Getty Images

New Reality of Medicare Physician Payments, Future with MIPS

Medicare physician payments have always been a source of debate, leading to several changes in its payment model as it continues its shift to value-based care.

The Medicare Access and CHIP Reauthorization Act of 2015 (MACRA) was enacted by Congress to address issues related to physician payments under Medicare. The primary goal of MACRA was to move away from the traditional fee-for-service payment model and towards a value-based payment system.

MACRA introduced the Quality Payment Program (QPP), which includes two tracks for value-based payments.

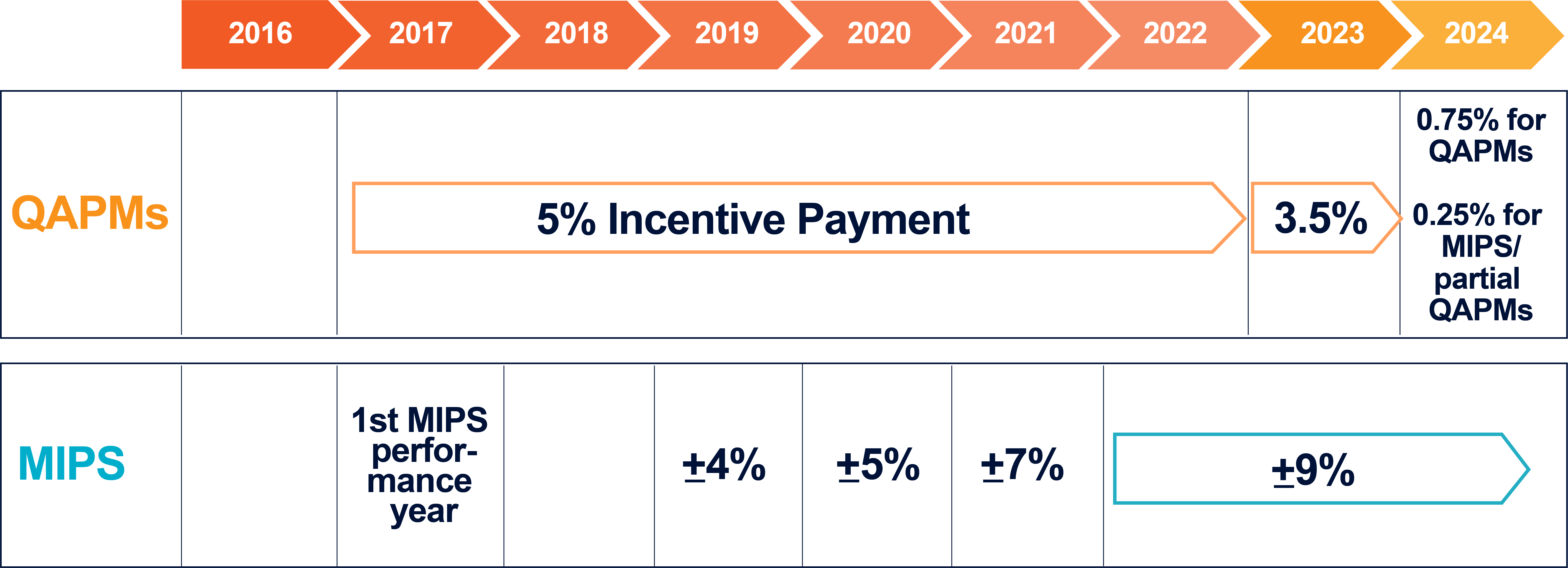

- The Merit-Based Incentive Payment System (MIPS), which adjusts physician payments based on annual performance. At the end of each performance year, CMS assigns a positive, neutral, or negative payment adjustment to each participant under MIPS.

- The Alternative Payment Models (APMs), which offers a separate track for those who qualify. These clinicians receive an automatic bonus payment and an exemption from MIPS, but they must maintain certain thresholds to remain eligible as a Qualifying Participant (QP).

“These payment models established a way for physicians to impact their Medicare reimbursement with better performance, but they also added a level of risk for those who score below the national average,” explains Dr. Andrea Brault, President and CEO of Brault Practice Solutions.

MIPS vs. APMs, which is the ideal track?

Most physicians are required to report through the MIPS track unless they qualify as an APM or have another type of exemption.

“There are pros and cons to each option, but it’s changed over time,” explains Dr. Brault. “So, it’s important to understand the changing rules and incentives under each option. Particularly for those who have traditionally reported as part of an APM.”

According to the National Association of ACOs (NAACOS), MACRA incentive payments for the 2024 performance year will favor those who do not participate in an Advanced APM and instead remain in the MIPS track. The professional society cites shrinking incentive payments and high barriers to entry as the main drivers for this negative outlook.

APMs have historically received a 5 percent incentive payment just for qualifying under this payment model. Those automatic payment were originally set to expire in 2023, but Congress stepped in to provide temporary relief with a 3.5 percent extension.

