What is sustainability risk management (SRM)?

Sustainability risk management (SRM) is a business strategy that aligns profit goals with a company's environmental, social and governance (ESG) policies. The goal of SRM is to make this alignment efficient enough to address potential risks and realize opportunities that come with sustainability.

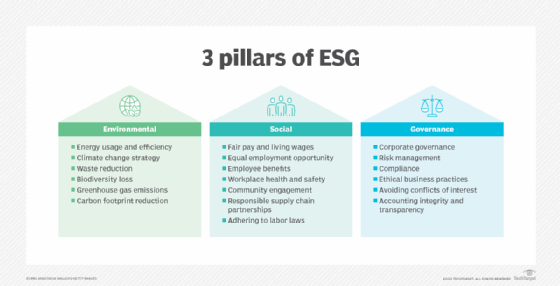

An organization's SRM approach is often incorporated into its larger enterprise risk management strategy. Under this model, sustainability is no longer seen as just a PR concern, but is recognized as a strategic priority that considers the three types of ESG risks:

- Environmental. This category includes the organization's overall impact on the environment, as well as the potential risks and opportunities it faces because of environmental issues. Examples of environmental risks include inefficient energy consumption, deforestation, biodiversity loss, air and water pollution, failure to adapt to climate change, and the fines and lawsuits that could result from not addressing environmental issues.

- Social. This category generally refers to how the organization treats different groups of people, whether employees, contractors, customers, suppliers, community members or anyone else. Examples of social risks include discriminatory hiring and compensation practices; human rights violations, such as child labor and forced labor; unsafe or unhealthy work environments; unfair treatment of customers or suppliers; and negative effects on the local community.

- Governance. This category is concerned with how an organization polices itself, internal controls it has in place, and how effectively it complies with applicable regulations and industry best practices. Examples of governance risks include corruption, tax evasion, unethical business practices, inadequate risk management, antagonistic employee relationships, absence of whistleblower programs and lack of financial transparency.

Many organizations are incorporating SRM into their long-term business and management policies to address ESG concerns and optimize their approaches. This approach has become increasingly important as awareness of ESG and sustainability issues grows.

Sustainability risk management practices

By following some basic risk management practices, organizations can develop a responsible, resilient corporate SRM model. These practices include the following:

- Identify risks. Knowing the ESG risks that need to be controlled is an important first step in SRM. These include everything from environmental to supply chain, security, technological and liability risks. This isn't a one-time effort; risks change over time.

- Establish objectives. Draft objectives to address the identified risks and incorporate them into the organization's overall risk management strategy.

- Measure and analyze progress. Implement systems to monitor progress toward sustainability goals. Information and data related to the company's sustainability goals can be collected and managed using automated auditing and reporting capabilities.

- Report to stakeholders. Communicate progress and assessments to all interested parties in ways they can understand and help with the decision-making processes.

- Develop controls. Develop strategies to mitigate risks. These can include carbon reduction, energy efficiency and supply chain resilience initiatives.

What is sustainability?

Find out about sustainability:

Examples of sustainability risks

ESG risks vary from industry to industry, depending on their operational and regulatory requirements and their role in the wider world. SRM requires a clear understanding of the risks associated with a specific industry. The following is a look at the risks within specific industries:

- Energy. High greenhouse gas emissions and potential negative environmental effects from fossil fuel extraction and use are among the risks in this industry. Financial and operational risks associated with the transition to renewable energy sources might decrease the value of fossil fuel investments.

- Manufacturing. Large-scale manufacturing raises the risk of overconsumption, pollution, resource depletion and environmental issues. Worker health and safety also come into play here.

- Retail. Retailers manage complex supply chains and must respond to consumer demand for responsibly produced, sustainable products. Risks include labor and environmental practices of manufacturing and supply chain partners. Supplier performance can harm a retailer's reputation and result in regulatory penalties. Supplier relationship management is a critical part of managing risks. And retailers' own practices can also come under scrutiny for waste and inefficiencies.

- Healthcare. Security and ethical concerns raise risks in healthcare. These include privacy and data security concerns, product safety issues related to drugs and treatments, ethical concerns tied to clinical trials, and worker safety risks.

- Financial services. Banks and other financial services organizations face a range of risks, including investments in carbon-producing industries and a highly regulated environment.

Challenges in achieving sustainability goals

The challenges associated with ESG-related issues can have legal and financial risks and consequences that can affect a company's overall reputation. These include the following:

- Varying stakeholder priorities. Investors, stockholders, employees, customers, clients and other stakeholders have varying priorities when it comes to sustainability issues. All want to know an organization's potential ESG risks before engaging with it. Some look for clearly defined ESG goals and progress in choosing a business to work with. Many stakeholders favor companies that are taking steps to manage these ESG risks more effectively while prioritizing sustainability. Others see sustainability goals in conflict with profit and growth. These varying priorities make it difficult for organizations to establish clear, consistent ESG goals.

- Lack of clarity. Sustainability goals can be difficult to clearly articulate and quantify in ways that everyone agrees on.

- Data issues. Good data that's consistent and comparable across organizations and industries isn't always available. This makes it difficult to track progress toward goals and assess risk factors.

- Regulatory pressure. One of the chief drivers for SRM adoption is the increasing number of global, national and local sustainability regulations. The evolving regulatory environment includes uncertainty and compliance challenges. All organizations are facing these requirements, but they can be especially complicated for international businesses.

- Long-term planning. Businesses often focus on short-term financial goals that might conflict with long-term sustainability efforts. For instance, the growing concerns over ESG risks have been fueled in large part by climate change, which is why the SRM efforts at many organizations have focused on the environmental impact of their operations. To this end, they have evaluated each business process individually and then looked for ways to minimize their effect on the environment. These steps aren't always in sync with near-term financial goals.

- Intractable culture. Sustainability efforts must be incorporated into a company's business strategy, collaboration efforts, operations and culture. This isn't an easy task given all the moving parts that need to be coordinated and adjusted, as well as the people that need to sign on to the effort.

- Resource and supply chain limitations. Time and money to invest in ESG efforts are often limited. In addition, when an organization's sustainability efforts encompass its entire supply chain, the effort becomes more technical and complex with visibility and control challenges.

- Overstated efforts. Companies publicizing their ESG efforts run the risk of overstating their progress and can face greenwashing challenges.

A broader SRM framework

Despite the focus on the environment, some organizations adopt a broader approach to sustainability, taking into account the social and governance components along with environmental. This broader interpretation of sustainability got a big boost in 2015 when the United Nations member states adopted the 2030 Agenda for Sustainable Development.

According to U.N. documentation, the agenda "provides a shared blueprint for peace and prosperity for people and the planet, now and into the future." At the core of this agenda are the 17 Sustainable Development Goals, which address issues such as poverty, hunger, health, gender equality, climate action, clean water and energy, and responsible consumption and action.

An effective SRM framework can help management identify emerging ESG challenges that could affect an organization's operations, including production, supply chain, health and safety, and other areas of concern. Examples of emerging issues include the availability of renewable energy sources, depletion of nonrenewable resources and changing government regulations.

SRM isn't the only framework available for ESG reporting. Learn more about the top ESG reporting frameworks.