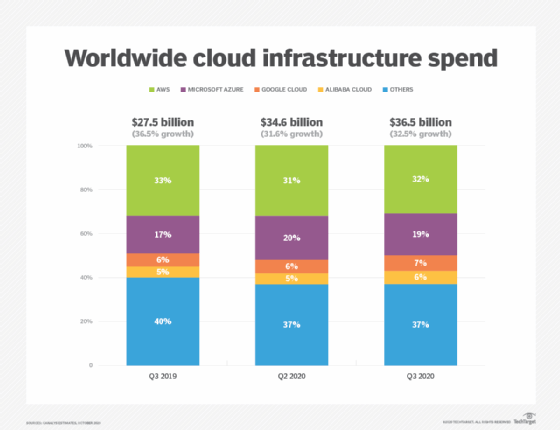

After a dozen years in the market and several shifts in strategy, Google remains a distant third in the cloud infrastructure market, behind AWS and Microsoft Azure. Still, Google Cloud has emerged as a viable first-tier cloud vendor with strong offerings in all three cloud categories: IaaS, PaaS and SaaS. Its cloud services emphasize portability and security, and Google has realigned its efforts around enterprises and industry verticals.

It's unclear if its progress will translate to greater market share, but enterprises should, at the very least, be aware of what the platform has to offer. To get a better sense of Google's cloud computing strategy, take a look at what caused it to fall so far behind in the first place and how it's positioned now. Review Google Cloud's strengths and limitations to see if it can support your IT initiatives.

Google's cloud beginnings

Google's struggles in the cloud services market are somewhat bewildering, since its developers and operations engineers arguably invented the concept of modern cloud services to meet the vast, dynamic and growing needs of its search and YouTube businesses.

Cloud Bigtable and MapReduce data processing software stem from work done in the mid-2000s, when AWS was little more than an idea. And Google's Borg cluster manager -- the predecessor to Kubernetes -- is still used internally.

Nonetheless, Google badly misjudged the market for cloud services. It delayed its entry until 2008 -- two years after AWS launched its core infrastructure services, Amazon EC2 and Amazon S3. And it initially focused on PaaS with App Engine, which didn't deliver what IT pros wanted at that time and wasn't generally available until 2011. Ultimately, Google released Compute Engine in 2013 to fill its IaaS void, but by that time AWS was well established. That same year, Amazon's second re:Invent conference attracted 9,000 attendees.

Initially, Google's cloud computing strategy was directed toward customers like itself -- advanced developers that wanted to build cloud native applications and services. It didn't target mainstream enterprises and small businesses coping with heterogeneous infrastructure, legacy software, or IT staffs that found cloud computing unfamiliar and threatening.

In sum, Google Cloud was technically sophisticated and elegant but less flexible than competing offers. It had weaker documentation and resisted efforts to integrate with existing IT systems. On top of these issues, Google Cloud was playing catch-up.

Google's strategic shift

Google's biggest hurdle is the market duopoly of AWS and Azure. It's exceedingly difficult for a tertiary player to crack this type of entrenchment -- something Google has experienced from both sides. It has fended off the largest competitors in the online search and advertising space; it has also struggled to break into the streaming media, smartphone and cloud computing markets.

By the time Google decided to get into cloud computing and commercialize its ample technology, Amazon and Microsoft had locked up more than half the cloud infrastructure and platform services market. Indeed, after years of competing, Google Cloud still only holds a mere 7% of the global market for cloud infrastructure, according to a recent Canalys estimate.

Google's early efforts put it in an untenable spot, especially for a company used to flexing its technical and financial muscle to dominate competitors. Its weak position even led some to predict that Google would abandon its cloud business like it did with so many other experiments, such as Google Fiber, Hangouts, Allo and more.

Nonetheless, when Google hired former Oracle VP Thomas Kurian as the head of Google Cloud in 2018, it was both a recommitment to the service and a repositioning to serve the all-important enterprise customers that AWS and Azure already had.

