Getty Images/iStockphoto

3 Patient Collections Best Practices to Boost the Bottom Line

Developing a proactive strategy, implementing payment plans, and tracking performance are patient collections best practices that help providers obtain patient financial responsibility.

Patient financial responsibility is steadily climbing, accounting for a greater portion of healthcare revenue. With patients shifting a provider’s revenue sources, hospitals and practices alike must implement internal patient collection strategies, so providers can collect all the revenue owed to them in a timely manner.

Patients are finding their financial responsibility significantly increasing under health plans with greater deductibles, out-of-pocket costs, and cost-sharing arrangements. Average out-of-pocket costs increased by 11 percent in 2017, TransUnion Healthcare recently reported.

As a result, patients ended up paying an average of $1,813 in out-of-pocket healthcare costs by the end of 2017.

With patients becoming increasingly responsible for total costs of care, provider revenue is shifting.

Traditionally, payer reimbursement made up the majority of a provider’s revenue. But hospitals recently reported an 88 percent increase in revenue attributable to patient financial responsibility after insurance between 2012 and 2017.

The analysis performed by TransUnion Healthcare also uncovered that patient financial responsibility after insurance increased from just eight percent of a patient’s total bill in 2012 to 12.2 percent by 2018.

Providers are relying more on their patients for complete payment of services. But as out-of-pocket costs increase, the chances of providers collecting all the revenue owed to them dwindles.

Hospitals collect significantly less from patients with higher out-of-pocket costs, a 2017 Crowe Horwath analysis revealed. Patient collection rates for accounts with balances greater than $5,000 were four times lower than the collection rates for accounts with lower patient financial responsibility rates.

With revenue collection relying more on the patient than payer, providers should be redesigning their internal patient collection strategies to get ahead of collections before a medical bill is even sent, developing convenient payment options for their patients, and monitoring collections performance to sustain success.

Develop a proactive patient collection strategy

By the time a patient receives a medical bill in the mail, providers are already seeing their revenue cycle slowdown. A McKinsey & Company study found that providers only expect to collect 50 to 70 percent of a patient’s balance after a visit. Seventy percent of providers said they wait at least a month to receive any payments from patients.

Educating providers and staff about patient financial responsibility and encouraging them to discuss patient collections prior to an appointment or at the point of service is key to a proactive patient collections strategy.

At the moment, providers are falling short of this goal.

Over one-third of providers (36 percent) admitted to never discussing patient financial responsibility or a patient’s ability to pay prior to delivering care, a 2017 West survey showed.

Only about 28 percent of adults surveyed by Public Agenda that year also said a clinician or staff member talked about costs and prices with them.

Patients are likely to delay paying their financial responsibility if their providers and their staff do not explain medical bills and how to pay them. Confusion about how much they owe and how to pay were top factors contributing to patients avoiding medical bill payment, the West survey found.

Discussing healthcare costs and patient collections prior to care delivery helped a small hospital in Illinois increase point-of-service payments by 300 percent in 2016. Iroquois Memorial Hospital’s Rebecca Wright focused on educating her staff about patient financial responsibility and training them to discuss collections with patients.

“We did just some general education for all of my staff and it was just baseline on what insurance is, what does a deductible mean, what does a co-pay mean, what is a patient’s responsibility altogether, how is it calculated,” the VP of Strategic Planning at the time said.

Armed with more information, schedulers felt comfortable talking to patients about their financial responsibility when scheduling procedures. They also started reminding patients to bring their checkbooks to the hospital on the day of the service.

The hospital also implemented a cost estimate tool to better inform their providers and patients about patient collections.

“[The tool] links to our chargemaster and it can link it to insurance companies in real-time,” she explained. “It gives me an estimate based on their real-time insurance and how much it is supposed to cost for patients to have the service here.”

Giving staff the tools to discuss patient financial responsibility with patient was key to boosting patient collections at Iroquois Memorial Hospital.

Implement payment plans

Individuals are struggling to pay their medical bills as high-deductible health plans dominate the employer-sponsored insurance market and healthcare prices continue to rise.

Medical bills top the list of patient concerns about healthcare and finances, according to a recent poll by the Kaiser Family Foundation. About 58 percent of healthcare consumers are concerned about general out-of-pocket costs increases, and 67 percent said they worried about surprise medical bills.

Providers can help patients to shoulder the financial burden of healthcare by implementing payment plans. Third-party vendors and banks offer hospitals and practices payment plan programs that allow the provider or patient to break down large medical bills into more affordable payments over time.

