chief financial officer (CFO)

What is a chief financial officer (CFO)?

A chief financial officer (CFO) is the corporate title for the person responsible for managing a company's financial operations and strategy. The CFO reports directly to the chief executive officer (CEO) and has substantial input into the company's investments, capital structure, money management and long-term business strategy.

The CFO is often considered the second highest-ranking person in a company after the CEO. The role can be a steppingstone to a higher corporate position, such as president, chairperson or CEO.

CFOs with the right balance of experience, education, people skills, strategic planning capabilities, drive and integrity typically are candidates for top corporate jobs. They frequently compete with chief operating officers (COOs) and chief strategy officers (CSOs) for the top position. The former will usually be an expert in operations management, strategic planning, and people management but not necessarily an expert on the financial side. The CSO might be an expert on strategy, business development, marketing and people management, but again not as strong on financial issues.

The CFO brings insight into bottom line financial issues, the balance sheet and profitability. This knowledge distinguishes the CFO from other C-level executives.

What the CFO does

The CFO's job skills and duties include the following:

- Day-to-day financial planning.

- Managing financial risks.

- Tracking cash flow and expenditures.

- Handling investment and taxation issues.

- Financial decision-making.

- Creating and enforcing internal accounting and financial policies.

- Collecting and managing financial data.

- Reporting financial performance to the board of directors.

- Ensuring regulatory compliance.

- Helping guide the company's strategic direction.

One of the most important CFO duties is ensuring compliance with domestic and international financial regulations. These include the Sarbanes-Oxley Act, the generally accepted accounting principles (GAAP) that the Securities and Exchange Commission (SEC) and other regulatory agencies define and maintain, and relevant international regulations, policies and standards from countries worldwide.

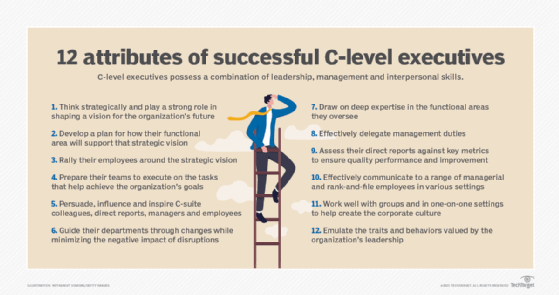

CFOs are often seen as team leaders for other departments and employees throughout an organization. They also collaborate with other C-level executives, such as the chief information officer (CIO) on technology investments and strategy. In some cases, the IT department, including the CIO, reports to the CFO. The CFO also works with the COO, CSO, chief information security officer, chief risk officer, chief people officer and chief marketing officer on financial-related decisions and implementing financial policies. Some of these roles might also report to the CFO.

How the CFO role has evolved

According to Deloitte's report "Four faces of the CFO," the CFO position traditionally has encompassed the following two roles:

- Steward. This role includes managing an organization's financial records and tasks focused on preserving the organization's assets by managing risk.

- Operator. In this role, the CRO is tasked with running a tight finance operation that's efficient and effective.

CFOs originally handled back-end and fiduciary functions, including quality control, compliance, and producing and analyzing financial statements.

However, Deloitte also said the CFO is evolving. With the advent of the digital economy, rapid technological change, and increased economic uncertainty and investor scrutiny, the CFO role has become more forward- and outward-facing. The focus is now on business value and opportunities.

For that reason, along with being stewards and operators, today's CFOs are strategists, helping to shape the company's direction, according to Deloitte. They also are catalysts, cultivating a financial approach and mindset throughout the company to help other segments of the business perform better.

In the past, CFOs were often seen as an obstacle in the way of new initiatives, especially if a capital investment was needed. In recent years, both operating units and financial teams have become more collaborative when developing new business activities and defining creative financial approaches to make them happen. CFOs are also more involved with vendors and suppliers when negotiating deals.

Today's CFOs are trusted advisors to the CEO and partners to other business leaders. They work closely with -- and often serve as the crucial intermediary between -- the C-suite, the back office and front-line business units. CFO responsibilities include helping shape the company's long-term goals.

The CFO must also play the role of diplomat with third parties; they're required to continually vouch for the company's financial viability. The CFO is the face of the company's perceived sustainability to customers, vendors, stakeholders and bankers.

