Cloud-native strategies pushing purchase decisions beyond IT

Buyer personas now include line-of-business groups, but senior IT management still owns most decisions, and cross-departmental collaboration, while improving, needs a lot of work.

Organizations are increasingly moving to distributed cloud ecosystems that require assembling a hybrid of on-premises and cloud technologies.

The trend is complicating decisions about where to develop and deploy applications, which continues to impact which departments influence IT purchasing and which ones make the final decision, according to a survey by TechTarget's Enterprise Strategy Group (ESG).

The upshot: Traditional technology buyer "personas" -- categories of customers grouped by common needs and responsibilities -- are evolving. Departments outside of IT who formerly played little to no role in the actual purchase of IT infrastructure and applications are increasingly involved in buying decisions. In addition, the sphere of influence over budgets for on-premises and cloud deployments is slowly widening beyond the traditional centers of IT management and operations to include line-of-business (LOB) leaders and specialists in cybersecurity, risk and compliance, cloud architecture and platform engineering.

The ESG survey points to improvements in how these groups collaborate on IT purchasing, but more progress needs to be made, according to ESG analysts, who summarized their findings in a report titled "Understanding Buyer and Influencer Personas."

"Senior IT management increasingly has extensive responsibilities to ensure that complex, multidisciplinary strategies are carried out in optimal form, without barriers that can slow business velocity. These responsibilities trickle down to a wide range of teams," the report states. "Collaboration is essential."

IT loosens the purse strings

ESG surveyed 368 IT professionals in the U.S. and Canada to better understand how IT departments are moving to distributed clouds and how the migration to this new ecosystem has affected their budgeting and purchasing processes.

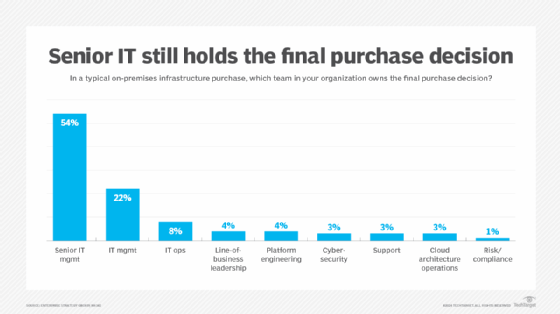

ESG analysts noted that although influencers might make strong suggestions, senior IT management still tends to be the final decision-maker for on-premises infrastructure. In the survey, 54% of respondents named that group as the owner of the purchase decision, followed by IT management (22%) and IT operations (8%). Other groups, including line-of-business leadership and cybersecurity, were in the low single digits (Figure 1). Purchases of on-premises applications follow a similar pattern.

Purchases of public cloud services, however, show a subtle shift in buying roles. While senior management was cited as the decider by a majority of respondents (57%), the involvement of cloud architecture and operations teams – not surprisingly -- was comparable to that of IT operations, at 8% and 7%, respectively.

Collaboration challenges, and some solutions

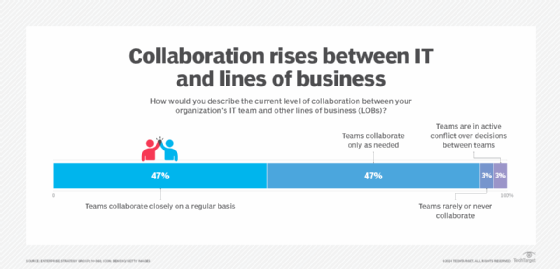

Survey respondents reported a strong level of collaboration between IT and LOB groups, with 47% saying they collaborate on a regular basis and the same percentage reporting that collaboration occurs as needed (Figure 2).

Collaboration is somewhat more frequent between IT and application development teams, which ESG attributes in part to a modern approach to cloud-native development. The collaboration between IT and application development is affecting buying decisions, the survey found. DevOps and platform engineering teams increasingly make spending decisions for development tools, albeit funded from budgets that are still set by senior IT management.

The survey report also noted that IT and app dev groups have made progress in improving the collaboration that is so necessary for cloud-native development, including more use of collaboration tools, more processes that rely on team collaboration and better sharing of data and resources across teams. But respondents said challenges persist, citing a wide range of inhibitors to collaboration between IT and development teams, including a lack of clear agendas, excessive reviews and iterations, vague requests and too many tools.

To address these issues, the analysts offered the following recommendations:

- Identify and define common goals. Provide visibility into the plans and goals of the various teams and foster teamwork through regular meetings. Use collaboration tools, but be careful not to have too many.

- Align skills development across teams. Train IT to have a basic understanding of the activities of other teams. Doing so can increase trust across teams and enable IT to more easily assess requirements and deliver suitable technology.

- Consider implementing or expanding full self-service. While self-service carries risk of unauthorized use, security issues, cost and complexity, expanding it also allows more freedom, particularly for developers, to improve the speed and regularity of application and platform development. That will be crucial as organizations increasingly use internally developed applications to drive revenue.

- Use requests for proposal (RFPs) for complex and highly impactful purchases. Using RFPs to identify and engage with vendors and service providers can help IT teams learn how to properly scope complex projects and requirements, standardize their purchasing approach, align with business goals and mitigate risks.

David Essex is an industry editor who covers enterprise applications, emerging technology and market trends, and creates in-depth content for several TechTarget websites.