Getty Images

How Hospital Merger and Acquisition Activity is Changing Healthcare

As value-based care takes over, hospital merger and acquisition activity is on the rise. But will these deals add measurable value to the industry?

As value-based reimbursement puts financial pressure on providers, healthcare organizations are striving for efficiency, cost control, and sustainability. An increasingly popular strategy to fulfill all these goals is to engage in hospital merger and acquisition (M&A) activity.

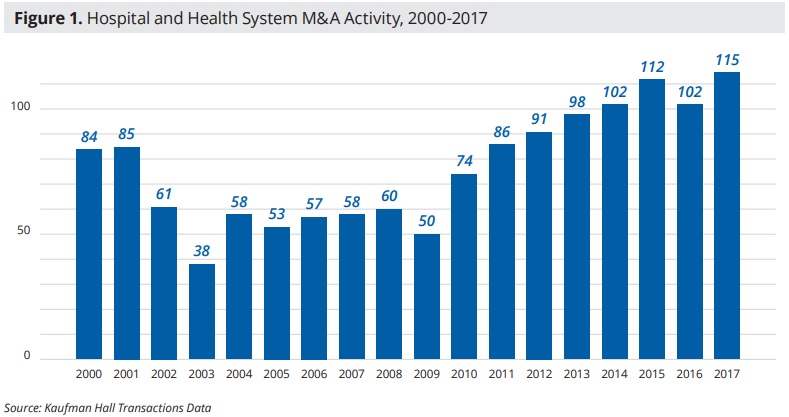

Hospital mergers and acquisitions are increasing at a rapid rate. Healthcare organizations announced 115 merger and acquisition transactions in 2017, the highest number in recent history.

2018 is likely to meet or even exceed the number of hospital merger and acquisition deals made in 2017, healthcare experts predict. Recent data from consulting firm Kaufman Hall shows that organizations already announced 50 transactions in the first half of 2018.

The value of these deals grew about 146 percent between 2016 and 2017, reaching a total of $175.2 billion, PricewaterhouseCoopers reported.

Megamergers are behind much of this growth, increasing in value by 325.9 percent to a total of $104.8 billion. PwC recorded five deals valued at $5 billion or more in 2017.

Healthcare organizations intend for these high-value mergers and acquisitions to give their systems greater scale to reduce costs, offer additional care services, and create a larger footprint in the local market.

But as the rate of hospital merger and acquisition activity accelerates, healthcare stakeholders are wondering what this trend means for providers, patients, and payers.

What do larger, more consolidated systems mean for healthcare costs and quality? And how can M&A deals add value to the healthcare system?

Like-sized organizations are merging, while hospitals acquire physician practices

Hospital mergers between similarly-sized organizations are driving the recent increase in healthcare mergers and acquisitions.

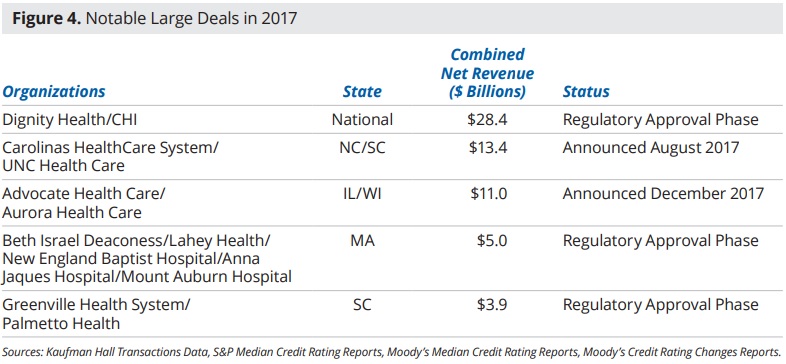

These organizations tend to be large to begin with, says Kaufman Hall. Ten hospital merger and acquisition transactions involved healthcare organizations with net revenues of $1 billion or more in 2017.

One of the largest deals announced in 2017 involved two health systems operating across most of the country.

Colorado-based Catholic Health Initiatives inked a merger agreement with Dignity Health in California in December 2017. Together, the organizations would create the largest non-profit health system in the country with 139 hospitals and over 700 other care sites across 28 states. The merger would also bring in more than $27 billion in revenue.