Financial technologies CFOs use

Financial applications are among the tools and resources CFOs and their financial teams use. While some tools are cloud-based and others are locally hosted, most support core financial activities and requirements, such as the following:

- Financial planning.

- Financial reporting.

- Government and regulatory reporting.

- Billing management.

- Global accounting and consolidation.

- Revenue recognition management.

- Governance, risk and compliance.

- Investment planning and management.

Financial software systems must accommodate ongoing changes in the way financial accounting is regulated. Artificial intelligence is increasingly part of financial software; it can be especially helpful with forecasting and financial analysis.

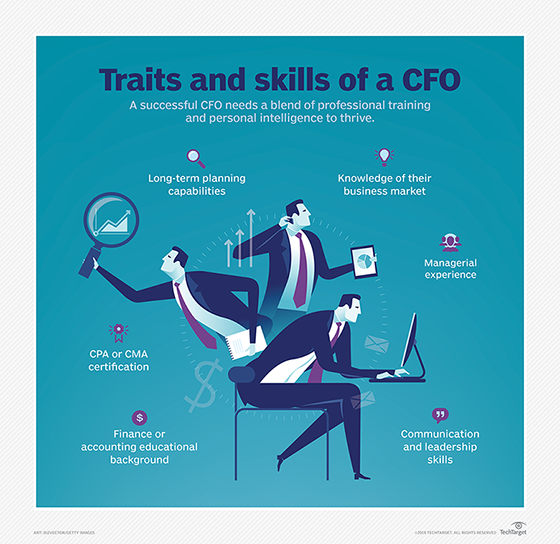

CFO qualifications and traits

In today's business environment, the CFO is less of a company accountant and more multifunctional executive with financial skills. Automation of the accounting function has diminished some of the CFO's accounting duties. However, the position still requires considerable financial management experience and academic training in accounting or finance.

CFO job descriptions usually require qualifications beyond a bachelor's degree, including the following:

- Master's degree in business administration specializing in accounting, finance or a related field.

- Certified public accountant.

- Chartered financial analyst or certified management accountant.

It's not uncommon for CFOs to have multiple credentials in addition to their experience.

A CFO candidate is usually expected to have at least 10 years of experience in accounting or finance, five years of which must have been in a managerial role. CFOs must have a strong understanding of GAAP and other tax accounting principles and experience working with or reporting to the SEC.

Along with analytical skills, a CFO must have solid leadership and people skills. Strong communication skills are a requirement because CFOs have to effectively communicate the company's financial information, health and strategic financial goals to the CEO, board members, C-suite, vendors and stakeholders. In global firms, CFOs must understand the finance and accounting rules and regulations in other countries.

Top finance executives must have a deep understanding of business and be able to work with all an organization's departments. They also should understand market trends and be able to help guide an organization's business plans and strategy.

Those in the CFO role must also be change agents who can embrace new ideas and take calculated risks to grow the business and improve the company's overall financial posture.

CFO vs. finance director vs. controller

There are some distinct differences among the three most important financial positions in organizations -- CFO, finance director and financial controller.

CFOs

The CFO is the highest-ranking financial position in many organizations. The primary function of a CFO is to understand past financial performance and be able to look ahead and accurately predict the organization's financial future. Those in this position usually manage finance departments, including a team of controllers and other financial personnel, such as analysts and administrators.

Large companies typically employ CFOs. CFOs often have an accounting or finance background and start as accountants and auditors.

Finance directors

Finance directors are also called vice presidents of finance. They have similar responsibilities to those of a CFO, but they are generally not part of the top executive team. Those in this position typically oversee an organization's financial operations and report to the CFO.

Companies sometimes have a CFO or a finance director, but not both. Small and midsize companies are more likely to employ finance directors than CFOs. In small businesses, the finance director oversees all the financial operations and reports to the business owner.

Financial controllers

The primary function of a controller is to maintain and operate the books, looking back at data already generated. Like CFOs, controllers usually have accounting or finance backgrounds and start their careers as accountants and auditors.

The controller role is a natural progression from accountant. Experience as a controller can lead to becoming a CFO or finance director, but the controller career path doesn't always lead to a CFO position. Controllers must have a strong set of business and leadership skills to make the leap to CFO.

With digital transformation taking on a key role at many businesses, CIOs and CFOs are working more closely than ever. Find out why the CIO-CFO relationship is key to business success.