ipopba/istock via Getty Images

Top 4 Claims Denial Management Challenges Impacting Revenue

Common claims denial management obstacles for providers include quantifying denial rates, using manual processes, receiving preventable denials, and appealing claims.

For most healthcare organizations, claim denials are a normal, if not a frequent, occurrence. While very few can boast that their denial rates are close to zero, many providers face a number of challenges with implementing an effective claims denial management process.

The average claim denial rate across the healthcare industry is between 5 percent and 10 percent, according to an American Academy of Family Physicians (AAFP) report. Providers should aim to keep their claim denial rate around 5 percent to ensure their organization is maximizing claim reimbursement revenue.

However, keeping claim denial rates closer to the lower end of the industry average is not always easy when providers engage with several payers at once. Most major private payers kept their claim line denial rates under the 5 percent marker, the most recent American Medical Association (AMA) national health insurer report card found. Anthem had the highest claim line denials with 2.64 percent of claim lines, followed by Humana with 1.97 percent, Aetna with 1.5 percent, and Cigna with 0.54 percent.

On the other hand, public payers tended to send more claim denials. The report card showed that 4.92 percent of claim lines were denied by Medicare.

Claim denials may be a fact of life in healthcare, but inadequate claims denial management strategies could be leaving more healthcare revenue on the table than expected. About 90 percent of claim denials are preventable, a 2014 Advisory Board study revealed.

While receiving a denial is a challenge in itself, healthcare organizations also face several obstacles with adopting an appropriate claim denials management system. Some common challenges include tracking denial statistics, using manual processes, receiving avoidable denials, and appealing claims through a resource-intensive process.

Various payer rules challenge claims denial rate calculations

The first step to better claims denial management is identifying denials and the reasons behind them. However, retrieving meaningful claim denial statistics may not be as easy as plugging numbers into a formula.

First, providers may not have access to claims denial data from payers. Payers are oftentimes hesitant to release the data, especially how often they reject claims, because of competition. They tend to keep the information private or restricted to prevent potential customers from passing them up for a payer with a lower denial rate.

As a result, industry averages for claims denial rates generally differ from one report to another. For example, the AAFP reported an industry average between 5 percent and 10 percent, whereas the Government Accountability Office (GAO) found that up to one-quarter of claims are denied.

Second, each payer develops its own rules for denying claims as well as how to communicate claim denials to providers. Therefore, the industry does not have an established strategy for providers or payers to analyze and present claim denials data.

“The wide variation in how often health insurers deny claims, and the reasons used to explain the denials indicates a serious lack of standardization in the health insurance industry,” the AMA stated in 2013.

With a lack of standardization, providers may find it difficult to decipher payer language when it comes to claim denials. The same claim could be denied by two payers, but each payer may use a different code and communication method to let providers know the reason.

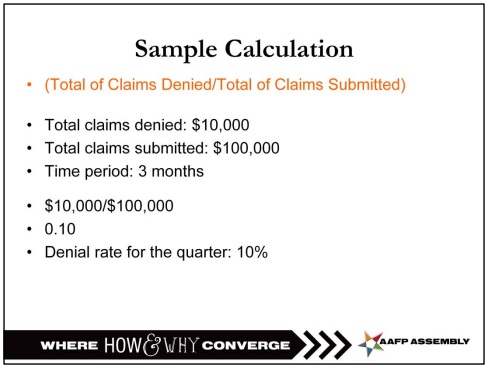

Fortunately, the AAFP released a guide on how a practice can quantify their own claim denials. To determine a practice’s denial rate, providers should take the total dollar amount of claims denied by payers within a set period and divide it by the total dollar amount of claims submitted within the same period.

The smaller the resulting number is, the healthier a practice’s revenue cycle is, the organization added.

Manual claims denial management processes delay timely reimbursement

Providers can choose from an almost never-ending list of health IT tools to manage everything from patient care to business operations. Yet, 31 percent of providers are still using manual claims denial management processes, a July 2016 HIMSS Analytics survey revealed.

“Given the complexities around submitting claims and the labor associated with managing denials, it came as a surprise that more organizations have not automated the denial management process through a vendor-provided solution,” said Brendan FitzGerald, HIMSS Analytics Director of Research.

Claims denial management and medical billing teams not only draw data from across the healthcare organization, but they must also manage different payer rules and codes. Using manual processes could slow productivity given the plethora of data needed to successfully manage denials.

Instead, healthcare organizations should automate as much as they can to avoid claim denials, Michelle Tohill, Director of Revenue Cycle Management at Bonafide Management Systems, stated in June 2016.

“Keeping up with all the diagnostic codes and different insurance policies can be exhausting, but there are many software providers that will automatically update codes and requirements,” she said. “This cuts down on your research time, allowing your billing team to spend more time double-checking claims to make sure they meet every single requirement.”

