Getty Images

How Artificial Intelligence Is Optimizing Revenue Cycle Management

Artificial intelligence is addressing some of the biggest pain points in revenue cycle management, leading to increased revenue capture and integrity for early adopters of the technology.

Prior authorizations are one of the most burdensome aspects of revenue cycle management.

In a survey of 1,000 practicing physicians conducted by the American Medical Association (AMA), 86 percent of doctors described the burden of prior authorizations as high or extremely high. Nearly an equal amount (88 percent) also said the burden has increased over the last five years.

"It's very, very resource-intensive on both sides, not just on the provider side. It's a series of interactions that are very transactional," Sharlene Seidman, a vice president at Yale New Haven Health, recently told RevCycleIntelligence.

Those interactions add up. Physicians and their staff spend almost two full business days each week completing prior authorizations, and more than one in three physicians has staff who work exclusively on the task, the AMA survey found.

The transactional nature of prior authorizations makes it ripe for automation, Seidman stated. But electronic adoption of prior authorizations remains low, according to data from the Council for Affordable Quality Healthcare, Inc. (CAQH).

Adoption of electronic prior authorizations increased by just one percentage point to 13 percent from 2018 to 2019, CAQH reported using data from medical plans covering nearly half of the US’ insured population.

“Numerous barriers have prevented or slowed the adoption of electronic prior authorization,” explained CAQH. Those barriers include lack of operating rules and standards, infrastructure, and vendor readiness.

Yale New Haven Health is overcoming some of those challenges using emerging technology in healthcare: artificial intelligence.

“There is a series of repetitive tasks that our staff has to follow and the automation solution that we're seeking with Olive can learn those steps and replicate them, and in the future even anticipate if there are changes based on historical denials that we've received,” Seidman explained.

“We have seen some early successes with cash coming in a little more quickly, claims getting resolved more quickly. It's working,” she stated.

Prior authorization is one of the best use cases for artificial intelligence in healthcare right now. The transactional nature of prior authorizations makes it an ideal candidate for AI technology, which can leverage real-time analytics and machine learning to identify cases needing prior authorization, submit requests to payers, and check statuses.

But prior authorizations are just one of the burdensome processes in a transaction-heavy part of healthcare: the revenue cycle.

“The level of complexity in managing revenue cycle is very high,” explained Joe Polaris, SVP of product and technology at R1 RCM, a revenue cycle management vendor. “It's a very transaction-oriented business in that every patient who has a need for medical care is going to have a significant number of transactions from the point of scheduling all the way through the multitude of steps to create a clean claim, submit it, and get paid.”

This makes revenue cycle management very difficult to scale, especially for large organizations. According to Polaris, the only real way to achieve scale without the right technology is “to hire really smart people, and make them work even harder, and get even smarter.”

But that isn’t an area that healthcare organizations should be directing their resources, Polaris stressed.

“That’s a business problem that makes revenue cycle right for disruption.”

The potential to optimize revenue cycle management

AI is not new to healthcare. For years, innovative providers have been leveraging the technology to deliver better care for patients with everything from sleep disorders, eye disease, cancer, and even COVID-19.

The technology has created hype for clinical care, promising to catch diseases faster, expand access to care in underserved or developing regions, reduce the burden of EHR use, and more.

But applying AI to revenue cycle management could be the technology’s biggest break in healthcare.

“There was a study done that estimated about $470 billion was spent on billing and insurance-related activities. The reason for that was there's an obscene amount of work that goes into getting a claim billed and then collecting on that claim,” said Ross Moore, MBA, general manager of revenue cycle at Olive, a health IT company that uses AI to automate provider workflows.

“Those manual, redundant tasks that are taking place in patient access, coding, billing, collections, and denials, those tasks themselves that are performed by the revenue cycle departments can actually be automated using AI.”

AI deals really well with high transaction environments in which there are codified rules – like the healthcare revenue cycle.

The revenue cycle contains an abundance of tagged data, which means values are codified to data points to indicate certain events, like why a claim was denied or attributes of a patient’s diagnosis, Polaris explained.

“Whether it's matching a patient with the right provider, estimating out-of-pocket costs, or coding the claim, those are things that have long lists of variables associated with them, and AI is pretty uniquely good at evaluating those variables and coming up with an ever-improving success rate of getting to the right outcome against any of those process steps,” he said.

AI can do this by imitating intelligent human behavior through algorithms that find patterns and plan future actions in order to produce a positive outcome. This differs from other emerging technologies like machine learning or robotic process automation, which can identify patterns like AI but focus on improving accuracy rather than achieving positive outcomes. These other technologies also have no or limited ability to plan a future action beyond the task at hand.

Therefore, AI’s “intelligence” can effectively address the most pressing revenue cycle management issues, such as prior authorizations, claim status checks, and out-of-pocket cost estimates, all while getting the information that needs human intervention to the right person at the right time.

“When the technology is used inside of Epic, Cerner, or our standalone clinical intelligence products, it looks based on what it learns in the document, and then it renders the information to the appropriate party,” stated Michael Clark, senior vice president and general manager for provider solutions within Nuance’s healthcare division.

