Chinnapong - stock.adobe.com

Key Ways to Improve Claims Management and Reimbursement in the Healthcare Revenue Cycle

To keep pace with changes to healthcare reimbursement, hospitals and healthcare organization need to reduce inefficiency in revenue cycle management.

Reimbursement is changing in healthcare. Even before elements of the Affordable Care Act began to go into effect, a growing focus on value- based care versus volume has led many healthcare organizations and providers to consider accountable and patient-centered care models in which they assume a greater share of risk.

In this changing climate, revenue must be managed differently to ensure that the value delivered to patients is paid for appropriately both in terms of accuracy and timeliness.

UNDERSTANDING CLAIMS IN THE CONTEXT OF THE REVENUE CYCLE

For hospitals and physician practices to ensure that their claims are paid, they must first understand how the different components of claims management affect reimbursement.

“Whether you call it revenue cycle or protecting your reimbursement, success will depend on making many improvements simultaneously,” says Nalin Jain, Delivery Director of Advisory Services for CTG Health Solutions “It’s not just one small thing that you fix, but making several improvements and making them simultaneously through the process from pre-care to zero balance.”

The negative impact poor claims management can have on reimbursement is significantly more pronounced in clinical settings where resources dedicated solely to the revenue cycle are often lacking.

“We realized early on that physicians are running the business, but they are not businessmen,” Jain explains. “They are caregivers, yet they have to manage their practice as a business and claims processing was the sand in the gears of practice management.”

According to Jain, those healthcare organizations and providers succeeding at reimbursement take into account and address how each of the various components of the patient-provider interaction fit into the revenue cycle and could introduce gaps leading to loss or risk:

- Pre-service (e.g., pre-registration, pre-authorization)

- Process of care

- Process integrity practices (e.g., charge master, coding compliance, clinical documentation)

- Billing services (e.g., customer support, collections, follow-up)

- Administrative services (e.g., contract management, fee schedules, debt collections, managed care contracts, denial management)

“When you compartmentalize your practice or your hospital across these five areas,” Jain continues, “you’re able to address within each of these components what is working and not working, what are the industry standards, where are your peers compared to where you are, and what you need to do to get to the next stage and then beyond that.”

In other words, improving reimbursements begins with assessing the current state of affairs. Jain recommends that physician practices and hospitals pay special attention to three broad functional areas: financial, technical, and operational.

“Whether you call it revenue cycle or protecting your reimbursement, success will depend on making many improvements simultaneously."

The financial side looks at accounts receivable (A/R), its metrics around collection rates, denials, and denial management. The technical side considers the systems, applications, and processes throughout the entirety of the patient-provider interaction. The operational side takes into account the staffing, vendor relationships, and workflows.

Depending on the size of the healthcare organization and extent of processes surveyed, the assessment can last from a few months to several months. But once it is complete, hospitals and physician practices have the means to create a remediation roadmap as well as benchmarks to measure performance against.

For Jain, the ideal remediation roadmap is tiered and begins with simple activities before moving on to more complex tasks. “Doing it this way ensures that you’re going to have buy-in within the organization because you can quickly come up with some low- hanging fruit and prove the proof of concept to the stakeholders, get their buy-in, and then move on to the larger target and the more difficult to achieve targets in stage 2 and stage 3,” he claims.

Technology indeed has a role to play in improving claims management and reimbursement rates, but it is of course not a replacement for the processes responsible for introducing or increasing the errors that leave bills unpaid, overpaid, or underpaid.

Only when the various part of the revenue cycle are in tune will reimbursements flow predictably. “They all contribute toward making sure that your revenue cycle is managed effectively,” says Jain.

