AndreyPopov/istock via Getty Ima

Impact of Future Medicare Cuts on Physician Reimbursement

Physician reimbursement under Medicare has remained stagnant for decades, and without legislative intervention, payments will be significantly reduced again in 2022.

Medicare is a federal health insurance program that serves seniors and people with disabilities. The program helps to pay for a variety of healthcare services, including hospitalizations, physician visits, prescription drugs, preventive services, skilled nursing facility stays, home health services, and hospice care.

Before Medicare, less than half of the elderly population had health insurance. Now, as of 2021, more than 63 million people have coverage through Medicare (roughly 19% of the United States population). But Medicare spending is outpacing the number of people paying into the system, and that’s now created a funding gap in the program.

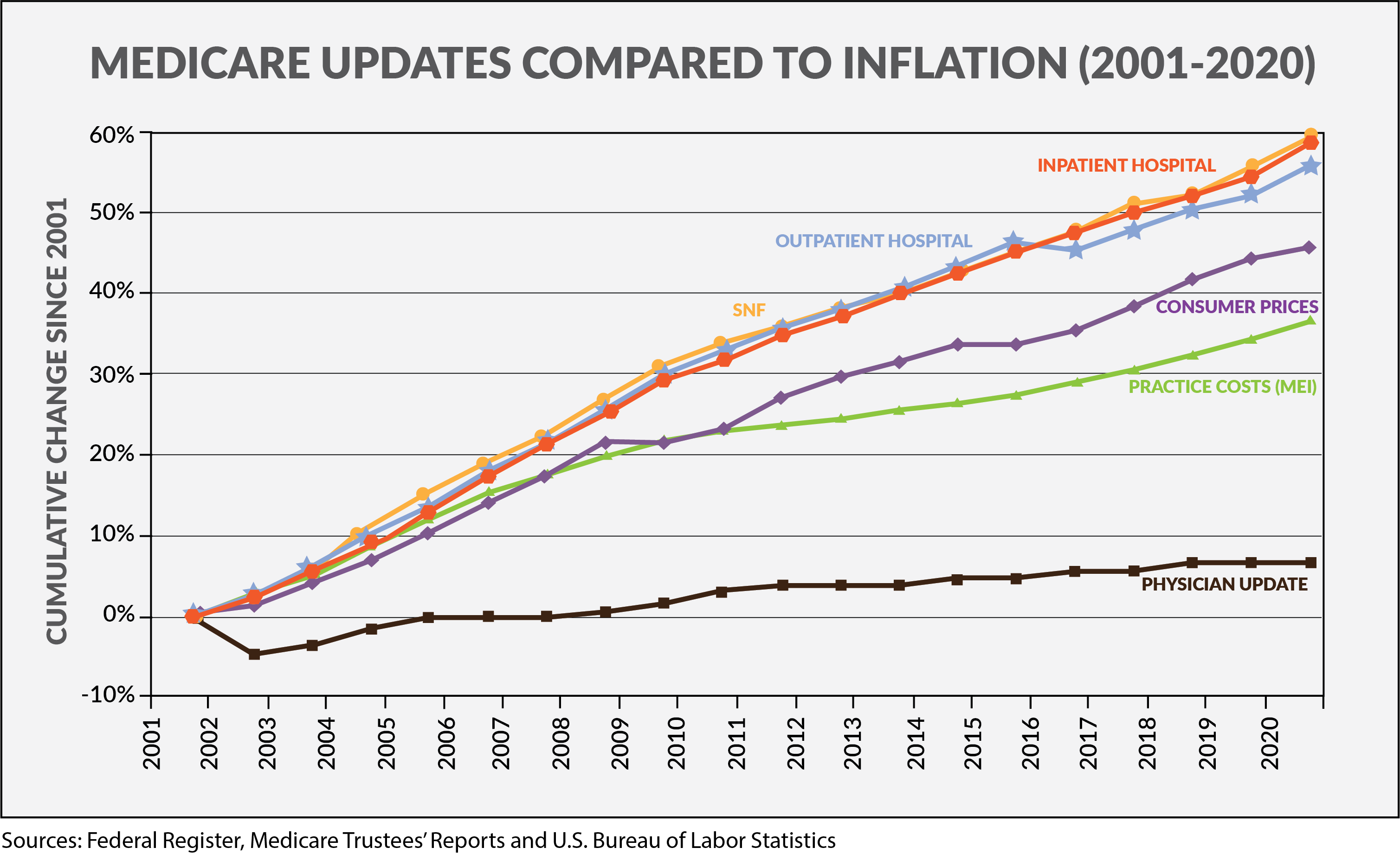

“Medicare spending has always been a hot topic in Congress,” says Dr. Andrea Brault, President and CEO at Brault Practice Solutions. “But if we take a closer look at how Medicare has adjusted their payments over the years, you see that it’s only physician payments that have stayed relatively flat over the past couple decades — while other areas of Medicare spending have generally kept up with inflation.”

