Olivier Le Moal - stock.adobe.co

Exploring Two-Sided Financial Risk in Alternative Payment Models

Incorporating two-sided financial risk is key to making providers more accountable for their care. What do providers need to know before entering these alternative payment models?

As value-based care becomes the name of the game in healthcare, public and private payers are pushing providers to take on more financial accountability for their services through alternative payment models.

In a fee-for-service world, providers received reimbursement for every test or procedure they performed without being penalized or rewarded if their services impacted patient outcomes and healthcare costs.

Under alternative payment models, however, providers become financially responsible for the care they provide. Upside risk, or one-sided risk models, allow participants to share in healthcare savings if their services make care delivery more efficient. but in downside risk arrangements, providers can also lose healthcare revenue if their care exceeds agreed-upon financial and clinical thresholds, or may be required to refund their payers if they go over a set budget for a certain group of services.

While alternative payment models can include both types of financial risk, payers are most interested in boosting two-sided financial risk implementation. The upside and downside risk structure promotes full provider accountability for care.

How do alternative payment models incorporate two-sided financial risk? What are payer expectations for providers accepting the risk structure? And what do providers need to know about implementing two-sided risk alternative payment models?

Understanding the Value-Based Reimbursement Model Landscape

Top 4 Best Practices for Transitioning to Value-Based Care

What is two-sided financial risk in alternative payment models?

Not all financial risk structures are created equal. Each alternative payment model has its own financial risk arrangement, which can include upside risk, downside risk, or a combination of the two.

In upside risk-only alternative payment models, providers are eligible to earn all or a percentage of any healthcare savings their care incurs. Payers typically set a financial benchmark for how much care delivery should cost for a care episode or patient. If providers perform services at costs below the benchmark, then they share in the savings.

However, if actual costs exceed the benchmark, providers in upside risk-only models do not qualify for shared savings payments. But they are also not financially penalized.

Many providers prefer upside risk-only alternative payment models because they are not liable to repay any financial losses if care costs go over budget. For example, most Medicare ACOs are in upside risk-only structures.

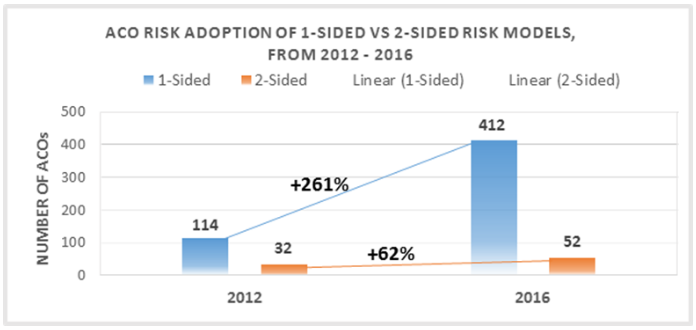

The National Association of ACOs reported in June 2016 that upside risk Medicare ACO model participation increased 261 percent between 2012 to 2016, while two-sided ACO model participation only grew 62 percent.

CMS also recently announced that 438 out of the 480 total Medicare Shared Savings Program (MSSP) ACOs are in Track 1, an upside risk-only model.

Some alternative payment models, however, require providers to take on downside financial risk. Under downside risk models, providers who incur actual care costs for a care episode or patient that go over the financial benchmark must refund the payer for all or a portion of the losses.

For example, CMS unveiled a bundled payment model for acute myocardial infarction episodes at the end of 2016. Participating providers will receive a retrospective episode-based payment. But if actual care costs for an acute myocardial infarction episode exceeds the quality-adjusted target price, then providers must repay a portion of the financial losses to CMS.

An alternative payment model that includes both upside and downside financial risk is considered a two-sided risk model.

While two-sided risk alternative payment models are not as popular as upside risk-only structures, CMS as well as other private payers are pushing providers to take on the double-sided arrangements, especially through higher risk ACO models.

A December 2016 Leavitt Partners study showed that 61 percent of accountable care organizations (ACOs) are in upside risk-only arrangements, indicating ACOs are either risk-adverse or still experimenting with risk.

“The ‘A’ in ACO stands for ‘Accountable,’” April Wortham- Collins, Manager of Customer Segment Analysis at Decision Resources Group, told RevCycleIntelligence.com in January 2016. “You cannot be fully accountable for patient population until you're willing to accept financial risk when things do not go as planned. We won't see the full potential of ACOs until we have more folks accepting that financial risk.”

Examining the Role of Financial Risk in Value-Based Care

Expectations for two-sided financial risk are rising over time

As part of the value-based care transition, financial responsibility will shift away from healthcare payers and move more to providers. The shift in accountability aims to incentivize providers to make smarter healthcare utilization decisions.