Kurian focused Google's cloud computing strategy on enterprise applications, workload migrations and application modernization. It attempted to execute on that strategy through use cases and services such as:

- Hybrid cloud workload migrations using Anthos or VMware;

- Modern containerized and serverless applications;

- Cloud-based data platforms including storage, databases, data warehouses, data extraction transformation and analysis; and

- AI and ML applications.

Kurian has also gone after vertical markets such as retail, financial services, telecommunications, media and entertainment.

Google believes its private network, big data, AI and security expertise could differentiate it from its competitors. Canalys recently named Google Cloud the "top cloud service provider for retailers worldwide," citing its "vertically-aligned strategy" and partnerships with system integrators and major retailers like Best Buy, Costco and Target.

Google Cloud's strengths

With its technical prowess and revamped enterprise focus, Google Cloud has become particularly strong in several areas that are central to its cloud computing strategy. Here are some of the ones that help Google stand out against the other major cloud providers.

Security

Google has been the most aggressive developer of and advocate for zero-trust security, authenticated endpoints, granular secure partitioning of microservices, two-factor authentication and hardware-based certification. These efforts are embodied in its BeyondCorp (user security) and BeyondProd (app security) strategies.

Billing

Google offers granular billing by the second and automatic committed-use discounts, a customer-friendly alternative to the more convoluted pricing options available at AWS.

Big data

Google has deep experience organizing and analyzing petabytes of search queries and online content. It's used this expertise to build a strong portfolio of database and analytics services, including:

- BigQuery, a managed data warehouse;

- Cloud Bigtable and Cloud Spanner, both managed database services;

- Dataflow, a stream analytics service; and

- Data Studio, a data reporting and visualization tool.

Global private network

Google says it has spent tens, if not hundreds of billions of dollars on data center and network infrastructure, including $30 billion on private undersea cabling and $13 billion on new U.S. data centers connected by a private network.

However, Google's network and technical sophistication -- it was one of the first to use SDN to optimize WAN traffic management and routing -- haven't insulated it from hiccups. The most recent example was a massive outage in June that caused servers to underuse available network capacity. This took out both Google and third-party services, including Gmail, YouTube and Snapchat.

Workload migration

Google has emphasized lock-in resistance with portable containers as the preferred application runtime environment, a few migration services, the Anthos app management platform and VMware Engine.

Serverless

Google offers services with serverless capability beyond event-driven functions like AWS Lambda. This includes:

- Databases: Cloud Storage, Firebase;

- Analytics: BigQuery, Data Studio;

- App platforms and code: App Engine, Cloud Functions;

- Compute: Cloud Run;

- AI: AI Platform, AutoML; and

- DevOps tools: Cloud Source Repositories, Cloud Build, Cloud Scheduler, Cloud Logging.

Developer focus

Google has services and tools for enterprise app modernization, including Anthos, Google Kubernetes Engine and Tekton -- a Kubernetes-based framework for creating CI/CD pipelines.

Google Cloud's weaknesses

Google's heavy push around app modernization underscores the fact that it hasn't yet properly addressed the needs of large, monolithic enterprise systems -- like SAP HANA, Infor and IFS, among others. Instead, Google remains focused on cloud native developers.

Under Kurian, Google has made a significant effort to win enterprise business by expanding the sales channel, lining up consulting and software partners -- like Deloitte and SAP -- adding enterprise-focused products like Anthos and other migration tools, including Cornerstone, a company it acquired in 2020 to transition mainframes to the cloud.

However, Google Cloud continues to struggle to support enterprise business software like SAP and Oracle products. Google also trails Microsoft and Amazon in the number of sales associates and software and consulting partners devoted to enterprise customers.

And while Google has done nothing but expand its cloud portfolio to compete with AWS and Azure, the company's reputation for abandoning experimental products, often with no or confusing options for replacement, continues to haunt it with enterprises looking for a long-term business partner.