“So, there's a case manager who is interested in what's going on in encounter documentation. There's a coder. There's certainly a physician. Through AI and machine learning, you can make available, out of the same set of facts and circumstances in the data, information to those different stakeholders, eliminating redundancy, reworking, and retrospective queries.”

AI-powered revenue cycle management technology can also do that in real-time – something the revenue cycle has struggled to achieve due to its high volume of transactions.

“Providers need to know in real-time who is cleared to be treated financially and who is not to make the most informed decisions for the practice. Patients, too, need to know what they’re responsible for paying so they can choose treatment options that are right for them,” said MaryAnne Thompson, controller at MidLantic Urology LLC, a group of 70-plus physicians in Pennsylvania.

“We were encouraged by the idea that AI would give us real-time insights to drive meaningful change and help us capture as many dollars as possible, while also delivering a good patient experience.”

MidLantic Urology is leveraging AI through a financial clearance workflow automation solution that “provides visual cues to practice executives, so [they] know where each patient is in the financial clearance process, in real-time, and what needs to happen next.”

The solution has already helped the group improve gross revenue by 18 percent, a number Thompson expects to increase by 12 percentage points this year. The group is also working on 85 percent fewer claims at any given time, she reported.

As a result, MidLantic Urology realized a 50 percent reduction in anticipated staffing requirements for its newly centralized billing department. Yale New Haven Health also saw workforce optimization results by using AI to improve prior authorizations.

“It has never been to eliminate positions. It's been more about refining processes and then moving further ahead,” Seidman said. “Getting to more of those value-adding functions sooner so that we could focus on what's really important to us, which is our patient.”

Results like these are creating buzz around AI and revenue cycle management. But adoption still lags as the market attempts to find the right place for AI.

Getting lost in the noise

Providers are being bombarded with pitches for products that promise to leverage the latest AI technology to solve some of the revenue cycle’s biggest pain points while maximizing revenue capture and integrity.

Despite the seemingly growing number of products and the revenue cycle’s ripeness for automation, adoption of AI for revenue cycle management is not as robust as one may think.

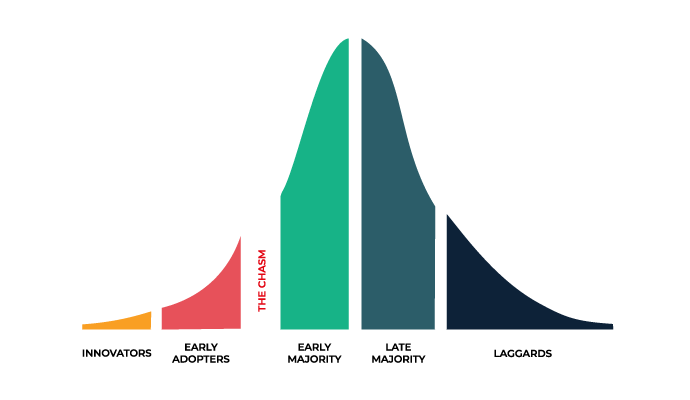

“We're shifting from early adopter where you have the innovative health systems trying to invest in technologies to do things differently to the early majority where we're seeing more and more providers that are doing things like pilots and proof of concepts to adopt automation in their organization,” Moore explained using the technology adoption curve from Geoffrey A. Moore’s 1991 book Crossing the Chasm.

Providers are gearing up for wider adoption. A recent Black Book survey of C-suite executives found less than half (44 percent) of healthcare organizations already use AI in some form or another, but 88 percent anticipate widespread implementation within the next five years. Those implementations would impact revenue integrity, clinical documentation improvement, coding, and other parts of the revenue cycle, respondents stated.

But getting everybody on board with crossing the chasm may be a challenge.

“There's still a black box feeling around AI, whether it's healthcare or other industries,” Clark said. “But in healthcare, more importantly, there are patients. At the end of the documentation, there's a patient. So, the black box aspect of it has slowed more rapid adoption.”

In healthcare, the work done during the early adopter stage will be key to AI investments in the near future. Providers need to see financial improvements before they will feel comfortable adopting AI technology in their revenue cycles.

“What truly drives the adoption and the belief are the demonstrable outcomes,” Clark said. “As more and more solutions deliver on the outcomes that were pitched to users, providers will gain confidence, and in gaining that confidence, they're more open to applying AI in a different setting or in another area that they may have been concerned about before, but are now ready to automate.”

Thompson offered a similar sentiment regarding her organization’s technology investment strategy.

“We would definitely consider purchasing future technology solutions that rely on AI or machine-learning algorithms if they are proven to help improve practice margins and operational efficiencies,” said Thompson.

“What do we want to accomplish by leveraging a particular technology solution? What efficiencies will we gain? How quickly will we yield a return on investment,” she said regarding MidLantic Urology’s “goal-oriented” strategy for purchasing IT.

The revenue cycle management solution market doesn’t answer those questions just yet. Technology companies have yet to deliver consistent tools to the market and physician practices and other small healthcare organizations are not experiencing the massive write-offs to demand the tools, according to Matt Seefeld, EVP at the health software and services company MedEvolve.