These options are in high-demand among patients. Ninety percent of healthcare consumers participating in a 2017 Porter Research and ClearBalance survey stated that they were more likely to return to a provider who offers a loan or payment plan program for patient financial responsibility.

In response to consumer demands and the rise in patient financial responsibility, Mosaic Life Care in Missouri recently implemented a payment plan program.

The network, which spans three states, noticed its patient collection performance dwindling as more of their patients enrolled in high-deductible health plans. The health system was collecting about five percent of self-pay responsibility and just 30 percent of account balances after insurance.

“It didn't look good for us. We didn't have a lot of options for our patients in terms of payments,” Deborah Vancleave, Mosaic Life Care’s VP of Revenue Cycle, told RevCycleIntelligence.com.

Vancleave partnered with a third-party vendor to boost patient collection rates through payment plans. Mosaic integrated the payment plan program into the health system’s front-end revenue cycle management solution, allowing the tool to calculate each patient’s ability to pay.

“The front-end software will look at the patient's ability to pay and it will recommend a number to the caregiver,” she explained. “In other words, if the system is coming back and saying the patient owes $500 and the patient could afford $150 a month, then it would spread that out over three or four months.”

The initiative produced a positive response from patients. Consumers financed $6.1 million through Mosaic Life Care’s vendor partner between July and December 2017 alone. As a result, the health system collected about $5.1 million in net cash during that period.

“On new accounts placed, we're projecting the collection rate as 89.3 percent,” Vancleave added. “We went from five percent on self-pay and 30 percent of balance after insurance and now we're projecting 89.3 percent. I'm not a mathematician, but I'll take those percentage differences any day of the week.”

Track patient collection KPIs to sustain improvement

According to the Healthcare Financial Management Association (HFMA), hospitals and practices should be tracking two key performance indicators (KPIs) to help sustain positive patient collection performance.

First, providers should calculate and track their point-of-service cash collections.

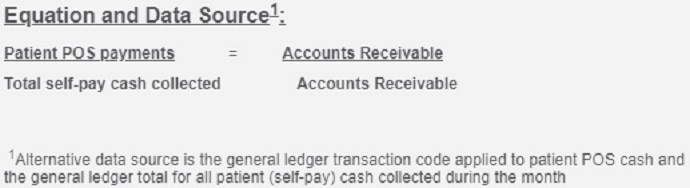

Providers can benchmark their point-of-service cash collections by dividing patient point-of-service payments by total self-pay cash collected.

Point-of-service payments include patient revenue for a current encounter which is collected before or at the time of service. Hospitals should also include patient revenue collected up to seven days after discharge. The point-of-service payments also include patient revenue for a prior encounter which is collected before or at the time of the next encounter.

Self-pay cash collected includes the total cash collected for patient financial responsibility for the reporting month, such as all posted self-pay payments, bad debt recoveries, loan payment, and combined hospital and physician payments.

Data for both the values can found in accounts receivable, HMFA reports.

Second, hospitals and providers should determine their cash collections as a percentage of net patient service revenue. The indicator tracks the provider’s ability to convert net patient services revenue to cash. It also provides an indication of the fiscal integrity and financial health of an organization, HFMA states.

Providers can calculate their cash collections as a percentage of net patient service revenue by dividing total patient service cash collected by the average monthly net patient service revenue.

Total patient service cash collected is found on the general ledger. The value includes all patient service payments posted to patient accounts and bad debt recoveries. For hospitals, the value also contains Medicare Disproportionate Share Hospital payments and Medicare Indirect Medical Education payments.

Average monthly net patient service revenue is the most recent three-month average of total net patient service revenue, HFMA explains. Net patient service revenue is the gross patient service revenue less contractual allowances, charity care provisions, and provision for doubtful accounts.

Hospitals should also include their Medicare Disproportionate Share Hospital payments and Medicare Indirect Medical Education payments when determining average monthly net patient service revenue.

Providers should track these two KPIs to monitor patient collection performance and catch potential setbacks before they impact revenue.

“The advantage of having strategic keys to look at is you can see very quickly if the trend line is going in the right direction,” HFMA’s Director of Healthcare Finance Policy and Revenue Cycle MAP Sandra Wolfskill told RevCycleIntelligence.com in 2017. “If so, life is good. If it is going in the wrong direction, how do I need to shift to try to have an impact within a 30, 60, or 90-day cycle?”

Layering a KPI strategy on top of proactive, convenient patient collection methods is critical to improving collection performance and sustaining success.