Despite the goal of increasing provider financial risk, a June 2016 American Journal of Managed Care study revealed that only one-third of healthcare organizations received more than half of their revenue from some type of risk-based payment arrangement.

“Provider organizations have not traditionally had to really manage risk,” Eric Chetwynd, former Director of Product Strategy at Curaspan, told RevCycleIntelligence.com in June 2015. “There definitely is the tendency to go towards the safer versions of those programs. In the ACO model, you clearly see that most organizations are going for the one-sided savings model versus the two-sided risk model.”

To kickstart more robust two-sided risk alternative payment model participation, CMS implemented upside risk-only limitations in several of its value-based reimbursement programs. For instance, MSSP ACOs in Track 1 can participate in the upside risk-only structure for two agreement periods before the ACO must accept additional financial risk to stay in the program.

Even the new MSSP Track 1+ model, which contains limited downside financial risk compared to MSSP Tracks 2 and 3, includes a one three-year agreement period participation limit.

"You cannot be fully accountable for patient population until you're willing to accept financial risk."

As a result, some Medicare ACOs are transitioning to two-sided risk arrangements. CMS recently touted that 131 Medicare ACOs will participate in a risk-bearing alternative payment model in 2017, including those in the MSSP, Next Generation ACO model, and Comprehensive End-Stage Renal Disease Care model.

Several Medicare bundled payment models also gradually increase two-sided financial risk levels as the programs mature. Cases of ramping up financial risk include the acute myocardial infarction, coronary artery bypass graft, and surgical hip and femur fracture treatment episode models.

In the bundled payment models, participants will not have to accept downside risk during the first two performance years. However, CMS will ramp up two-sided risk levels by starting with a reduced discount repayment percentage in the third performance year.

While CMS set explicit two-sided risk alternative payment model goals, the commercial market seems to be lagging behind. The AMGA reported in December 2016 that 18 percent of healthcare leaders have no access to commercial risk-based reimbursement plans. Another 46 percent of healthcare leaders also said that only 1 to 19 percent of commercial plans offered two-sided risk models.

Without more commercial options, providers gearing up to take on more financial risk may not be able to succeed with value-based care, the survey indicated. Healthcare leaders projected revenue from shared risk products to increase from 4.4 percent in 2016 to 11.1 percent by 2018, a 152 percent growth.

Healthcare leaders also reported that their organization would be ready to accept two-sided financial risk within two years, while 41 percent said they needed five or more years.

“AMGA members are working diligently to provide high-quality healthcare in a value-based payment environment,” stated Chester A. Speed, JD, LLM, AMGA Vice President of Public Policy. “But without access to commercial risk products and appropriate data that’s exchanged in a standardized way, it will be difficult for them to fully succeed under risk-based reimbursements.”

The Future of Accountable Care Organizations Involves Risk

Risk-Value-Based Payment Programs a Return on Investment?

MACRA alternative payment models to boost two-sided risk adoption

MACRA’s Quality Payment Program will also play a role in raising adoption levels of two-sided risk models. Greater financial rewards are available to providers who perform well under risk-based models.

The program contains two value-based reimbursement tracks: the Merit-Based Incentive Payment System (MIPS) and the Advanced Alternative Payment Model track. Providers who take on sufficient financial risk under an Advanced Alternative Payment Model can earn value-based incentive payments greater than the MIPS payment adjustments.

The federal agency expects about 25 percent of eligible clinicians in the Quality Payment Program to participate in an approved two-sided risk alternative payment model by 2018.

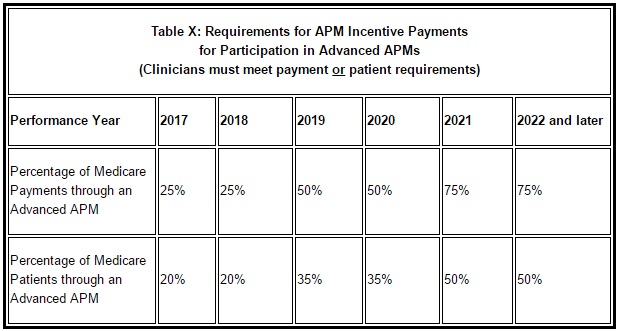

To qualify for Advanced Alternative Payment Model participation, eligible clinicians must “bear more than nominal financial risk for losses” under the alternative payment model. Nominal financial risk requirements are based on either Medicare revenue or number of Medicare patients.