“Anti-inflationary policies have really impacted Medicare physician payments over the past 20 years,” explains Dr. Brault. “And if you adjust for the inflation in practice costs, you realize that Medicare physician payments have actually declined by 22% from 2001 to 2020.”

History of physician reimbursement for Medicare services (1965–2015)

Physician payments under Medicare have been highly debated since the inception of the program, and Congress has been forced to make several key changes over the years.

- In 1965, when the Medicare program was established, physician payments were based on the physician’s charges. However, Medicare spending quickly escalated over the next several years as physicians continued to raise their charges.

- In 1975, the Medicare Economic Index (MEI) was developed as a fixed fee schedule that would limit increases in physician fees. Annual increases were then based on increases in physician operating costs and general earning levels. But this system was also flawed.

- By 1984, Congress was again worried about the rising cost of Medicare physician fees — and annual changes to physician fees had to be determined by Congressional action between 1984 and 1991.

- In 1992, Congress went back to the MEI standard but added the Medicare Volume Performance Standard (MVPS) as an adjustment factor to counteract those who might manipulate the system by simply performing more services.

- In 1998, the MVPS was replaced by the Sustainable Growth Rate (SGR) in order to link physician reimbursement under Medicare with increases in gross domestic product. This formula invariably resulted in payment cuts for physicians, and Congress was forced to pass a series of patches each year to reduce the impact of these cuts.

- In 2015, the SGR methodology was replaced by the Medicare Access and CHIP Reauthorization Act (MACRA) in order to avoid a 21% reduction in payments under the Medicare Physician Fee Schedule (PFS).

MACRA shifts Medicare from volume to value (2015 – Present)

The 2015 MACRA legislation introduced a new method for paying physicians under Medicare by gradually moving providers into a risk-sharing model and eliminating any automatic increases to physician payments.

Physician fee updates under MACRA:

- 0.5% annual increase to physician reimbursement (2015–2019)

- 0.0% annual increase to physician reimbursement (2020–2025)

The risk-sharing part of MACRA is the Merit-Based Incentive Program (MIPS), which awards additional Medicare payments (or penalties) based on physician performance — with a potential swing of +/-7 percent in 2021 and +/-9 percent in 2022 (and beyond).

“This potential loss of Medicare revenue will definitely have an impact on some physician groups,” Dr. Brault stresses. “But this is just the tip of the iceberg in terms looming Medicare cuts.”

Dr. Brault previously detailed why active MIPS optimization program is key to mitigating this potential loss of revenue.

Existing legislation has created a Medicare payment cliff

“There are several Medicare payment cuts scheduled to resume in 2022,” explains Dr. Brault. “These are going to be broad reductions in overall payments, and it’s going to impact reimbursement for the entire house of medicine.”

Medicare payment cuts beginning in 2022

- Medicare sequestration cuts (-2%). Since 2013, Medicare payments have been subject to a 2% annual reduction that was established by the Budget Control Act of 2011. But a temporary moratorium was put in place during the pandemic, and these sequestration cuts were paused through the end of 2021. Now, this 2% reduction is scheduled to resume on January 1, 2022.

- PAYGO sequestration cuts (-4%). Further Medicare cuts are also scheduled to take place due to the Pay-As-You-Go (PAYGO) budget rule that requires mandatory spending increases to be offset by tax increases or cuts to other areas of mandatory spending. So, the $1.9 trillion that was allocated for the American Rescue Plan Act will now trigger an additional 4% reduction in Medicare.

- Physician Fee Schedule & “Budget Neutrality” (-10.2%). Providers were also expecting to see an additional 10.2% cut in the Medicare Conversion Factor (CF) due to updates in the 2021 Medicare Physician Fee Schedule (PFS). The CF was expected to go from $36.0896 (in 2020) to $32.4085.

“Fortunately, we got a big win in this area,” Dr. Brault maintains. “Congress passed the Consolidated Appropriations Act of 2021, which added 3.75% back to the PFS and delayed the implementation of a Medicare add-on code. This resulted in a Medicare CF of $34.8931, which is equal to a 3.4% cut. So, we got a temporary win here, but Congress still has to act in order to prevent these cuts from resuming.”

Only an act of Congress can fix this threat to Medicare reimbursement.

Dr. Brault cautions that “moving forward, Congress must recognize the need for critical reforms to the Medicare PFS system — especially the budget neutrality requirement, which can lead to arbitrary reductions to reimbursement that are unrelated to the cost of providing care.

“These Medicare cuts are going to happen unless we can convince Congress to take action,” Dr. Brault observes. “Providers should be getting involved through their local or national medical societies. These groups typically have resources to help educate your members of Congress and ask them to take action. Physician groups have helped shaped Medicare policy in the past, and we must continue this level of advocacy to ensure that our patients have access to vital health care services moving forward.”

_________________________________

Brault is a revenue cycle and practice management organization that partners exclusively with hospitals and acute care physician groups. Their intelligent practice solutions include MIPS optimization, practice analytics, and provider documentation training. Learn more at www.Brault.us