Getty Images

Value-Based Contracting 101: Preparing, Negotiating, and Succeeding

The healthcare industry is increasingly engaging in value-based contracting; here are keys to success with these more complex payment arrangements.

The Triple Aim. The Quadruple Aim. Right care at the right place at the right time. Whether one works in a hospital or small independent practice, healthcare providers are leaning on these concepts to deliver valuable care to their patients, and that is in its simplest form: care that results in the best patient outcomes at the lowest possible cost to the patient and the system.

And for the most part, provider organizations have already established the infrastructure and workflows to support this value-based care. Perhaps they have hired additional staff to coordinate discharges or transitions of care, implemented data analytics solutions to prevent chronic conditions, or taking a couple of extra minutes during a routine exam to ask about a patient’s access to healthy food, transportation, and safe lodging.

But the value added by these actions—and the better outcomes they have produced—are not necessarily aligning with the contracts most organizations have with payers to finance care.

A majority of respondents to the latest Value-Based Care Assessment from Insights said over 75 percent of their organization’s revenue is from fee-for-service contracts. This was especially true for respondents working in physician practices, of which 64 percent relied almost entirely on fee-for-service payments.

Fee-for-service contracts present a real challenge to value-based care, especially for physician practices.

“It begins and ends with the right contract in place,” David Hatfield, MD, chief medical officer of Hatfield Medical Group, recently said at Xtelligent Healthcare Media’s Revenue Cycle Management Virtual Summit. “If you're not getting paid for all of this hard work, you will absolutely tire and exhaust and burn out. You cannot do it. You have to have a contract.”

“If it is a fee-for-service contract that is just very transactional, you're not going to do social determinant of health screening and put it in the EMR system and do chronic care management and have your providers back off how many patients they're seeing so that they can spend more time closing gaps in care.”

Negotiating value-based contracts that support population health management and other value-adding activities is key. But value-based contracts carry financial risk, even when they are upside or shared savings only, and they require a robust infrastructure to influence patient outcomes and costs. Some markets are also stuck on “the fee-for-service hamster wheel,” as Hatfield put it.

Providers will need to overcome these challenges and step off the wheel in order to survive.

“It became very difficult to keep up a high-volume pace,” Hatfield explains, mentioning the constant pressure to see more patients a day to be profitable and the additional data entry and administrative burden associated with that volume.

That pressure is even greater on organizations struggling to recover financially from COVID-19.

Primary care practices lost approximately $15 billion last year because of volume dips when communities shut down to stop the spread of COVID-19, one study found. Meanwhile, hospital visits hit a record low in April 2020, declining by 33 to 62 percent from March to mid-April, another report showed.

The pandemic exposed the shortcomings of fee-for-service while shining a light on the benefits of value-based contracts, which enabled organizations to pivot operations quickly and maintain revenue when volumes dropped.

Value-based contract adoption is likely to increase over the next year as organizations look to protect themselves from future crises. Fortunately for providers, it only takes one contract.

“It was one contract and off we went with that one contract into the world of value-based,” Hatfield states.

Preparing for a value-based contract

Value-based contracts come in all shapes and sizes, from pay-for-reporting to bundled payments for episodic care to full capitation for patient populations. The type of value-based contract organizations implement will depend on the type of care they deliver, the market in which they reside, and their patient population, among other factors. But all organizations should start with a commitment, according to Gale Pearce, chief population office at Millennium Physician Group.

“The first thing is to be honest with themselves about how serious they are to committing to changing their workload in an effort to eliminate the inefficiencies of healthcare,” Pearce recently told RevCycleIntelligence.

“When we first started, we encountered some physicians who thought this money was just going to come to them because they signed the contract and that's really not the case. They need to make sure that they eliminate all the inefficiencies of healthcare and that's how they'll save money and achieve quality goals. So that's the first thing: a very honest commitment.”

Millennium, an independent physician group of over 500 providers throughout Florida, has found that this commitment has been key to the organization’s value-based success, which includes being one of the highest-earning accountable care organizations (ACOs) in the Medicare Shared Savings Program.

“Sometimes you’ll hear it called provider engagement,” Pearce stated. “That’s the secret to Millennium. That’s the number one important thing about value-based [care], physicians have to lead it and be engaged.”

“I always recommend strong physician leadership,” adds Jennifer Jackman, VP of business development at America's Physician Groups (APG), a trade association based in California. “Physicians lead physicians much better and have a way of explaining things to physicians who are maybe worried about taking risk or being in a value-based arrangement.”