Similar deals between like-sized organizations include the finalized merger between Advocate Health Care and Aurora Health Care, the proposed merger between Beth Israel Deaconess Medical Center and Lahey Health in Massachusetts, and the potential combination of Bon Secours Health System and Mercy Health.

“Increasingly larger organizations are exploring mergers of equals in which an alignment results not in incremental change, but in transformative change for the demands of a transforming healthcare system,” explained Anu Singh, Managing Director at Kaufman Hall.

“These changes include the ability to manage the health of populations, reduce the total cost of care, and introduce innovations such as precision medicine.”

Hospitals are also busy acquiring physician practices to extend their reach into the community and capture more of the care continuum.

Hospitals acquired 5,000 physician practices from July 2015 to July 2016 alone, a recent Physicians Advocacy Institute and Avalere Health analysis revealed.

Hospitals owned nearly 30 percent of physician practices by late 2016, accounting for a 107 percent boost in the number of hospital-owned practices since 2012.

The recent acceleration of physician practice acquisitions also represented a doubling in the hospital ownership percentage over the previous four years.

Surviving Solo with Independent Practice Association Support

Managing the Revenue Cycle while Acquiring Physician Practices

Why the sudden spike in mergers and acquisitions?

Hospitals and health systems are making merger and acquisition moves to implement value-based care.

“The transition from volume to value and the corresponding move to population health management require major capital investments and sophisticated management expertise of the sort that may prompt even the most independent-minded hospitals and health systems to consider their consolidation options,” stated Healthcare Financial Management Association (HFMA) in a 2016 report.

Value-based care requires providers to control the costs and outcomes for an entire episode of care. Accountable care organizations (ACOs) and other more advanced alternative payment models also call on providers to be responsible for the costs and outcomes of an entire patient population.

Providers are joining a larger organization or adding other providers to their network to better understand a patient’s entire healthcare journey and gain insights on how to prevent costly services and conditions.

Slightly over one-half of physicians (53 percent) in a 2016 Deloitte survey said they would consider merging with a larger healthcare organization to gain access to the capabilities needed for value-based care success.

The New York-based consulting firm also predicted that only half of the health systems operating in 2014 would remain independent by 2024.

“Organizations are seeking new capabilities for a value-based, consumer-oriented health system, such as data analytics, care coordination across the continuum, retail or urgent care centers, and telehealth, among others,” Kaufman Hall’s Singh explained.

“Through partnerships, healthcare organizations are seeking economies of scale initially in areas such as support services, supplies, information technology, and purchased services, and over the longer term by rationalizing service distribution across the system.”

Generating the scale to succeed with value-based care is also key. Caring for a large patient population helps providers offset potential financial risks when a small portion of the population’s care ends up costing more or outcomes deteriorate.

Scale also helps healthcare organizations to achieve cost and care efficiencies, which are essential to earning bonuses and incentive payments under value-based care models.

Can M&A really reduce costs?

Leaders of healthcare organizations tend to highlight how merging with or acquiring another provider will reduce costs, improve care quality, and expand patient access.

For example, when Bon Secours Health System and Mercy Health announced their intention to create one of the nation’s largest hospital systems, Mercy Health’s President and CEO explained that the merger would decrease costs.

“As consumers grapple with the implications of healthcare reform in a dynamic marketplace, Mercy Health and Bon Secours share a vision to improve the health of the communities we serve as the low-cost, high-value provider,” he said. “Working together, our strong faith-based heritage fuels our mutual focus to provide efficient and effective health care for each patient who comes through our doors.”

Beth Israel Deaconess Medical Center’s CEO Kevin Tabb, MD, made similar assertions when he announced the proposed merger deal between his health system and Lahey Health.

“Together, we will improve patient care, help contain rising healthcare costs, and better position our member hospitals in a rapidly changing healthcare environment,” stated Tabb, who was tapped to head the combined system.

But just because healthcare leaders say their merger and acquisition deals will improve costs and outcomes, does it really mean they really will?

A study conducted by the Charles River Associates for the American Hospital Association (AHA) indicates that hospital mergers and acquisitions can indeed reduce healthcare costs. Acquired hospitals saw operating expenses per admission drop 2.5 percent after a deal, resulting in $5.8 million in savings at each acquired hospital.

