Getty Images

Healthcare Revenue Cycle Recovery After the COVID-19 Pandemic

Financial losses from the COVID-19 pandemic will have lasting effects on providers but leveraging some of the capabilities developed during crisis can build a more resilient healthcare revenue cycle.

Halfway through 2020, hospitals have been doing the unimaginable.

Patients have been asked to avoid healthcare facilities when possible, while more visits have been done via smartphones and laptops than in exam rooms. Meanwhile, some providers transformed hotels, sports arenas, and park spaces into makeshift hospitals, and others called on staff who once had schedules packed with surgeries and other procedures to sew cloth masks and gowns.

And these are just a few examples of how hospitals and other healthcare organizations have adapted to a world in which a new highly contagious and deadly virus exists.

The novel coronavirus, which started an outbreak in Wuhan, China at the start of the year, has now infected over 15.5 million people worldwide, claiming over 634,000 lives, according to data from Johns Hopkins University at the time of publication.

The pandemic has been an unprecedented public health crisis in the US, which currently leads the world in both number of confirmed cases and deaths. And while healthcare providers have risen – and continue to rise – to the challenge, their bottom lines and future financial stability have taken a massive hit as they uncover new ways to ensure safe access to care during a pandemic.

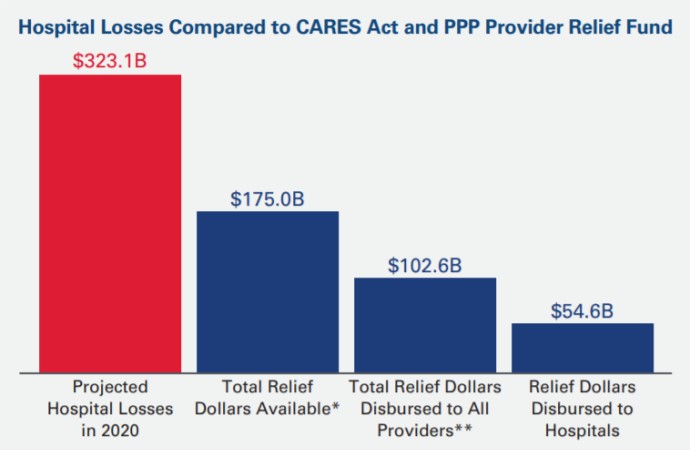

Canceled surgeries, personal protective equipment costs, workforce support, and other expenses have already cost hospitals $50.7 billion a month between March and June 2020, according to estimates from the American Hospital Association (AHA).

But that number could have been a lot higher without some quick thinking and swift actions.

Efforts to maintain operations during a pandemic, including telehealth implementation and compassionate patient billing, have helped the bottom line from bottoming out for some hospitals.

Still, hospitals are slated to lose at least another $120.5 billion in 2020 from pandemic-related expenses, updated projections from AHA show. And losses could get worse if COVID-19 cases surge again, the industry group warns.

Unlike the first wave of COVID-19, however, healthcare organizations may be more resilient. Stabilizing finances and leveraging capabilities developed during the pandemic, like telehealth and patient-friendly collections, providers can help their revenue cycles recover and adapt to a post-pandemic world.

Stabilizing the healthcare revenue cycle

Rebuilding clinical capacity, especially for the small subset of procedures and services that drive revenue, is top of mind for hospital leaders coming off the heels of the initial wave of COVID-19.

Top inpatient procedures – which account for 50 percent of total payments made to hospitals – saw volume decreases of up to 99 percent during the early phases, according to data from Strata Decision Technology.

Instilling patient confidence in resuming these procedures and ensuring the capacity and supplies necessary for elective services is key to generating much-needed revenue during and after the pandemic.

But healthcare organizations also need to rebuild their financial capacity after such dramatic revenue losses.

“The main message is play defense as much as you can and really focus on locking things down."

“The main message is play defense as much as you can and really focus on locking things down,” Eric Jordahl, a managing director at Kaufman Hall and practice leader of treasure and capital markets at the consulting firm, told RevCycleIntelligence back in March. “Once you do that, then pay attention to where there might be opportunities.”

Jordahl’s advice for healthcare finance leaders still rings true, especially since COVID-19 did result in a recession as predicted.

Playing defense by assessing liquidity and taking another look at investment plans for the rest of the year will be key to stabilizing the revenue cycle following volume and revenue declines. The strategy will require cost reductions across the organization, with some hospitals having to resort to layoffs, furloughs, and other workforce changes. Others may also have to cancel planned capital projects to ensure cash is still king during the recession.

However, these measures are designed to get providers back on their feet. Meanwhile, leveraging telehealth and other capabilities core to the hospital’s COVID-19 response efforts can help to offset drastic spending reductions with revenue generation now and after the pandemic.

Telehealth during and after the pandemic

One of the biggest changes to healthcare delivery coming out of the pandemic is telehealth.

More than 9 million Medicare beneficiaries received care via telehealth during the early stages of the COVID-19 pandemic, with a weekly increase in virtual visits from 13,000 pre-pandemic to nearly 1.7 million in April, CMS recently announced.