For 2017, eligible clinicians must receive at least 25 percent of their Medicare Part B reimbursements or see at least 20 percent of Medicare patients through the alternative payment model. The nominal risk requirements will increase every two years and non-Medicare payments and patients may be included in the risk calculations by 2019.

In addition to two-sided financial risk requirements, eligible clinicians must also participate in an approved model. The following alternative payment models qualify for 2017 Advanced Alternative Payment Model participation:

• Comprehensive End-Stage Renal Disease Care Model (two-sided risk track)

• Comprehensive Primary Care Plus

• Next Generation ACO Model

• MSSP Tracks 2 and 3

• Oncology Care Model (two-sided risk track)

• Comprehensive Care for Joint Replacement Payment Model (certified EHR use track)

• Vermont Medicare ACO Initiative (part of the Vermont All-Payer ACO model)

In 2018, three bundled payment models (acute myocardial infarction, coronary artery bypass graft, and surgical hip and femur fracture treatment models), the Cardiac Rehabilitation Incentive Payment Model, and the MSSP Track 1+ program will also qualify.

CMS Timelines for Stage 3 Meaningful Use, MACRA Implementation

What We Know About Value-Based Care Under MACRA, MIPS, APMs

Developing a foundation for APM success

Before putting healthcare revenue at risk under an alternative payment model, healthcare organizations should ensure that lines of communication are open across payers, providers, and provider networks.

Connecting with payers is an important step for succeeding under risk-based alternative payment models, especially for small practices.

“Health payers can play a role in improving education and awareness,” stated Mitch Morris, Principal and healthcare industry leader at Deloitte. “Many physicians, especially the ones in smaller independent practices, don’t have a good understanding of what it means to manage clinical and financial risk. Health plans can help them do that certainly when there are financial incentives.”

In addition to being a major resource, payers and healthcare organizations should keep lines of communication open for data sharing purposes. Managing patient outcomes and costs across the care continuum is key to realizing shared savings under two-sided risk models.

“Cost and claims data are useful,” Morris said. “Some of the most successful uses of information are when payers and providers work together in alignment to share both sides of the equation - the more detailed clinical data that a provider has as well as the cost and claims data that the payer has. That gives a really rich and full picture.”

Additionally, healthcare organizations should communicate with their providers on how to change physician workflows to align with risk-based payments. Providers should be aware that risk-based alternative payment models require high-value care delivery for maximum reimbursement.

Many providers are not incentivized to align with risk-based payments, though. About 86 percent of primary care providers and specialists are still primarily compensated under fee-for-service or salary arrangements, Deloitte Center for Health Solutions reported in October 2016.

While some provider compensation plans contained value-based incentives, the survey also showed that two-sided risk arrangements were the most uncommon for provider compensation. Only 10 percent of providers said they received compensation through capitation and 4 percent through shared-saving arrangements.

“Physicians should change their behavior to make implementation of value-based care models effective,” stated Mitch Morris, Principal and healthcare industry leader at Deloitte. “But today there is little incentive for them to change; many are still being paid under fee-for-service models and they're not equipped with tools that could help them deliver high-value care.”

To incentivize providers to shift away from a fee-for-service mentality, healthcare organizations should implement financial rewards for providers for furnishing high-quality, efficient, and team-based care.

"At the end of the day, you're all managing these patients together and sharing risk together."

Healthcare organizations should also develop provider networks that can improve care coordination, decrease duplicate and unnecessary services, and extend their reach into the community. Since many risk-based alternative payment models make providers financially accountable for a total episode of care, which could last up to 90 days after the patient’s initial visit, organizations should ensure that post-acute and community care are also high-quality and affordable.

“The first step is to build out these networks, start engaging your other providers,” stated Chetwynd. “Realize that under value-based programs, whether you're managing a population under an ACO initiative or patient episodes under bundled payments, before you can take your first step, you have to understand who else you're working with.”

“At the end of the day, you're all managing these patients together and sharing risk together, so really engage those provider networks,” he added.

Premier also recently emphasized how healthcare organizations should expand post-acute care partnerships for alternative payment model success. Building post-acute care networks allows healthcare organizations to better monitor and improve post-acute care for costs and quality.

To develop post-acute care networks, Premier advised healthcare organizations to identify roles within the organization to lead the network, understand post-acute care performance through data, develop narrow preferred provider networks, and create a collaborative culture for improving care.

While participating in two-sided alternative payment models may seem like too much of a financial risk, providers may want to keep the risk-reward ratio concept in mind. For every risk, the return could be double.

How to Favorably Manage Risk in Value-Based Care Reimbursement

Considering Healthcare Providers’ Value-Based Risk Burdens