cnythzl/DigitalVision Vectors vi

How to Maximize Revenue with Improved Claims Denials Management

Enhancing claim denials management strategies can help providers recoup lost healthcare revenue and maximize reimbursements.

Claims denials may be a part of life for healthcare revenue cycle managers, but a prevention-focused denials management strategy may be able to significantly reduce the number of times billing staff are faced with unpaid claims.

Recent healthcare reforms, such as reporting-heavy value-based reimbursement models, an updated ICD-10 coding system, and lower payment rates, have made it even more important for providers to offset declining revenues or profitability losses by tightening up the denials process and ensuring that they collect their due in a timely, efficient manner.

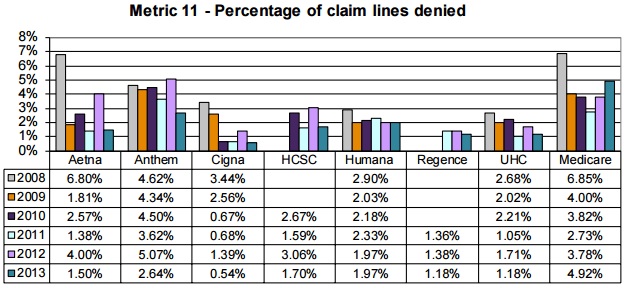

According to the American Medical Association’s (AMA) most recent health insurer report card, claim denial rates ranged from 0.54 percent to 2.64 percent for major private payers in 2013, while Medicare denied almost five percent of claims.

Even though the report card revealed that claim denial rates across payers decreased by an average 0.84 percentage points since 2012, the rates still spelled revenue cycle management trouble for providers. The average automated claim denial from Medicare’s Recovery Audit Program was worth $714 in the second quarter of 2016, the American Hospital Association (AHA) reported. For complex denials that required medical record review, the average dollar amount per claim denial was $5,418.

While some claim denials could lead to significant healthcare revenue declines, the Medical Group Management Association (MGMA) found that approximately 65 percent of claim denials were never corrected and re-submitted to payers for reimbursement.

The costly claim denials management process has spurred some providers to focus on preventing denials. To start a prevention-focused claim denials management strategy, providers should implement automated processes, identify and analyze claim denial reasons, improve front-end revenue cycle management procedures, and work denials in a timely manner.

8 Tips for Avoiding Denials, Improving Claims Reimbursement

Key Ways to Improve Claims Management and Reimbursement in the Healthcare Revenue Cycle

Working towards denial prevention by identifying root causes of denials

Realistically, providers are probably never going to decrease their claim denial rates to zero. However, pinpointing the reasons why payers denied claims and tracking common denial reasons are key steps to correcting claim denial management processes and moving towards a prevention-focused strategy.

A 2014 Advisory Board study showed that 90 percent of claim denials are preventable. Some of the most common claim denial reasons can be rectified by correcting claims management workflows, including claims submission and patient registration procedures.

The 2013 MGMA health insurer report card identified the following most common claim denial reasons:

- Missing information, including absent or incorrect patient demographic information and technical errors

- Duplicate claim submission

- Service previously adjudicated

- Services not covered by payer

- Time limit for claim submission expired

Providers can prevent common claim denials by moving away from a reactive healthcare billing process, Monte Sandler, NextGen RCM Services Executive Vice President told RevCycleIntelligence.com in March 2015. He added that traditional healthcare billing offices tend to wait until they receive payer and clearinghouse rejections and denials before resolving claim issues.

“It’s a terribly inefficient process,” Sandler said. “It delays the payment cycle. It reduces the probability of payment. I’m a big proponent of flipping that whole cycle upside down to build a much more proactive revenue cycle.”

“Diligence is needed to scrub claims to make sure they’re clean before they go out the door,” he asserted. “Every practice should know if a patient is eligible before the doctor sees the patient. Plenty of tools allow you to check eligibility two or three days prior to a patient even coming in. It’s solvable if the right checks and balances are in place.”

Managing the healthcare billing team is another crucial step, added Michelle Tohill, Director of Revenue Cycle Management at Bonafide Management Systems. Providers should give billing staff access to claims management data and establish claims management policies.

“Set up policies and procedures to ensure your team is carefully checking reimbursement requests before they are sent to payers,” she said. “Track the claim denial rate, and set increasingly challenging goals to improve performance over time. A little bit of management goes a long way in minimizing claim denials.”

Quantify Denial Rates for Smooth Revenue Cycle Management

Enhancing front-end revenue cycle management to prevent common errors

Since most claims are denied because of missing information, providers should pay particular attention to collecting complete and accurate data during the start of the cycle: during front-end revenue cycle management processes like patient registration and scheduling.

