Getty Images

In $1.9B deal, Salesforce buys data backup company Own

In the lead-up to its annual user conference, Salesforce buys Own Company for $1.9 billion, its second acquisition of the week and its third for 2024.

Salesforce plans to acquire SaaS backup vendor Own Company for $1.9 billion in cash to blend Own's technology into Salesforce's data protection catalog.

The definitive agreement to acquire Own came Thursday and marked the second acquisition Salesforce made this week. It also signed a definitive agreement Tuesday to acquire Tenyx, an AI-voice chatbot vendor. Details of the Tenyx acquisition were not disclosed.

Both acquisitions are expected to be completed during Salesforce's fiscal 2025 -- with Tenyx slated to close during its fiscal third quarter and Own slated to close during its fiscal fourth quarter. Salesforce's fiscal 2024 ended Jan. 31.

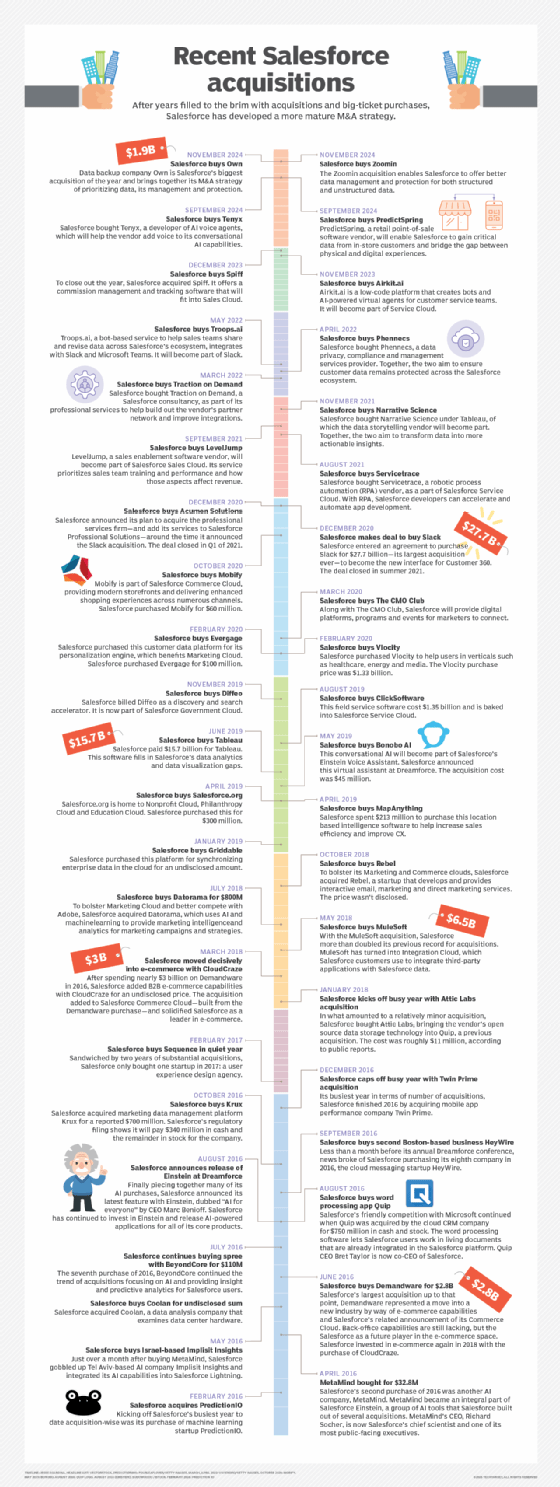

Salesforce isn't shy about acquisitions, having scooped up 39 companies since 2016, with Slack's $27.7 billion price tag topping the list. But the company has taken a purchasing pause in 2024, according to Rebecca Wettemann, founder of independent research firm Valoir. That pause ended in August when the company acquired PredictSpring, a point-of-sale software vendor.

The acquisition of Own isn't surprising, she said, as Own's executive team consists of Salesforce alumni and had secured investment from Salesforce Ventures, the company's VC arm.

"These aren't big acquisitions, but they're important," Wettemann said. "It's a lot easier to integrate an acquisition when you have a good working relationship."

Own the backup business

Own, which launched in 2015 as OwnBackup, started as a SaaS backup to the Salesforce PaaS. The Own platform enables backup, recovery, sandbox seeding and data discovery capabilities using Salesforce data. Own expanded in 2022 to support the Microsoft 365 and ServiceNow platforms. In 2023, it rebranded as Own Company.

Salesforce, which provides a comprehensive suite of SaaS platforms and services primarily for enterprise business transactions, offers its own data backup and protection add-on services. These services include Salesforce Backup, Shield and Data Mask. The acquisition will "enable Salesforce to offer a more comprehensive data protection and loss prevention set of products," according to a press release. The release did not provide integration details or changes in supporting and servicing Microsoft 365 and ServiceNow Own customers.

The release also claims Own supports about 7,000 customers, a sizable jump from the 4,400 TechTarget Editorial reported two years ago based on an interview with CEO Sam Gutmann.

Own was valued at $3.35 billion during its Series E funding round in 2021, making the $1.9 billion purchase a more attractive price point for Salesforce, according to Jon Brown, an analyst at TechTarget's Enterprise Strategy Group.

"The data is very valuable to their customers, so giving them that extra functionality to address a pain point just makes sense," he said.

SaaS platforms such as Salesforce do not offer complimentary backup capabilities. Instead, they operate under the shared responsibility model, a framework where the service provider is responsible for its software availability and security while customers are responsible for their data's availability and security.

That framework isn't likely to change anytime, Brown said, as the legal liability to protect customer data could end up costing more than the value of a company itself.

"It's tricky when you get to the liability piece," he said. "I think organizations are going to stay with that shared responsibility model that leaves a gray area in case of a disaster."

Tim McCarthy is a news writer for TechTarget Editorial covering cloud and data storage.