Physician engagement, and more generally, clinician engagement has proven time and again to be the secret sauce to value-based success regardless of the complexity of the contract. But it’ll also take more than a clinician champion to enable value-based care; it requires infrastructure.

Organizations need to know what resources they are willing to commit for value-based contract success, says Pearce. And that could be expanding access by staying open later, creating educational resources for high-risk patients, or implementing analytics. These are all considerations when deciding on the type of value-based contract that fits the organization.

“And a network,” adds Jackman. “Do you have all your referral sources in place? Do you have all the specialties covered? Where are you sending your physical therapy, your ancillary services, what hospitals are you using? Make sure you have a good, robust, comprehensive network across the spectrum of healthcare providers.”

Networks and partnerships are key because organizations cannot do value-based care by themselves, Tyler Munson, senior VP of operations at Southwestern Health Resources (SWHR), asserted at the Revenue Cycle Management Summit.

“When you think about all the partners and all the folks that go into caring for a patient, you can’t impact that globally by yourself,” stated Munson, who oversees operations of SWHR’s Next Generation ACO. “It’s about the right alignment in the community with physicians, with other clinical providers, with hospital systems, with payers, with post-acute, with home health, and it’s about understanding how to bring those pieces together for a common purpose.”

Controlling care across the care continuum is a tall order, but Munson stressed that these connections are also key to building the infrastructure necessary for value-based care since providers are going to need a lot more data and support systems to achieve quality and savings.

The final consideration surrounds the financial component of value-based contracts.

“We recommend that you assess your risk readiness,” advises Jackman. “You need to do some financial modeling of the population you think you're going to get in that value-based arrangement. Do you have the resources that you need to manage those medical costs and administrative costs of that population that you might get?”

Risk appetite, infrastructure, and clinical engagement are all key to the value-based contracting process. Once leaders assess their organization’s capabilities across these considerations, then they are ready to engage with a payer to put a contract in place.

What to bring to the table

Partnerships are at the core of value-based care. Value-based contracts can bring partners together, but the negotiation process is still key to establishing a partnership that benefits both parties. And provider organizations need to be prepared to go back and forth with payer partners to ensure contracts are appropriate and favorable.

The process doesn’t have to be as cutthroat as some contract negotiations though. For Pearce, it can all start with basic introductions, even if the organization has a longstanding relationship with a payer under fee-for-service contracts.

“What we have found is that it's really important to introduce yourself, and I know this sounds simple, but it really is important,” Pearce states. “The people who are your provider reps and the people who are the provider contractors are totally different people. They seldom coordinate with each other. We have learned the hard way to really start by saying, this is who we are, these are the resources we have, and this is our experience.”

A basic understanding of the organization and its patients sets the stage for smooth value-based contract negotiations. Then, provider organizations can get into what makes them positioned to deliver value-based care.

Market standing, for example, is a good point to highlight during the negotiation process, Jackman says. “If you have the best outcomes, or excellent patient satisfaction, it benefits you to emphasize this in negotiations.”

“Are you strong in your market? Are you the only game in town? That's one great position,” Jackman explains, “but if you're in a very competitive environment, then what are your strengths? What's unique about you? What differentiates you from the medical group down the street? And so that gets into some data.”

Data on quality of care and efficiency are key, but provider organizations should also be able to highlight data and capabilities that show how the value-based contract will add to a payer’s portfolio.

“If you're willing to have expanded office hours that's another thing that the payers really like,” Pearce says. “We found that those two major strategies are the ones to help to introduce yourself and let you know who you are, and then try to find something that they want that they don't have right now.”

That could be something as simple as what hospital affiliations the organization has and whether that is a high-quality hospital or whether staff at the organization speak another language. Patient satisfaction data is also a major selling point if organizations can prove that they are providing an excellent experience.

Payers should also be able to demonstrate what they can do for a value-based provider. “The payer needs a high-quality, high-performing network and you have to be able to demonstrate you're that partner. On the other hand, what you need is a high-quality payer that is marketing your business and helping you to grow,” Jackman states.

This is especially important as payers eye more narrow networks in an effort to cut costs while improving quality of care for their members. Value-based organizations want to be included in these networks and preferably in the “top tier,” meaning plans identify the practice as high-quality and low-cost. Alternatively, practices do not want to be lost in a long provider directory.

According to Jackman, some questions practices should consider include: What are payers going to do to announce the affiliation? How are they going to promote you? Are they going to let employers know that you're in the network now?

