Getty Images

Coronavirus Healthcare Spending Dwindles, Threatening Health Equity

Congress’s failure to allocate additional healthcare spending for uninsured COVID-19 claims is a blow to health equity, access to care, and patients’ lives.

The coronavirus pandemic spawned a wave of government spending that increased health equity for uninsured or underprivileged people and encouraged access to care for all.

That wave of funding is now drying up, with billions of dollars set to leave the marketplace in the coming year. While healthcare professionals continue to treat patients afflicted with COVID-19, the government has begun to draw curtains on a once-in-a-century pandemic after only two years of funding.

Withdrawal of Congressional Support

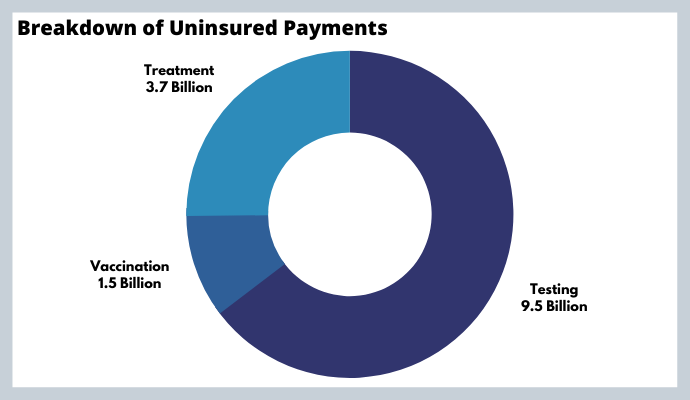

Uninsured Americans sought $14.7 billion in treatment, vaccinations, or testing during the pandemic. These medical claims were processed and paid for by the federal government via the HRSA COVID-19 Uninsured Program, which will soon be cut off from financial support.

The withdrawal of aid results from a congressional decision to exclude additional funding from its recent omnibus budget bill. In response, the Biden Administration laid out the consequences of this decision:

- Providers no longer able to submit claims for testing, treating, and vaccinating uninsured people

- Ending the purchase of monoclonal antibody treatments

- Halting critical testing, vaccine, treatment efforts

- Scaling back planned purchases of preventive treatments for immunocompromised

- Reducing the ability to identify and assess emerging variants rapidly

- Inability to secure sufficient booster doses or variant-specific vaccines

Concurrently, states are making decisions that will end access to government-run testing and limit or eliminate the daily reporting of coronavirus statistics.

The White House has asked Congress for $22.5 billion in additional funding and emphasized the costs of losing funding for treatments, therapies, and other tools as variants of the coronavirus continue to emerge.

“If the science shows that fourth doses are needed for the general population later this year, we will not have the supply necessary to ensure shots are available, free, and easy to access for all Americans,” explained White House COVID-19 coordinator Jeff Zients.

American Rescue Plan Expiration

Federal subsidies for health coverage introduced in the American Rescue Plan (ARP) are set to expire by the end of 2022. This could result in people paying more for coverage or failing to maintain healthcare coverage in the future.

Subsidies introduced in the ARP increased coverage by 21 percent, and the extended federal marketplace’s open enrollment period incentivized consumers to gain health insurance during this period. The ending of these incentives at the close of 2022 indicates that coverage levels could be reduced to pre-pandemic amounts.

Losing subsidized insurance coverage would create additional financial stress for millions of Americans, and more than 8 million federal marketplace enrollees would see their premiums doubled without this assistance.

Increased premiums may also force people with the lowest income levels to move to high deductible plans, raising their medical expenditures. On top of this, middle-income groups with income above the poverty level would see a 36 percent premium hike, and those aged 60 or older with income four times the poverty level could experience a 165 percent hike if ARP subsidies expire at the end of 2022.

The Congressional Budget Office (CBO) considered the costs of extending these subsidies in a recent report. It concluded that continued subsidization would contribute $34.2 billion to the federal deficit over ten years while providing coverage for 1.3 million previously uninsured people. Additionally, the Department of Health and Human Services estimates that federally subsidized insurance through the ARP costs the government $537 million every month.

Public Health Emergency Concluding

These statistics indicate that the federal and state governments are ready to end continued funding for the coronavirus public health emergency. However, it is not clear that COVID-19 is under control within the United States, nor are experts confident that new strains will not cause increased infections in the future.

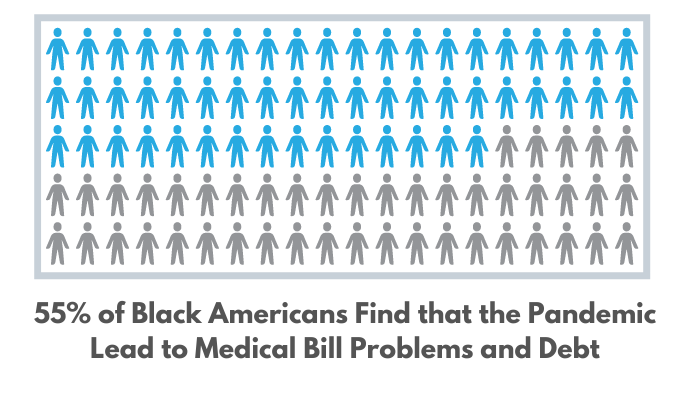

Once the public health emergency does eventually end, 80 million people will have their Medicare eligibility redetermined, and some will lose coverage. This burden is expected to fall especially hard on Black and Latin populations who have already experienced the pandemic’s brunt.

Accordingly, medical bill problems and debt affected 55 percent of Black and 44 percent of Latin adults during the pandemic. Black and Latin adults also lost income during the pandemic at higher rates than White adults. The problem of medical debt has now become so extensive that most credit rating agencies are no longer considering it in credit reports.

Medicaid spending grew by 9.2 percent in 2020 compared to 3 percent in 2019, and the total Medicaid cost reached $671.2 billion due to increased supplemental payments and expansion at the state level. These state Medicaid expansions that provided insurance for lower-income groups may be reversed at the conclusion of the declared public health emergency.

Even privately insured individuals have begun to feel higher costs after most insurers began to stop waiving cost-sharing for COVID-19 treatments and raised premiums for employer-sponsored insurance. The end of cost-sharing has already led to higher out-of-pocket costs for patients who received care after a COVID-19 diagnosis.

Families and individuals have relied on government programs during the pandemic to avoid paying large medical bills in the case of a COVID-19 hospitalization. If government stopgaps expire while hospitalizations remain elevated, the associated costs could produce financial strain on people most unable to pay for care.

Multiple budgets are evaporating without a plan to care for vulnerable groups, and officials are wagering that the pandemic’s most intense stage has passed. For now, an extension of the ARP benefits is the most robust available option that could prevent pandemic-caused financial hardship if coronavirus variants continue to emerge.