Luiz - Fotolia

AWS bare-metal instances target a niche market -- for now

AWS' addition of bare-metal instances runs counter to its heritage but is another example of how the vendor wants to keep users on its cloud and also attract new ones.

AWS raised some eyebrows when it added bare-metal instances -- a niche cloud product for now, but one that, in some cases, may be preferable to VMs.

Bare-metal instances target legacy, nonvirtualized applications or other workloads that require direct access to system hardware. Amazon's biggest competitors, Microsoft Azure and Google Cloud, haven't adopted bare metal yet, but users who want direct access to server hardware as an on-demand service have other options, most notably from IBM and Oracle.

Let's review some of the technical specs of these new AWS bare-metal instance types, compare them to other providers' options and delve into potential use cases for what could be a burgeoning market.

Instance types

Users could easily overlook AWS bare-metal instances in the EC2 catalog. They're tucked into the storage-optimized category amidst the other i3 instance types, which are designed for transaction-processing workloads, data warehouses and data analysis that requires low latency and high throughput I/O. Bare-metal instances are built on AWS' Nitro system, which is a collection of custom hardware and software components that underlie most of the newer EC2 instance types.

They run on fourth-generation Xeon processors -- so, Broadwell, not the newer Skylake parts -- with 18 cores in a dual-socket server, for 36 total hyperthreaded cores. The systems have nonvolatile memory express (NVMe) solid-state storage for faster throughput than a Serial Advanced Technology Attachment or Serial-Attached SCSI solid-state drive, with 15.2 TB of capacity. Amazon's custom-designed Elastic Network Adapter gives a network performance boost with a 25 Gb Ethernet interface, not the 10 GbE found in most enterprise data center servers.

AWS bare-metal instances provide a dedicated server with direct hardware access, but they're the same as shared EC2 instances in all other aspects, including full access to other native features and services, such as Amazon Virtual Private Cloud (VPC), Elastic Load Balancing, Auto Scaling, CloudWatch, EC2 Systems Manager and AWS Management Console. They're currently available in five regions in the U.S. and Europe and follow the usual EC2 pricing options.

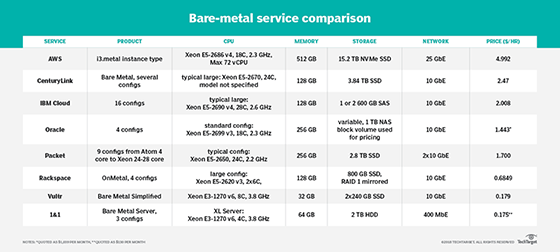

Bare-metal service comparison

AWS received plenty of attention when it disclosed plans to sell bare-metal cloud servers. The move seemed to go against the efficiency and agility of shared cloud services but also validated the bare-metal cloud market. However, AWS was arguably late to the party since there are at least seven other cloud services with nonvirtualized platforms -- some large and well-known, others small and catered to developers.

As the chart below indicates, AWS only offers one high-end configuration, which might be overkill in many situations. Others sell multiple configurations, which IT teams can then use to tune the system size to their workload needs. Players such as Vultr and 1&1 specialize in small systems designed for individual developers or small workgroups.

Bare-metal use cases and market dynamics

Few people outside AWS know the motivation behind the addition of this service or the amount of engineering that went into it, though executives would likely say it's a response to customer demand. Perhaps it was a relatively simple effort for AWS after the Nitro conversion.

Whatever the back story, there are several scenarios or application types that might require, or benefit from, AWS bare-metal instances over virtualized EC2 instances:

- Legacy applications that weren't built for and won't run properly in virtualized environments.

- Applications with archaic software licensing terms and enforcement mechanisms tied to hardware.

- Software that requires direct hardware access, such as Type 1 hypervisors. AWS bare-metal instances can run Hyper-V, which can be done with a virtual switch connected to a VPC and private Dynamic Host Configuration Protocol server that's ready to launch guest VMs just like a stock Windows Server.

- Kubernetes container clusters run without the overhead of VMs. Containers on EC2 or container instances on Fargate are already quite responsive and can be provisioned in seconds, but running cluster nodes on bare metal enables more container instances per node and further reduces latency.

Aside from container infrastructure, these scenarios might seem like corner cases, but AWS bare-metal instances might catch the front end of a market ready to explode. By one estimate, the bare-metal cloud market will grow more than thirteenfold to $26.2 billion by 2025, a CAGR of 38.4%. Don't be surprised if Azure and Google enter the fray with bare-metal offerings of their own if those numbers are accurate.