Read More Why Healthcare Needs Value-Based Supply Chain Management

IDENTIFYING KEY STAKEHOLDERS, ACTIVITIES IN CLAIMS PROCESSING

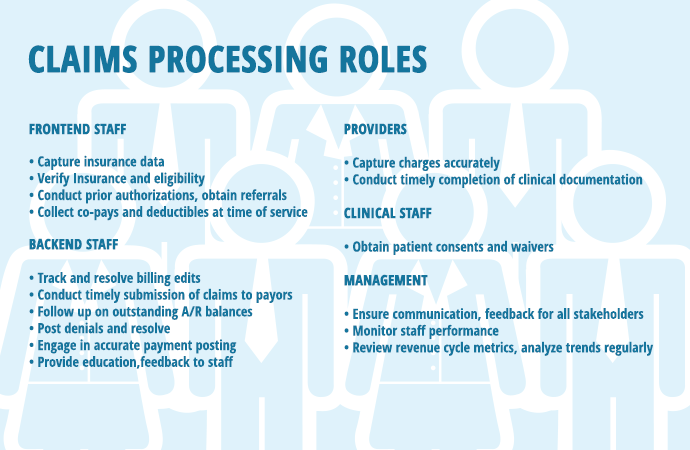

A successful claims processing operation comprises skilled personnel and well-monitored processes. The revenue cycle, of which claims processing is but one part, will vary according to the makeup of a healthcare organization as well as the billing model being used by that health system, hospital, or physician practices.

Here is a breakdown of personnel and activities within a hybrid billing model that marries both a decentralized and centralized billing models:

In order that the revenue cycle functions smoothly and that opportunities for improvement in claims reimbursement are addressed in a timely fashion, leaders from the various departments in a healthcare organization must communicate in a scheduled way with certain meetings occurring more frequently than others.

For instance, whereas the business office manager and financial counselors and members eligibility/authorization team might on a biweekly basis to review trends in patient access, the group administrator, business office manager and business office staff might meet on a monthly basis to discuss underpayment trends, cash balancing, and claims-related problems or concerns.

No matter the size of an organized, key stakeholders and activities in claims processing from the front to the back should be organized in a standardized way.

HOW ARE FEDERAL POLICIES CHANGING REIMBURSEMENT STRATEGIES?

A shift from fee-for-service to pay-for-performance has healthcare organizations reconsidering how their clinical practices will impact their bottom lines moving forward as providers assume greater and greater accountability.

With most health systems, hospitals, and physician practices still relying on encounter-based, reimbursement challenges over next several years could become “exponential,” says John Dugan, CPA, Partner at PricewaterhouseCoopers (PwC) who oversees its healthcare provider practice.

“Those that are getting it are making investments in several areas as well as trying to understand how well they are following evidence-based medicine across the organization,” he explains. “Having those standardized levels of care that are supported by data analytics for them to understand what the outliers are in the cost to treat, that’s where you’re seeing savings driven out of the system.”

The areas in question generally fall into two categories: regulation-based or patient-centered. The first has become more salient over the past few months with the Centers for Medicare & Medicare Services (CMS) imposing more and more rules around admissions, which has led to an increasing number of denials among the providers Dugan works with.

“The winners in the game are going to be the ones who really focus on patient/consumer — those patients now become their own payer class.”

“Certainly from a clinical denial space, a lot of it surfaces around medical necessity for inpatient admissions,” he observes. “Medicare came out recently with a further clarification on an existing regulation that was known as the two-midnight rule that has left many of our clients scampering around.”

While the purpose of these and similar regulations was to shift hospital use away from inpatient and toward outpatient settings, the effect has been that healthcare organizations have “had to take a much deeper look at their short-stay admissions practices” and CFOs have had to calculate potential losses in revenue and ways of counteracting them, claims Dugan.

With the implementation of the ACA well underway, the healthcare industry has also had to come to terms with the consumerization of the patient population — that is, the patient as consumer — and what that means to doing business in a new era of patient-centered care.

“What you’re seeing providers doing right now to augment that is making more investments within the entire patient access function (e.g., call centers, relationship portals — around pricing transparency to compete in a high-deductible world,” Dugan reveals.

A focus on the needs and wants of patients has emerged as a significant differentiator among healthcare providers.

