Getty Images/iStockphoto

FTC changes course on prior approval for reattempted mergers

The FTC has opened the doors to routinely requiring prior approval for reattempted mergers, as well as requiring prior notice of mergers beyond what's required in the Clayton Act.

The Federal Trade Commission is making moves on merger scrutiny policies following President Joe Biden's executive order pushing for greater insight into potentially problematic mergers and acquisitions.

In an open meeting Wednesday, the FTC voted to rescind a 1995 policy statement on prior approval and prior notice provisions that FTC Chairman Lina Khan said would help "better protect the public from unlawful mergers and acquisitions." The 1995 policy statement limited use of prior approval and prior notice provisions to situations where there was a credible risk of merging parties reattempting anticompetitive deals, whereas previously the provisions were more routinely required for mergers the FTC had found previously unlawful.

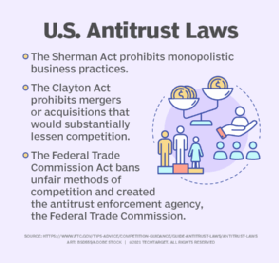

If a prior approval provision is imposed, a company will need approval before attempting to repeat a merger or acquisition previously found to be unlawful by the FTC. Prior notice provisions mean the FTC would need to be notified of mergers or acquisitions that fall below the premerger notification threshold as outlined in Section 7A of the Clayton Act, also known as the Hart-Scott-Rodino (HSR) Act.

Khan said without the prior approval provision, the FTC must initiate new, time-consuming investigations into reattempted or similar merger deals even if the FTC already found the deal to be unlawful. The prior approval provision requires companies seeking to merge to demonstrate why their reattempted merger would not harm competition or create the same risks the FTC already warned about, Khan said.

"Without the prior approval provision, the FTC could spend months reviewing documents, interviewing parties and thoroughly investigating a merger the agency determined was unlawful," Khan said. "Although the 1974 Hard-Scott-Rodino Act requires prior notice for some deals, it did not relieve the FTC from having to redo its work, even in cases where the agency had already investigated and determined that a merger was unlawful and deals below the HSR threshold would not be reported. HSR, therefore, was a complement to, not a substitute, for a prior approval and prior notice policy."

Khan did not receive full support from FTC commissioners on rescinding the policy, winning approval in a 3-2 vote.

Commissioner Noah Phillips opposed rescinding the policy statement. He said "things change in the market," meaning though a merger may have been unlawful at one point in time, factors could change that mean a reattempted merger may not be unlawful. Failure to fully reassess reattempted or similar mergers will "hinder normal market operations," he said.

"The point of this is that you actually have to study the market," Philips said. "Yes, it costs money to investigate, but understanding the businesses in front of us, understanding markets, is our job. When things change, even if the merging party is the same, we need to take new facts, understand market realities, and put that all into account."

Khan said FTC staff and commissioners will craft processes and procedures by which the commission will implement prior approval and prior notice provisions.

Also this week:

- President Joe Biden named Jonathan Kanter, a big tech critic, to fill the role of assistant attorney general for the antitrust division at the Department of Justice. Kanter has spent 20 years as an antitrust lawyer promoting strong antitrust enforcement and competition policy. Among numerous former roles, Kanter previously served as an attorney for the FTC's Bureau of Competition. His nomination follows the appointment of Khan, another big tech critic, as head of the FTC.

- Epic Games has filed an amended complaint to its antitrust case against Google outlining further details around Google's alleged anticompetitive behavior when it comes to how it operates its app store, the Google Play Store. Epic sued Google last year for removing its popular Fortnite game from the Play Store, and a case hearing is scheduled to take place in October. The lawsuit has been linked to a similar antitrust lawsuit filed by 37 state attorneys general earlier this month against the Google Play Store. Epic also sued Apple for pulling the game from its App Store and is awaiting a verdict after the case went to trial earlier this year.

- The U.K.'s Competition and Markets Authority has delivered a report to Oliver Dowden, secretary of state for digital, culture, media and sport, on its investigation into Nvidia's acquisition of Arm Ltd., a prominent chip designer based in the U.K. Arm provides chip designs to major companies around the globe, including Apple. Earlier this year, Dowden raised concerns that the acquisition could affect national security if the deal goes through.

- Salesforce completed its acquisition of communication platform Slack Technologies Inc. Salesforce CEO Marc Benioff said in a news release that the two companies will "define the future of enterprise software, creating the digital HQ that enables every organization to deliver customer and employee success from anywhere."

Makenzie Holland is a news writer covering big tech and federal regulation. Prior to joining TechTarget, she was a general reporter for the Wilmington StarNews and a crime and education reporter at the Wabash Plain Dealer.