Automating claim denials management processes can also help healthcare organizations identify errors before claims are submitted for payment.

“This means that your whole team can become aware of what needs to happen in order to get reimbursed, cutting down on the time the billing team needs to spend figuring out what is missing and tracking down the necessary parties,” she added.

However, whether to select a vendor or in-house claims denial management solution is still up in the air. The HIMSS Analytics survey revealed that 44 percent of providers use a vendor, such as a clearinghouse, EHR, or revenue cycle management vendor, while 18 percent implemented an in-house automated system.

90% of claim denials are preventable, but still occur

The Advisory Board reported in 2014 that 90% of claim denials are avoidable and the most common claim denial reasons demonstrate that. According to the 2013 MGMA health insurer report card, most claims were denied for the following reasons:

• Missing information, such as absent or incorrect patient demographic data and technical errors

• Duplicate claim submission

• Service already adjudicated

• Services not covered by payer

• Time limit for claim submission already passed

Despite the relatively preventable top claims denial reasons, many providers are still making the same mistakes and receiving pushback from payers instead of payments. This may be because most medical billing and claims denial management processes are reactive, Monte Sandler, Executive Vice President of NextGen RCM Services, told RevCycleIntelligence.com in March 2016.

“A billing office is getting charges entered and bills out the door,” he said. “Then, they basically wait until they get responses from clearinghouses or payers in the form of rejections and denials. Then, they react to those.”

“It’s a terribly inefficient process,” he continued. “It delays the payment cycle. It reduces the probability of payment. I’m a big proponent of flipping that whole cycle upside down to build a much more proactive revenue cycle.”

The key to a more proactive claims denial management system is to ensure patient and insurance information is accurately collected and reported before or at the point-of-service.

“From a revenue cycle perspective, getting the most accurate information up front starts with patient scheduling and patient registration,” Gary Marlow, Vice President of Finance for Beverly Hospital and Addison Gilbert Hospital, shared with RevCycleIntelligence.com in March 2015.

“That provides the groundwork by which claims can be billed and collected in the most efficient and effective manner possible,” he said. “The last thing you want is getting a claim submission kicking back to them then having to work their way through the institution.”

Front-end staff will need to work with claim denials management or medical billing teams to understand what patient and insurance data are needed to ensure that demographic errors do not occur and services are covered by the patient’s plan.

As part of a more proactive claims denial management strategy, healthcare organizations should also implement a no-tolerance policy for late claim submissions.

“With all the complexity in the billing arena, some denials are inevitable,” Tohill stated. “But there is one type that is inexcusable, and that is a denial based on a failure to file in time. There is no recourse if you miss a deadline, and therefore the money is forever lost. Train your team and reinforce the rule that no claim should ever be late. You should have a 0% rate of denial based on untimely filing.”

Appealing denials costs providers money and time

No matter how proactive a claims denial management system is, providers will probably never reduce their claims denial rates to zero. While a denial is just another part of the healthcare revenue cycle, that does not mean providers must give up reimbursement.

Many payers have an appeals process for claim denials. Under a formal process, providers can work with payers to either provide the proper information needed for claims reimbursement or make their argument as to why the claim should not be denied.

The claims appeals process may seem like an opportunity for providers to recoup lost revenue, but going through the process can actually cost providers. A recent AMA study found that practices spend roughly $15,000 on re-working claims, including phone calls, investigative work, and claims appeals.

Even providers appealing Medicare claim denials shelled out significant cash. About 43 percent of providers spent more than $10,000 in the first quarter of 2016 on managing the Medicare Recovery Audit Contractor (RAC) appeals process, the American Hospital Association (AHA) reported in June 2016.

Another 26 percent said they spent more than $26,000 and 8 percent dished out over $100,000 in the same period.

In addition to costs, appeal processes can be time-consuming. The AHA reported in October 2016 that three-quarters of appealed Medicare claims remained at the administrative law judge level for longer than the 90-day statutory limit.

By the end of 2016’s second quarter, about 27 percent of all appealed Medicare claims were still held up in the appeals process.

The Medicare appeals process became so backed up that the Department of Health and Human Services faced a lawsuit calling on the department to resolve the backlog of cases. As part of the case, HHS reported that appeal hearings at the administrative law judge level were not typically held for 935.4 days despite a 90-day limit.

To resolve the Medicare appeals backlog, a federal judge ordered HHS in December 2016 to eliminate all pending cases at the administrative law judge level by 2021. The federal department, however, said that achieving this goal was not feasible.

With no end in sight for some claim appeals, healthcare organizations may want to focus their attentions on ensuring that claims submissions are as clean as possible to avoid resource-intensive appeals process.

Focusing on submitting cleaner claims may also be the key to overcoming many major claims denial management challenges. Flagging potential denial-causing errors before payers see them should lead to higher and timelier claims reimbursement.