Similarly, telehealth utilization among the privately insured population skyrocketed as indicated by an 8,336 percent increase in telehealth claim lines observed by FAIR HEALTH from April 2019 to April 2020.

“Telemedicine has been key,” Phillip Coule, MD, MBA, vice president and chief medical officer at Augusta University Medical Center in Georgia, recently told RevCycleIntelligence. “We were well-positioned with telemedicine to quickly pivot to telemedicine visits as a way of maintaining the continuity of care and continuing to support those patients and have the encounters that would have been unbillable otherwise and may not have been as high level of care.”

Other hospitals like those part of Eisenhower Health in California had not really engaged with telehealth before, but quickly did to save continuity of care, patient engagement, and revenue cycle during the pandemic.

“With the loosening from the federal restriction standpoint on telehealth guidelines in terms of the billing and other security privacy guidelines with patients, we did open that up,” Ken Wheat, senior vice president and CFO of Eisenhower Health, stated in a recent Healthcare Strategies podcast. “We basically had two methods. One was very simplistic, and that was a FaceTime approach to telehealth. We also used the Epic system through My Chart for telehealth outreach to patients.”

Within a matter of a month, Eisenhower Health went from conducting virtually no telehealth visits to about 30 percent, or 20,000, of its visits through FaceTime and other virtual care offerings, Wheat stated.

Telehealth has been a lifeline for hospitals faced with declining volumes and subsequently revenues. But with communities starting to reopen in the face of declining COVID-19 numbers, in-person volumes are slowly creeping back up, begging the question: Will telehealth be just a pandemic resource?

According to hospital leaders, the answer to that is a resounding no.

“COVID-19 has been the ultimate burning platform,” said Coule. “Physicians, nurses, administrators, finance people, everybody involved had an immediate pressing need to change the way we were doing business and delivering care. And everybody once they did it went, ‘Gosh, why don't I do this more often?’ Suddenly, we couldn't meet the demand for expanding telemedicine quickly enough.”

Telehealth capabilities have not only become a tool in the back pocket, but also a way to rebuild clinical capacity, especially in the aftermath of the pandemic.

But for systems like Eisenhower Health, permanent telehealth expansions will depend on payer policy.

Telehealth is a challenge financially, explained Wheat, because reimbursement rates do not support the level of investment needed to fully develop capabilities for Eisenhower Health’s older population.

CMS and other payers increased telehealth reimbursement rates during the pandemic, oftentimes on par with payments for in-person care. CMS is currently assessing new rates after COVID-19 passes but providers are still unsure if payments will be enough to keep robust telehealth utilization going.

“COVID-19 has been the ultimate burning platform."

In the meantime, hospitals plan to leverage telehealth to smooth out longstanding revenue cycle bumps made worse by the pandemic.

“One of the things that we found incredibly beneficial with some of the work that we've done is making sure that we are leveraging pre-work for clinic visits,” Coule stated, referencing Augusta University Medical Center’s use of telehealth to for COVID-19 screening when lab capacity was nearing its limit. “For registration, for example, all of that work can be done prior to the visit to make the visit encounter as smooth and efficient as possible.”

The medical center has also partnered with Jvion to use artificial intelligence and data analytics to create back-to-work assessments to screen employees.

Wheat also sees a happy home for telehealth services in a post-pandemic world on the front-end of the revenue cycle.

“Long term, I do see us developing patient self-scheduling in the health system over the next few years, and at that point in time, we'll have the technology on the front end to make patient health assessments as to what might be appropriate for a telehealth visit and provide some options for patient choice for telehealth versus an in-person visit,” Wheat explained. “So, we're certainly looking to advance our digital profile and always looking for new ways to connect with our patients.”

Aligning patient billing with the new reality

Connecting with patients is starting to look different as the COVID-19 pandemic continues to place the entire economy in a recession.

According to the Urban Institute, approximately 2.9 million individuals will become uninsured by the end of 2020 because of job losses related to the pandemic. Millions more will also lose employer-sponsored coverage, the non-profit think tank projected, resulting in more Medicaid beneficiaries.

This shift in coverage will create dramatic changes in payer mix and consequently, patient billing tactics.

“One of the things that we've done recently and put a lot of effort into is reevaluating our uninsured discount policy, as well as our charity care and sliding fee scale,” Ted Syverson, the vice president of revenue cycle at South Dakota-based Monument Health, recently said in a RevCycleIntelligence interview. “We are making sure that those are complementary to the financial conditions that patients can encounter, and that people across our organization have a better general understanding of the impact of those and their availability.”

Healthcare organizations have placed greater emphasis on self-pay patient accounts since the rising popularity of high-deductible health plans. But the COVID-19 pandemic is prompting hospital leaders to lean more on their self-pay patient billing strategies to ensure complete, timely payment during the recession.

“Had [payment plans] not been in place before this, we probably would have struggled more."

At Floyd Medical Center, that means working more closely with its patient financing partner.

