Getty Images/iStockphoto

Explore the impact of data science in business workflows

Data science and machine learning are reshaping business workflows and customer experiences, ushering in an era of highly tailored services and predictive strategies.

On a recent trip to Europe, flying from Vienna to Frankfurt, my plans changed as they so often do on business trips.

I arrived at the airport very early, so I thought I might be able to catch a different flight. At the line for the service desk, I scanned my boarding pass, took a number and waited while a few other customers dealt with their requests. When my turn came, I approached the desk -- but before I could even say hello, the assistant said in English, "Good afternoon, Mr. Farmer. You are here quite early; do you want an earlier flight?"

I had barely nodded when she handed me a boarding pass already printed out, apologizing that I only had a middle seat instead of my preferred window. She then gave me a priority pass for the security line, noting that I only had a short time before boarding.

The service was perfect: personal, aware, precise and attentive. It's the kind of service that a top-class concierge or service agent might provide, but only with a wealth of experience and a real personal commitment to their customer. My service agent was good, but what made her great was the data-driven insight and prompting of the customer service system, which I could see her referring to.

For me as the customer, it didn't matter that this exchange was driven by data. But predicting and resolving my request with minimal fuss and maximum attention to detail? That was delightful: a fine example of customer service in the age of personalization.

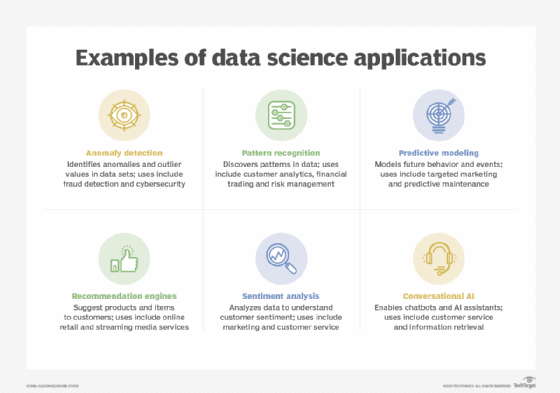

With the potential for services like this, it's no surprise that data science and machine learning have become indispensable in modern business workflows as they help tailor product offerings, predict market trends and personalize marketing. By using data analytics and algorithms, companies can gain valuable insights to significantly improve operations and support.

This data-driven approach represents a fundamental shift. Businesses can now tailor their services to individual customers in an unprecedented manner that customers have increasingly come to expect.

Data science use cases in business workflows

Data science has opened exciting possibilities for businesses to offer hyper-personalized, tailored services. Companies across many sectors use customer and operational data to optimize their operations.

However, businesses must also use data ethically. With responsible data practices, companies can unlock data's full potential for both business value and positive social impact. The data-driven business model ushers in a new era for many industries: the age of personalization.

Personalized marketing and product offerings

The era of broad-brush, one-message-for-all marketing is gradually fading, paving the way for more personalized -- and effective -- marketing strategies.

By analyzing customer data, retailers can now fine-tune their marketing campaigns, often to the level of individual consumer preferences. This transition is about not just better engagement but also optimizing the return on investment in marketing campaigns, which has always been difficult to measure.

However, personalization does not end with marketing. In the retail sector, data science has transformed the way online vendors present their products to shoppers. By examining past purchase data, retailers can discover customer preferences and tailor product recommendations accordingly.

For example, online clothing retailer Stitch Fix uses algorithms extensively to get to know each client's style. This enables Stitch Fix to directly ship to customers automated deliveries of items that they are likely to enjoy and keep. Although customers provide some explicit features, such as size preferences, the system infers other features from data such as purchase histories and Pinterest boards and by using natural language to analyze customer feedback.

Healthcare improvements and drug development

Although the healthcare industry isn't quite as commercial as the retail sector, it still relies on data to improve patient outcomes.

Predictive analytics in healthcare can help providers identify patients at risk of developing certain conditions, such as heart disease, enabling doctors to intervene earlier. Data also enables hospitals to reduce readmission rates by pinpointing factors associated with hospital readmission. This supports healthcare systems in developing targeted care management strategies for specific high-risk patients.

Data science is also useful for pharmaceutical research and development. Machine learning algorithms can now parse millions of compounds to identify potential drug candidates in mere days -- a process that previously took months or years for human researchers.

Know your customer

In the financial services sector, the know-your-customer (KYC) framework is not just a suggestion for better service but a critical regulatory requirement designed to prevent fraud, money laundering and terrorist financing. Data science plays a dual role in KYC, functioning as both a protective measure and a tool for personalization.

Financial institutions, by law, must verify the identity of their customers. This typically involves checking official documents such as passports, driving licenses or utility bills. But institutions must also assess the purpose of an account, expected transaction behaviors and the sources of funds to ensure they align with what is known about the customer.

Data science can greatly help here, especially when operating at the scale of a large consumer bank. Regularly monitoring customer accounts enables financial services providers to detect suspicious activity. Anomalies such as a high-value transaction or an unusual transfer pattern can trigger further investigations, making anomaly detection a critical use case for data science in financial services.

With these regulatory components in place, data science can also extend the principles of KYC into service offerings. Insights into a customer's financial behavior and needs help banks and other financial institutions improve their recommendations to that customer for specific products or services. For instance, a customer with regular international transactions might benefit from a multi-currency account.

Data ethics considerations for businesses

Data analytics has become a powerful tool that businesses harness to drive personalization in design, marketing and customer service. However, with its benefits come significant ethical challenges.

Often, customers interact with digital platforms without fully understanding the trail of data they leave behind. Companies bear responsibility for transparency and direct communication about how they collect, store and use customer data. Moreover, businesses must provide clear options for customers to opt out of data collection or even request data deletion.

Yet transparency alone isn't the end of the ethical considerations associated with data use in business contexts. Biases in algorithms, primarily arising from skewed data inputs, can lead to unfair or discriminatory outcomes. For instance, a discriminatory algorithm can lead to biased product recommendations or even influence significant decisions like loan approvals.

Organizations need to rigorously audit the data they use to train machine learning algorithms, ensuring representativeness and eliminating unwanted biases. Furthermore, continuous monitoring of these algorithms after deployment is crucial. It's not enough to set ethical policies: Businesses must test them in practice.

Donald Farmer is the principal of TreeHive Strategy, where he advises software vendors, enterprises and investors on data and advanced analytics strategy. He has worked on some of the leading data technologies in the market and at award-winning startups. He previously led design and innovation teams at Microsoft and Qlik.