“When you get in the larger groups, the pain is starting to really amp up. But when you're still an independent private practice, surgical specialty, or even specialties like derm, ophthalmology, ortho, neuro, cardiology, a lot of those folks are still getting by with average tools. That's not going to last forever,” he said.

“But I think that there are going to be some key players that bring more awareness to this topic and it's going to have to be the clients that start to demand it from vendors.”

Healthcare organizations that have yet to see the need for such technology or do not have the capital or infrastructure to support the investment may have to wait a little to unlock the benefits of AI-powered revenue cycle management. But being an early adopter does have its advantages, said Clark.

“That learning loop and its imperfections are not reasons to not embrace it,” Clark explained. “As a matter of fact, it's more of a reason to embrace it because by living it, you end up really understanding how real it is or how real it isn't.”

“It gives you a chance to make some quick decisions on whether this is something worth continuing to invest the time, energy, or the money in, or whether it's something that is not really artificial intelligence and shouldn't be construed as such.”

Investing in AI for revenue cycle management

Healthcare may still be figuring out the market for AI in revenue cycle management, but providers can still realize the benefits of the innovative technology.

A good place to start with AI investments is identifying use cases. Providers should be looking for opportunities to use automation to perform tasks that negatively impact net revenue. Then, they should assess staffing costs, Moore stated.

He encouraged stakeholders to ask: How many people are performing a specific function? And where can automation free up capacity for more value-adding activities?

This strategy helped Yale New Haven Health leverage AI to optimize prior authorizations.

“We had to take a much closer look at our processes because we didn't want to automate a bad process or an already efficient process. We did some pre-work to process map what we were doing,” Seidman explained.

Once the health system decided on what processes to automate with AI, it then went on to select a technology partner. Seidman and her team reviewed around 25 companies, a process that was well worth the effort to find the right technology partner.

“Make sure that you find a company who you share the same goals with,” Seidman advised. “It's a little difficult because a lot of these companies are saying, they have it built. Then, when you actually have a conversation, they’re really looking for a partner to build this with.”

Yale New Haven Health’s goal was to put the patient in the center of everything being done, so the health system went with a vendor whose mission was not to replace staff with AI, but redirect staff to doing more patient-centric activities, like talking about insurance benefits or setting expectations for patient financial responsibility.

Providers should also bring in the employees who do the work to evaluate the solution, she recommended. “They can share the process that they're following in reality versus what we believed what was happening.”

Implementation of AI can also start small to ensure revenue cycle management success, added Thompson.

MidAtlantic Urology recently underwent exponential growth, from a small practice with a few locations to one of the largest specialty practices in the nation with 46 locations. Growth through acquisitions translated to value for patients, but it also left the practice with a fragmented revenue cycle management system.

“We had little to no reporting mechanisms in place and we weren’t automated, so we couldn’t identify the problem areas, where they stemmed from, who made them, or how to resolve them,” Thompson stated. “These challenges were holding back the organization’s overall success, so we started looking at cloud-based applications that could provide us with visibility into financial clearance as well as insights, metrics, and KPIs that would allow us to effect a positive change in our A/R.”

MidAtlantic Urology chose to beta test a financial clearance workflow automation tool from MedEvolve. The organization started by using the tool at one practice and expanding out from there once financial improvements were realized.

It took six months for the organization to go 100 percent live with the tool, but providers in the practice are now seeing revenue increases and the organization plans to keep improving by adding more AI-powered revenue cycle management tools, including AI as-a-service.

AI as-a-service may be the next step for the technology in the revenue cycle management space. The service allows healthcare organizations to outsource AI technology, which enables providers to dabble with AI for revenue cycle management without heavy upfront investments.

This type of AI is not as mature in the market as other versions of the technology, like point solutions or robotic process automation offerings. But it is gaining a foothold, Moore stated.

“The end-to-end identification of processes to automate, doing the actual build, and maintaining those bots is really a huge effort,” he said. “Over 50 percent of automation programs fail, and this isn't healthcare specific, but across the board. The reason for that is there’s a lot of work that goes into maintaining those bots.”

“AI-as-a-service is focusing on offering that maintenance aspect, as well as using machine learning capabilities and learning that's taking place across a neural network to enhance that bot.”

The service enables providers to engage with AI to optimize revenue cycle management and even beyond.

“Health systems are taking those pilots and the proofs of concept and adopting it on a broader level,” Moore stated. “What we'll find most of the time is revenue cycle management is a natural place to get started with automation. But then as you're having the conversations with an organization, they're thinking about where they want to be in the future.”

“It's really not focused solely on revenue cycle. It's being able to set up the capabilities in a way you can scale the program to other areas in the organization whether it be supply chain some of the clinical departments in the organization, IT, or accounting.”

So, whether one believes in the hype or not, AI is making a place for itself in the healthcare revenue cycle.

“There's going to be more of a bias, or even a mandate, that organizations adopt some of these technologies,” Polaris maintained. “Right, wrong, or indifferent, the buzz is out there.”