“Now, those automatic payments have ended, and the financial incentive has diminished for APMs,” says Dr. Brault. “At the same time, we’re seeing an increase to the QP threshold – which means more physicians are likely to be forced into MIPS reporting.”

MIPS grading is no longer an easy ‘A’

In the first five years of MIPS, most physicians qualified for a positive payment adjustment. However, the financial impact was relatively small in those early years. Particularly because CMS established guardrails to limit the number of physicians who received MIPS penalties, which then limited the pool of available funds for those who achieved high scores.

CMS reported that, in the 2021 performance year, more than 86 percent of physicians received a positive MIPS adjustment, but only 3.3 percent received a penalty. So, the positive adjustment maxed out at 2.3 percent.

“In those early years, there wasn’t a lot of motivation to do well or even participate in MIPS,” explains Dr. Brault. “MIPS started with an optional transition period, and many physicians chose to wait a few years before jumping in. Many also claimed a hardship exemption during the public health emergency, which further delayed their participation in MIPS. The result was a very slow start to the program, with a relatively small pool of participants.”

From 2020 to 2023, CMS allowed physicians to claim a MIPS exemption for Extreme and Uncontrollable Circumstances (EUC). But, those protections are no longer automatic and future exemptions will likely become more difficult to justify.

MIPS penalties will continue to grow

The MIPS program includes a minimum performance threshold, which physicians must be met to avoid a penalty adjustment. For 2024, CMS had signaled that it would be setting the threshold at 82 points, which would have resulted in about 50 percent of participants landing in neutral or penalty range.

But after significant push back from the physician community, the 2024 threshold was set to 75 points. CMS now estimates that in the 2024 performance year, the median MIPS penalty will be -1.24 percent with a maximum penalty of -9 percent. However, positive payment adjustments are only expected to reach a median of 1.74 percent and a maximum of 2.99 percent.

“It’s important to remember that negative adjustments fund the positive payments,” says Dr. Brault. “So, while it’s good news that the performance threshold is lower than expected, it also means that there will be fewer participants paying into the bonus pool.”

In 2024, additional cost and population health measures may also make it harder to achieve a higher MIPS score.

“More cost and population health measures translates to more risk,” says Dr. Brault. “Physicians typically don’t have visibility or control over these measures, but they get tacked on to the final calculation and can have a significant impact on your overall MIPS score.”

Dr. Brault explains that it’ll continue to be an uphill battle for those participating in traditional MIPS. But she notes that a new MIPS track has also emerged for physicians who qualify under a specific medical specialty or condition.

MVPs offer a streamlined alternative with a less risk

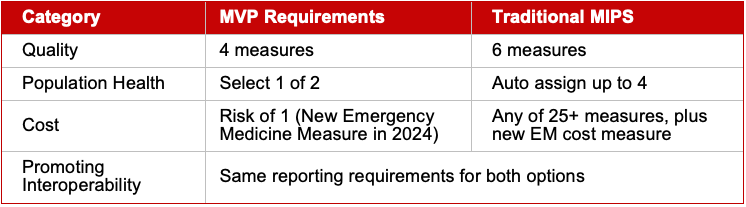

In recent years, many physicians complained of too much complexity in the original MIPS program. And in 2023, CMS launched its first set of MIPS Value Pathways (MVPs) as an alternative reporting option with streamlined rules and requirements.

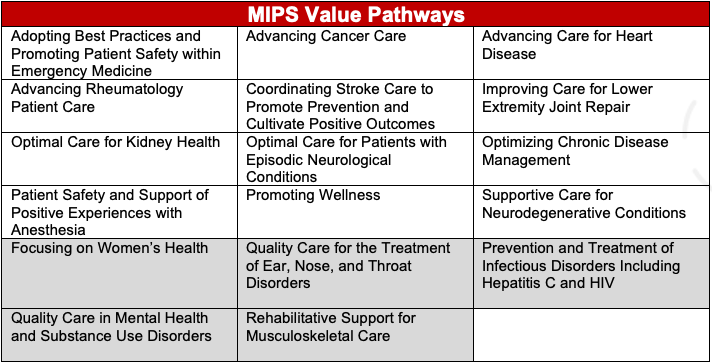

Each MVP has measures and activities that are tailored to a specific medical specialty or condition, including specialized quality measures and a limited set of cost and population health measures.

CMS has also signaled that it intends to fully replace the current MIPS model with this new MVP framework through future rulemaking. And as of 2024, they have launched 17 MVPs – including 12 from its initial year and five more that were added this year.

“It’s too early in this program to determine whether the current MVPs offer benefits over traditional MIPS.” says Dr. Brault. “However, it is at least an early opportunity for physicians to familiarize themselves with this new MVP model that will soon become the future of Medicare Physician Reimbursement.”

_________________________

ABOUT BRAULT PRACTICE SOLUTIONS

Brault is a revenue cycle and practice management organization that partners with hospitals and independent physician groups. Their intelligent practice solutions include coding and billing, MIPS optimization, provider documentation training, and practice management. Learn more at www.Brault.us