Since 2017, the Georgia-based health system has partnered with CarePayment to implement patient payment plans. Patients have had the option at registration to sign on to a payment plan for the upcoming visit or revenue cycle staff would send an account to the vendor if they have not heard from a patient after two billing statements.

The payment plan option had been very successful at improving patient collections, according to the health system’s vice president of revenue cycle, Rick Childs. But it has been especially crucial for the system’s financial well-being during the pandemic.

“Had it not been in place before this, we probably would have struggled more,” said Childs.

Questions regarding payments flooded Floyd Medical Center’s call lines once patients started to learn they had been furloughed and would be without income for the next couple of months, Childs explained.

“Being able to work with something that was already set up and was very responsive to the need of the patient has really been a benefit,” Childs said.

And the patient payment plans will be just as crucial to the health system as communities start to get back to some semblance of normal.

“I foresee in the future, as people start getting those services that they have put off and getting back to work, they're going to be behind on bills. They're going to need that flexibility of a payment plan,” stated Childs.

Building the next generation of care

Whether you loathe the term “new normal” or not, there is no question that the healthcare system – and the revenue cycle – will not be quite the same after the pandemic ends. COVID-19 has upended the way providers deliver safe, effective care and how they collect revenue for it.

But the pandemic is also likely to bring about what experts at Manatt Health have identified as “the next-generation distributed, highly interconnected, community engaged and extensively digital system of care.”

According to the firm’s recent report Emergence From COVID-19: Imperatives for Health System Leaders, this system of care builds on the capabilities developed during the pandemic like telehealth and community partnerships to help healthcare organizations withstand future crises, as well as align operations with new priorities and demands emerging from the COVID-19 pandemic.

But the idea of a connected, engaged, and digital system isn’t necessarily new.

“It’s moving there because healthcare is way behind. It should have been there, and patients want it. The technology hasn’t necessarily caught up, but it is now,” said Brenda Pawlak, one of the report’s authors and managing director of Manatt Health.

With telehealth implementation, for example, healthcare organizations have made more progress in the first few weeks of the pandemic compared to the last couple of years. But organizations will need to transition their telehealth capabilities from “crisis” mode to develop and scale new digitally-enabled care models, especially since providers agree telehealth is here to stay.

“Getting that balance of telemedicine and in-office visits right is going to be important because you’ve got a lot of patients who you can stay connected with and like the convenience of telemedicine. A lot of people are scared still, and the world is tentatively opening up, so you need to be able to adequately support your patients in a few different swimming lanes,” Pawlak explained.

In the same vein, Pawlak and colleagues advise health system leaders to build out ambulatory and home-based care capabilities to complement “hospital without walls” efforts during the pandemic.

“Health systems should seize this moment to rethink their care delivery models by developing and expanding clinical services on a distributed basis and in the home. In doing so, health systems should challenge themselves to seamlessly integrate these services into existing facility-based service portfolios to ensure that the resulting system of care is greater than its component parts,” Pawlak et al. wrote in the report.

This next-generation system of care delivery will be key to financial stability post-pandemic. However, policy and regulation, particularly around reimbursement, will be crucial to operationalize a healthcare system that aligns with new patient demands.

“An ongoing conversation about payment reform is going to be important,” Pawlak stated.

“When you have an encounter-based payment model that strongly favors procedures, when you need complex care in the inpatient setting, well the system, from a payment perspective, isn't flexible enough,” Pawlak explained. “As we go forward, you don't want the whole health system to be contingent on whether you're doing a whole bunch of expensive, inpatient procedures. We want to foster minimally invasive, outpatient interventions, which is better for everybody. We've all known the balance has been wrong for a while, but it really brings it to the forefront.”

Preliminary research has already shown that providers engaging in alternatives to encounter-based payments had a head start with managing the COVID-19 surge by leveraging triage call centers, remote patient monitoring, and population health data management more than their peers in the more traditional model.

Anecdotally, providers in value-based contracts have also said they were able to more quickly pivot operations at the start of the pandemic by relying on a more predictable and flexible source of revenue in the face of falling volumes.

“Greater predictability is very aligned with value-based care, and moving away from encounter-based or transactional care will actually give greater accountability to physicians managing panels and populations,” explained Sanjay Doddamani, MD, chief physician executive and COO at Southwestern Health Resources.

“An ongoing conversation about payment reform is going to be important."

But the next generation healthcare delivery system does not need to rely on value-based contracting, Pawlak maintained.

“I would say broader payment reform because there is a preconceived notion that value-based payment or contracting means one swimming lane and it's really not,” Pawlak stated. “It's that broader universe of organizing payment around care management support services, population health services, and delivering care in the right way to the patient at the right time.”

Getting healthcare right – the right care at the right time in the right setting – has been a goal for many providers for the last decade, if not longer. Many would argue that most providers have yet to achieve this type of care, but COVID-19 is putting pressure on healthcare organizations.

The healthcare system was stretched thin from the pandemic and the road to revenue cycle recovery will be a long one. Telehealth, patient-friendly collections, and a focus on financial resiliency can be the shot in the arm healthcare organizations need to overcome the financial challenges of COVID-19 and other possible waves or crises.