The deals did not negatively impact care quality, either, researchers reported. In fact, the study linked hospital mergers and acquisitions to a decrease in 30-day readmissions rates for acute myocardial infarctions, heart failure, and pneumonia of about 1 percent.

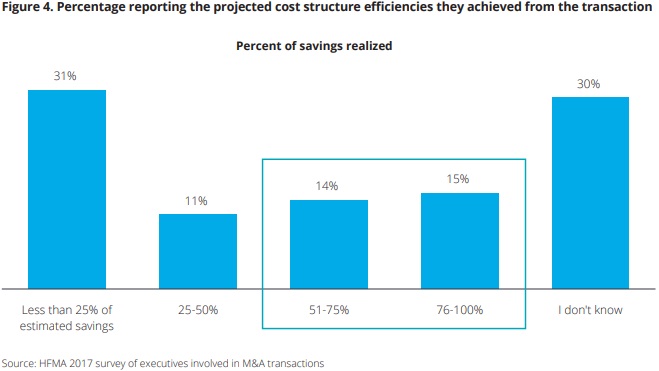

However, it may take some time for organizations to realize the cost savings stemming from a hospital merger and acquisition. The deals usually take two or more years to generate cost savings because operating revenue tends to decline at a higher rate than operating expenses at the start of a merger, Deloitte and HFMA reported.

But after about two years, 40 percent of healthcare leaders said their organization met 25 percent of their cost-structure efficiency goals.

Respondents used the savings for capital investments post-transaction (80 percent), health IT or facility upgrades (66 percent), and renovations, expansions, or new acute facility creation (33 percent).

About one-half of the healthcare leaders also reported care improvements after the merger or acquisition. Around 17 percent also said their deal accomplished both care quality improvements and cost savings.

3 Strategies to Decrease Low-Value Care, Healthcare Costs

Avoiding antitrust concerns and ensuring healthy competition

For hospital mergers and acquisitions to improve healthcare, the deals must meet criteria laid out by antitrust regulations. The Federal Trade Commission (FTC) and state law enforcement officials closely scrutinize proposed merger and acquisition deals to ensure the combined entity will not create a monopoly in a particular market.

In light of recent trends, the FTC has been more critical of proposed deals, blocking potential mergers such as the one between Advocate Health Care and NorthShore University Health System in 2016.

“Vigorous enforcement of the antitrust laws is more important than ever,” former FTC Chairwoman Edith Ramirez said in 2016. “Most provider mergers are not anti-competitive, but the few that are could cause significant competitive harm.”

Hospital prices in monopoly markets were more than 15 percent higher than prices in areas with four or more competitors. Hospitals with just one or two competitors charged between 5 and 6 percent more than hospitals with more than four rivals, she added.

Prices may be higher after a merger or acquisition because hospitals and health systems feel less pressure to reduce their costs post-deal, the Medicare Payment Advisory Commission (MedPAC) found.

Mergers and acquisitions can boost a provider organization’s market power and, therefore, the organization’s bargaining power with private payers. Providers can use their market power to negotiate higher claims reimbursement rates.

Because they are one of the only options serving beneficiaries in a particular reason, private payers will still try to keep the market leader as part of their network despite the provider’s higher costs.

“Over the years, the market power of hospitals has resulted in limited pressure to constrain costs, resulting in an average cost structure across the United States that is higher than in similar countries (even after accounting for the general cost of living), and in commercial payer rates that exceed even this high cost structure by 50 percent,” MedPAC explained.

Combined entities that still allow healthy competition must also take extra care to ensure their patients stay well, too.

Hospital mergers and acquisitions result in higher patient volumes, as well as shifts in patient demographics. Failing to prepare on-the-ground providers for a change in patient populations could lead to an uptick in medical errors or patient safety incidents.

Additionally, unfamiliar technologies, such as a new EHR system, may make routine tasks more time-consuming and error-prone, according to an article published in JAMA earlier in 2018.

“Teams with little expertise in patient safety are typically responsible for implementing healthcare mergers, acquisitions, and affiliations,” wrote healthcare experts Susan Haas, MD, MSc, Atul Gawande, MD, MPH, and Mark E. Reynolds.