“The winners in the game are going to be the ones who really focus on patient/consumer — those patients now become their own payer class,” says Dugan. “And I don’t mean self-pay in the old form of the case where somebody didn’t have insurance. Every single customer ultimately has a form of self- pay now with high-deductible plans.”

This emergent retail mentality in healthcare has hospitals, health systems, and physician practices thinking about quality not only in terms of providing evidence-based care but also understanding the patient experience from the receiving end.

“Those that are getting it are making investments in those areas as well as trying to understand how well they are following evidence-based medicine across the organization,” Dugan maintain. “Having those standardized levels of care that are supported by data analytics for them to understand what the outliers are in the cost to treat, that’s where you’re seeing savings driven out of the system.”

As the healthcare industry transitions from volume to value, where healthcare organizations are making their investments becomes as important as how much they are making available. With patients be- coming more knowledgeable about the care they receive, providers must offer something worth paying for.

TACKLING CLAIMS PROCESSING, PAYMENT MANAGEMENT BOTTLENECKS

Healthcare organizations of all sizes find themselves in a particularly challenging spot when it comes to reimbursement. Although reimbursement is beginning to shift away from volume to value, much of their revenue today still depends on the fee-for- service payment system. How then do healthcare organizations — from health systems to physician practices — ensure that best practices are in place to succeed in both reimbursement environments?

The answer to that question involves taking a step back and looking at several key considerations impacting the professional revenue cycle and ways to implement organizational models that support efficiencies in billing operations and claims management.

"If the professional revenue cycle is not managed effectively, billing costs will rise, collection rates will drop, and accounts receivable will increase to the point that the value of the acquisition is lost," says Benjamin C. Colton, Senior Manager, ECG Management Consultants, Inc.

This understanding is especially important during a time of increasing provider consolidation wherein larger organizations such as health systems and hospitals are acquiring or affiliating with independent practices. In this current environment, organization becomes the key to eliminating loss or waste within the revenue cycle.

"The quality of the revenue cycle is dependent upon the linkage of people, processes, and infrastructure," Colton maintains. "When considering physician billing, members of leadership must identify the degree to which they want to “manage” professional revenue cycle operations."

According to Colton and based on his work with a host of healthcare organizations, several billing models exist, each with their own advantages and disadvantages:

In a centralized billing model, the majority of billing functions are completed in a central business office (CBO). Its advantages are economies of scale, consistency, dedicated expertise, standardized reporting and monitoring, and opportunities for enhanced IT systems/re-sources. Its disadvantages come in the form of increased physician billing and response lag, higher billing cost, potential for "not my job" mind- set among frontend staff.

In a decentralized billing model, the majority of billing functions are completed/managed at the site of service (i.e., each practice maintains a small business office). On the plus side, it allows organizations to have site-level control, close relationships with patients and physicians that create a sense of "owner- ship," and prompt resolution of physician-driven errors. On the negative side, it can lead to disparate standards and processes as well as staffing inefficiencies.

As part of an outsourced model, functional areas (typically backend functions) are managed by a third party, which enables the organization to focus on its core competencies (e.g., patient) but at the cost of these third parties not being apt to "care" as much as much for the patients and the billing services themselves.

Colton views the hybrid billing model as the best fit for most organizations with a moderate-sized physician group. This mixture of centralized and decentralized (e.g., coding, charge capture/entry, co-pay posting) gives organizations the best of both worlds although it does require additional training and the implementation of reporting/control tools.

Read More How Value-Based Care Payment Improves Patient Outcomes

Irrespective of the model chosen, healthcare organizations that are successful in managing their revenue cycle from pre-registration to zero balance are those that have access to the big picture and the ability to communicate to the staff whose performance may be negatively affecting reimbursement.

