Sergey Nivens - Fotolia

Cloud providers jockey for 2021 market share

AWS and Microsoft still dominate the cloud market, but Google, IBM and Oracle aren't without merit. Learn where each provider excels to find your perfect match.

Consumers have long faced a tradeoff between the convenience of one-stop shopping and the satisfaction of choosing the best product for their needs. IT pros face the same choices when they evaluate cloud providers.

Just like big-box retailers, the major cloud providers try to offer something for everyone. AWS, Microsoft Azure and Google Cloud have considerable overlap, but each has areas where it excels and falls short. Smaller providers, such Oracle and IBM, offer more specialized services for targeted audiences.

Below, we outline the strengths of cloud giants and niche providers and evaluate their place in the cloud market.

AWS: The default shop

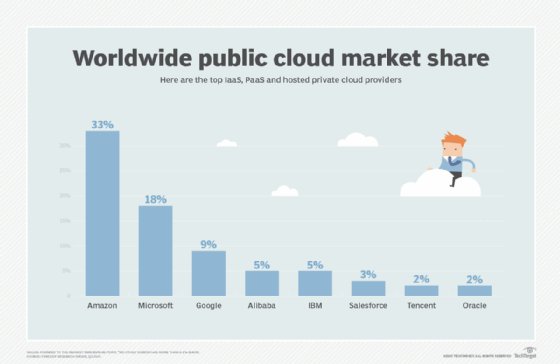

AWS remains the provider to beat. It has the largest portfolio with over 170 services, as well as a 33% share of the cloud infrastructure services market, according to the most recent analysis from Synergy Research Group. AWS is still the default cloud vendor, but its extensive product line and complicated, multifaceted pricing models require due diligence to select the top cloud service for the job.

Much like its retail parent, AWS is a quintessential one-stop shop. In the re:Invent 2020 keynote, CEO Andy Jassy stressed that AWS creates products "on behalf of customers, instead of building stuff because it is cool." The result epitomizes the paradox of choice: AWS is a cloud service with something for everyone, assuming they can find it.

Until recently, a persistent critique of AWS was its dismissal of hybrid cloud designs, in which enterprises supplement legacy systems and on-premises infrastructure with cloud services. The company first rectified this shortcoming via a partnership with VMware and, more recently, a growing set of AWS Outpost options. VMware Cloud for AWS and Outposts give enterprises a choice of hybrid models: The first extends traditional VMware environments to the cloud and the second brings AWS-managed services and infrastructure on premises.

AWS will extend its hybrid cloud strategy further in 2021, when enterprises will be able to run Amazon's managed container services in any environment, even outside AWS.

Microsoft Azure: First-stop Windows shop

Microsoft is a top cloud service provider and strong number two in the market, garnering an estimated 18% share of the cloud market. Under the leadership of CEO Satya Nadella, Microsoft has relied on its sizable resources and ancillary SaaS revenue to sustain the multibillion-dollar investments required to continually expand its cloud infrastructure and service offerings.

Azure's portfolio is understandably strong in:

- Windows services and integrations;

- true hybrid infrastructure via the Azure Stack products; and

- development tools and platform services.

Azure is ideal for organizations that want to extend Windows-centric IT environments to the cloud, particularly those that also use the Microsoft 365 suite of SaaS productivity and collaboration tools. Azure is tightly coupled with products like Active Directory, Azure Site Recovery, PowerBI and Visual Studio. It hosts equivalent cloud services well-suited for organizations that want to build hybrid environments using familiar technologies and UIs.

Aside from IT shops deeply committed to Microsoft products, Azure is also popular with enterprises that compete with Amazon in online retail or other industries. Those businesses turn to Azure because they're uncomfortable using a competitor to host their IT infrastructure and business applications.

Google Cloud: Cloud-native and microservices shop

Google Cloud is third in line with 9% of the cloud market share. Google has deep expertise in cloud services, hyperscale infrastructure and global private networking. Although Google Cloud can't match the product breadth of AWS or Azure, it covers the basics and has some notable advantages, which include the following:

- a full set of managed container services and integrations, such as Google Kubernetes Engine and Cloud Run;

- a simpler pricing model that includes automatic sustained-use discounts; and

- a robust set of scalable data analytics services including BigQuery, Dataproc and Dataflow.

Under CEO Thomas Kurian, Google has redoubled efforts to win enterprise business through new technologies (Anthos), partnerships (Cisco, VMware) and a robust sales team. Google Cloud is a viable alternative for organizations building hybrid environments. Its strength in containers also makes it an ideal choice for those building cloud-native applications using microservices, containers and serverless services.

Oracle and IBM Cloud: The niche shops

IBM bought SoftLayer more than seven years ago, but it has been unable to gain a significant cloud market presence -- currently at 5% -- compared to the other top cloud service providers. Red Hat, which was acquired in 2019, is IBM's latest attempt to jumpstart its cloud and app modernization efforts by positioning OpenShift as a hybrid container platform. IBM Cloud is a viable option for legacy applications, particularly memory-intensive databases.

Oracle Cloud Infrastructure is another alternative with 2% of the cloud market share, and a good option for cloud migrations of Oracle-based enterprise applications. Oracle's autonomous database, data warehouse and transaction processing services eliminate most of the administrative overhead associated with these complicated systems. They automatically apply patches, recover from system failures, configure backup, replicate and tune parameters and proactively correct problems using Oracle's AI-enhanced monitoring technology.