“Their primary impetus is often financial rather than clinical, and when the impetus is clinical, the concerns usually involve patient access and services rather than the way care is practiced in the affected institutions. Goals and responsibility for safety and quality are frequently unclear.”

Healthcare organizations will need to carefully review their practices, procedures, and facility cultures during and after a merger to ensure that staff are adequately prepared and trained for new challenges.

Healthcare Mergers, Increased Access to Boost Medical Costs 6%

Boost Healthcare Competition to Drive Down Prices, Up Quality

Strategies for high-value hospital mergers and acquisitions

The jury is still out on whether hospital merger and acquisition deals will add value to healthcare. However, that is not stopping providers from pursuing new deals.

To ensure hospital mergers and acquisitions are truly positive for the providers and the community, healthcare leaders should ensure they focus on integration, HFMA and Deloitte advised.

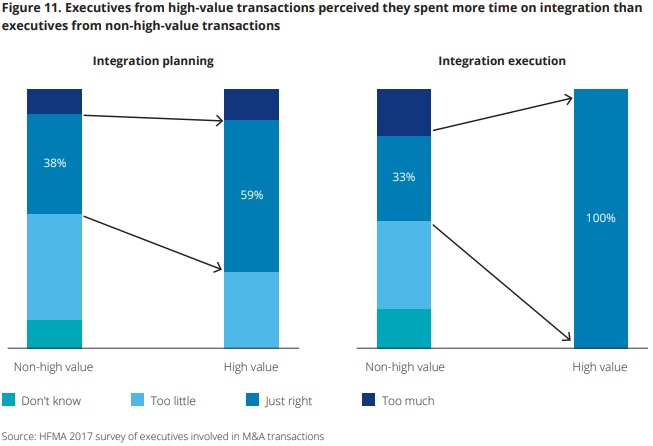

Of the 17 percent of surveyed executives reporting both cost and quality improvements after a deal, about 59 percent said their organization dedicated ample time to integration planning, and 100 percent prioritized integration execution.

In contrast, most executives who engaged in mergers and acquisitions that did not meet cost and quality goals post-transaction did not focus on integration. Only 38 percent of leaders involved in low-value transactions reported prioritizing integration activities.

Provider organizations should identify integration team leaders as early in the merger and acquisition process as possible, HFMA and Deloitte suggested. Integration specialists should pinpoint possible challenges and implement a detailed integration plan.

Based on their survey of high- and low-value hospital mergers and acquisitions, HFMA and Deloitte also found that successful organizations did the following:

- Created a strategic vision for seeking transactions

- Established explicit financial and non-financial goals

- Identified cultural differences between acquired and acquirer organizations

- Made upfront and clear decisions on executive and middle management leadership

- Aligned clinical and financial leadership early on in the transaction process

- Developed best practices for integrating an acquired or merged facility

- Established project management best practices for tracking goals and milestones for two years after the transaction closes

In a separate 2016 report, Deloitte also advised provider organizations to be proactive with their merger and acquisition activity by developing a detailed and comprehensive growth strategy.

“Winning and creating value in this environment may require... a set of detailed action steps to help companies proactively identify and transact strategic deals rather than reactively pursue disparate, ad hoc opportunities,” the organization said.

Rather than leave their growth strategy to investment bankers, Deloitte advised healthcare organizations to create their own plan by performing self-assessments to identify their organization’s strengths, weaknesses, and opportunities.

“These opportunities include choosing the most attractive customer segments and geographies, serving customers in ways competitors cannot replicate, and understanding the capabilities and market access required to achieve those goals,” the report stated.

Healthcare experts do not anticipate that the M&A bubble will burst any time soon. Providers are going to continue to engage in merger and acquisition deals to develop the capabilities for value-based care and healthcare cost control

But whether these trends will result in higher quality care and/or lower costs to the patient, provider, or healthcare system is still up for debate.

Provider organizations should carefully consider their merger and acquisition transactions to ensure they provide value to both the organization and consumers in their community. To add value and avoid antitrust challenges, an organization’s growth strategy should prioritize improving care quality and reducing costs in their local market.