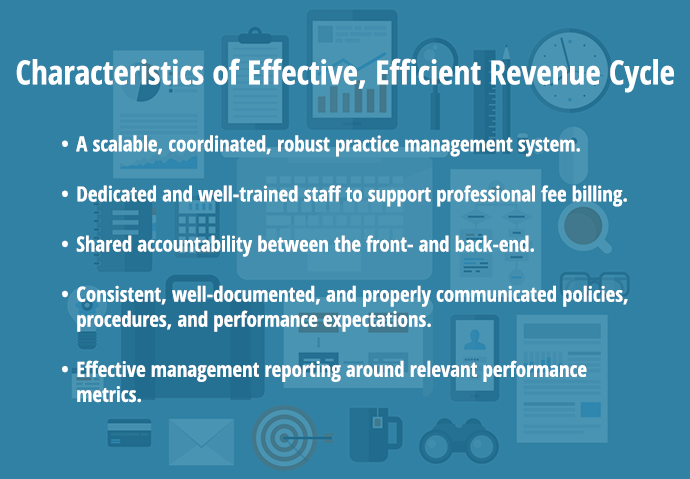

In the end, an effective and efficient revenue cycle has the following attributes:

It is within that last couple of points where real gains are made by healthcare organizations. "Actively reviewing the revenue cycle of your clinical practice will identify opportunities for cash improvement, cost reduction, and increased margins, regardless of whether billing functions are centrally maintained," says Colton.

Health IT, Automation to the Rescue?

Since the passing of the Health Information Technology for Clinical and Economic Health (HITECH) Act, the healthcare industry has spent most of its time and resources on selecting, implementing, and optimizing EHR systems.

While EHR adoption certainly will play an important to clinical quality improvements, what about the IT systems and services necessary for ensuring that a healthcare organization’s care is being properly billed and paid?

According to industry insider, that’s a question being asked by members of the finance departments at healthcare organizations. “You’re at an interesting time where meaningful use has created the government investment into wiring up electronic health information and at the same time running parallel are executives saying, ‘Are we making the same in- vestments on the revenue side of those applications?’” says John Dugan, CPA, Partner with PricewaterhouseCoopers (PwC).

And the current state of reimbursement-related technologies — a series of bolt-ons and ad-hoc solutions — bear witness to the lack of market forces increasing the demand for more mature and robust IT in this area.

"Actively reviewing the revenue cycle of your clinical practice will identify opportunities for cash improvement, cost reduction, and increased margins, regardless of whether billing functions are centrally maintained."

“There is a tremendous amount of opportunity with automation,” continues Dugan. “From a claims processing perspective, there are still a number of manual processes as you go through the entire revenue cycle, which in and of itself contributes to inaccuracies. That is why there is a huge need for claims scrubbers, follow-up work, etc.”

One obvious way for health systems, hospitals, and physician practices to meet increasing demands on value over volume is by having accurate and timely data in the hands of decision-makers.

“We’re making huge strides in technology each and every day to solve those problems,” he explains. “The question is how quickly it will come. We’ve got a group of executives and middle managers that are struggling with basic business intelligence as they try to position their organizations in a new health economy of reimbursement. The technology will certainly be a big enabler in providing a solution.”

Dugan sees this technology taking the form of dashboards capable of clueing members of the C-suite into various areas of the revenue cycle, especially the status of claims in A/R.

“Those that are investing in some capabilities are getting daily key performance indicator dashboards at the C-suite level which are customized for the user,” he observes. “That CFO can get a daily feed on some of the key statistics — whether it’s days in A/R, discharged not final billed, or case mix performance — in more real-time.”

Although the interest in financial capabilities will continue to grow over the next several months and years, healthcare organizations need to be careful of buying too much into marketing speak and investing in a product that doesn’t perform as advertised.

“Each day, business intelligence is getting stronger,” Dugan maintains. “To me, part of the challenge is that many firms are saying ‘big data’ and ‘analytics,’ but that doesn’t mean they are providing analysis. There’s a lot of data out there but not with the in- sight.”

Ultimately, all that drilling down serves the purpose of moving healthcare financial services closer to its primary aim — its proverbial Holy Grail of information — the true cost-per-case. “Can we dig down to a true cost-per-case based upon a service line? That’s what they’re trying to answer,” says Dugan.