“From a revenue cycle perspective, getting the most accurate information up front starts with patient scheduling and patient registration,” said Gary Marlow, Vice President of Finance at Beverly Hospital and Addison Gilbert Hospital. “That provides the groundwork by which claims can be billed and collected in the most efficient and effective manner possible.”

“The last thing you want is getting a claim submission kicking back to them then having to work their way through the institution,” he continued. “If you get the information up front in as pleasant a manner as possible, it saves heartache for the patient and family if the claim is processed and cleared in a judicious manner.”

In addition to missing patient information, providers frequently receive claims denials because some services are ineligible for coverage under a payer. About eight percent of submitted claims are rejected because of eligibility problems, according to a ClaimRemedi report.

"From a revenue cycle perspective, getting the most accurate information up front starts with patient scheduling and patient registration."

Despite contributing to higher claim denial rates, researchers reported that only 79 percent of practices check a patient’s eligibility before the first appointment and only one-quarter check during subsequent visits.

Front-end revenue cycle management and billing staff should be more proactive about verifying patient demographic and insurance information during pre-registration to prevent claim denials.

“Most claims are denied due to minor details,” said Tohill. “Train your staff, your providers and everyone else who impacts billing to complete forms accurately, legibly, and without error. By taking care up front, you minimize agony on the back end.”

What Is Healthcare Revenue Cycle Management?

4 Medical Billing Issues Affecting Healthcare Revenue Cycle

Using automation to streamline claim denials management

While the pen may be mightier than the sword in some cases, using automated processes and data analytics tools can help providers to focus on delivering high-quality care rather than claims management best practices.

According to a HIMSS Analytics survey from July, approximately one-third of healthcare providers still use a manual claim denials management process.

Implementing more automated claim denials management processes can also help providers navigate a plethora of different payer rules and codes.

“Keeping up with all the diagnostic codes and different insurance policies can be exhausting, but there are many software providers that will automatically update codes and requirements,” explained Tohill. “This cuts down on your research time, allowing your billing team to spend more time double-checking claims to make sure they meet every single requirement.”

Data analytics tools are also key to optimizing claim denial management strategies, stated Jeff Wood, Vice President of Product Management at Navicure. Through analytics dashboards, interactive reports, and claims-level data, providers can streamline claim management processes and correct potential issues before claims are submitted.

By putting claim denial data into the hands of providers and billing teams, organizations will be better positioned to set claim denial benchmarks and improvement strategies.

However, providers are still split between proprietary and vendor solutions for automation claim denials management. The HIMSS Analytics survey revealed that 44 percent of providers use an automated claim denials management service from a vendor, such as a clearinghouse, EHR, or revenue cycle management vendor, while 18 percent built an in-house program.

Outsourced solutions are also on the rise, according to a September 2015 Black Book report. Approximately 83 percent of hospitals currently outsource some accounts receivable and collections, while 68 percent of physician groups with ten or more practitioners outsource a combination of collections and claims management.

Benefits, Challenges of Value-Based Health IT Implementation

How EHR Data Analytics Influences Value-Based Reimbursement

Addressing claim denials in a timely manner to recoup claims reimbursement

When a payer denies a claim, providers risk losing crucial healthcare revenue if the claim in question is not corrected and resubmitted for payment. However, over half of claim denials are never resubmitted to payers, MGMA reported.

“Sometimes billing teams are so focused on daily new claims that they fail to re-work denied claims,” Tohill stated. “Make it standard procedure for your team to work on denied claims every single day. Just because a claim was denied once does not mean it will be permanently denied. Your billers should be able to make the necessary adjustments and capture the reimbursement with attention and perseverance.”

Engaging billing teams with claim denials management daily could also help providers keep track of claims. As evident from the most common claim denial reasons, payers expect claims to be submitted and resubmitted according to a specific timeframe.

"Make it standard procedure for your team to work on denied claims every single day."

Establishing a standard claim denials management workflow will allow billing teams to track where claims are in the management process and what needs to be completed to receive claims reimbursement. Going forward, a daily claim denials management process will improve initial claims submission processes because billing teams better understand denial reasons.

“In every practice, maximizing reimbursement equals maximizing revenue,” concluded Tohill. “Without effective billing practices and the consistent attention to detail, your practice will experience a high rate of claim denials for all sorts of reasons. A well-managed billing team can single-handedly increase practice revenue significantly simply by avoiding and managing claim denials.”

Hospitals Still Facing Medicare Claims Denial Management Issues

5 Claims Denials Management Conversations From 2015