kentoh - Fotolia

Enterprise architecture tools could be acquisition targets

Avolution, Bizzdesign, Mega and Software AG tools lead the Gartner Magic Quadrant on enterprise architecture, but analysts see big players in neighboring markets joining the fray.

A new Gartner report on enterprise architecture tools predicts that big players in adjacent markets will buy the products or launch their own due to the growing importance of models in modern business.

Leading vendors in areas such as product and portfolio management (PPM) and IT service management (ITSM) could venture into enterprise architecture (EA) tooling through partnerships or acquisitions, said Akshay Jhawar, a Gartner associate principal analyst who co-authored Gartner's 2020 Magic Quadrant for EA tools.

"Clients are looking for more integrated one-stop solutions or platforms that can serve various areas, like product and portfolio management, EA and innovation," Jhawar said.

In a separate report on ITSM tools, Gartner noted that BMC, Ivanti and ServiceNow commanded 70% of the market share in 2019.

Enterprise architecture tools adoption

Jhawar said the adoption of enterprise architecture tools is increasing as organizations advance their business models to meet changing customer needs, pursue digital transformation and build a "composable enterprise" using interchangeable building blocks. He said some EA teams mistakenly limit their scope to cataloging their existing IT systems, applications and technologies when they should take the opportunity to capture their organization's business architecture and strategy.

Gartner's latest Magic Quadrant on EA tools reflects a shift to features that enable users to drag and drop objects and classes, get context-sensitive help, and use collaboration tools such as Microsoft Teams and Slack. Other key capabilities in many of the EA tools featured in the report include guided navigation, autogenerated views, smart search and virtual assistant support, Jhawar said.

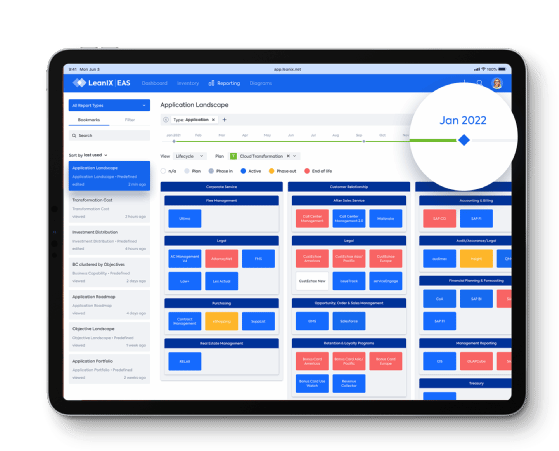

Avolution, Bizzdesign, Mega International and Software AG "sustained excellence in both execution and vision" to hold their positions as leaders in the 2020 Magic Quadrant for EA tools, just as they were in 2019, according to the Gartner report. But Gartner now lists a longer group of challengers behind them, with BOC Group, LeanIX, Orbus Software and QualiWare.

"These players generally have a traditional, IT-centric vision for EA," the Gartner report said of the challengers, claiming they are "not as aggressive" as the leaders and visionaries in pursuing business strategy and shared operating models.

Four EA vendors that Gartner called visionary are Ardoq, with a roadmap focusing on automation, maintenance and representation using algorithms and analytics; Capsifi, offering flexibility and scalability with graph analytics; Enterprise Architecture Solutions, with an open source offering for unlimited users and low-cost support service subscription; and Planview, combining EA with portfolio management and enterprise agile planning.

Niche players that Gartner identified in the EA Magic Quadrant are Clausmark, Erwin, Unicom Systems and ValueBlue.

Integration with enterprise architecture tools

Jhawar said vendors increasingly have been integrating enterprise architecture tools with products in adjacent categories, such as PPM and configuration management databases. He expects that trend to continue in support of customers that need to tie together different elements of the "patchwork quilt needed to support the modern enterprise."

Gartner analysts evaluated EA tools across five use cases they see as important to enterprise architects and senior leadership. The use cases are as follow:

- capture, structure, analyze and present models;

- support change, transformation and optimization;

- assess and manage an evolving IT portfolio;

- enterprise architecture management; and

- innovation.

To qualify for the Magic Quadrant, EA tools vendors had to have $8 million or more per year in perpetual licensing revenue, $5 million in annual recurring SaaS subscription revenue, or 50% year-over-year revenue growth for the past three years. The vendors needed to have an installed base of at least 50 production customers using their product exclusively on an enterprise-wide basis and at least 15 new customers in three geographical regions in 12 months.