Patient attribution is another consideration the industry leaders brought up again and again.

“In value-based programs, you’re trying to manage that population better and improve their health, and it’s really hard to do if they’re not paneled with or attributed to a PCP,” Jackman explained. “Some of the payors use an attribution model instead of PCP assignment. Understanding who the PCP is becomes critical in a value-based contract.”

This panel management has been central to supporting value-based contracts for organizations like Hatfield Medical Group. “To me, it begins and ends with having the right contract in place, panel management, and creating access to care for that patient,” Hatfield shared at the Summit.

But others, like Millennium, have experienced some lessons learned with patient attribution in value-based contracts.

“What we've learned is that payers have different rules. It's not like they misrepresent what's in their contract. There's just a lot more detail in the contract about the attribution. Then, we find out about it later,” Pearce explained. “When you're negotiating with them, you really need to make sure how those patients are attributed to you and make sure that you actually have the capacity to take care of them. We've got some situations now where patients are attributed to us, but we don't know about it until three or four months later and they are attributed by claims.”

With so many data points to bring up, compiling a team for value-based contract negotiations is advisable. Millennium, for example, not only includes Pearce but also the CEO, a CPA to analyze reimbursement rates, and the chief analytics officer. The contracting team may also include a lawyer or just someone with a really good eye for details, if resources are tight.

During contract review, Jackman recommends a review by internal stakeholders as well as legal advice. “Maybe you have a person who's really meticulous and reads everything word by word and understands, if we agree to this, that's going to impact operations,” Jackman explains. For example, if the payer wants quality data sent in a particular format, but the practice does not have capability to generate data that way.

“The lawyer wouldn't know that. So, it's nice to have some of your own internal people review the contract terms, even if they're not experienced in contracting,” Jackman says.

These can be tough conversations with payers, Pearce admits, but necessary ones. The negotiation process should set reasonable expectations for both payers and providers to ensure the success of value-based contracts, which ultimately benefit the patient. These conversations foster an air of trust necessary for delivering value-based care to patients.

“Sometimes you have to get heated and discuss with payers, but what I consider a success factor is after those tough discussions, you really do trust each other and work together in a partnership,” Pearce says.

Evaluating success of value-based contracts

Trust among payers and providers will certainly move the needle with value-based care—the model hinges on care coordination across every organization in a patient’s healthcare journey, after all. But there are also some other more obvious factors that point to the success of a value-based contract once it is in place.

Cost savings is one of those obvious factors, especially in Medicare contracts. For example, if your ACO meets or exceeds quality measurements, saves money in the Medicare Shared Savings Program, and those savings covered the added costs of the value-based infrastructure, then your ACO contract has been a success. In a commercial contract though, you might measure success a little differently, Jackman states.

Financially solvency is key; practices need a maintain a margin of profitability in order to add more patients to the value-based care model. However, some other factors to consider include provider satisfaction with the contract, physician growth in the organization, and patient as well as employer satisfaction with the care delivered per the contract. A lot of times, practices will connect with local brokers to gauge employer satisfaction with plans, Jackman says.

Growth after value-based contract implementation is key because organizations need a panel of patients for contracts to work and those patients cannot all be high-risk. Plans without the appropriate clout in the market oftentimes lose their healthiest patients, leaving provider reimbursement hinging high-risk, high-cost patients.

Additionally, quality improvement is another obvious factor. Value-based contracts only work when organizations notice a significant improvement in quality metrics agreed upon by the practice and the payer. Noticeable dips in quality performance necessitate change and possibly another round of negotiation.

In addition to these factors though, organizations should also consider how the value-based contract has improved its standing in the local market.

“Has the program made you more attractive to other payers,” asks Jackman. “Because you're participating in that one [contract] and you're doing well, then all of a sudden, other payers may say, ‘Hey, that group's doing well. Let's go contract with that group, too.’ And maybe, it improved your relationship with your hospital system. Now you're better partners.”

A successful value-based contract may need to be tweaked and updated as capabilities mature and patient populations shift, but a sign of a successful contract ultimately comes down to its ability to foster collaboration, coordination, and partnership.

Value-based care relies on partnerships to impact a patient’s entire healthcare journey to deliver a high-quality, affordable result that patients are happy with. So while contracts ensure organizations get paid and sustain a wide range of services and capabilities necessary for valuable care delivery, it is ultimately the patient who wins when good contracts are in place.

“Who wins? It's the patient,” Hatfield said. “The patient wins when you do value-based care the right way because they're getting the right care, at the right place, at the right time.”

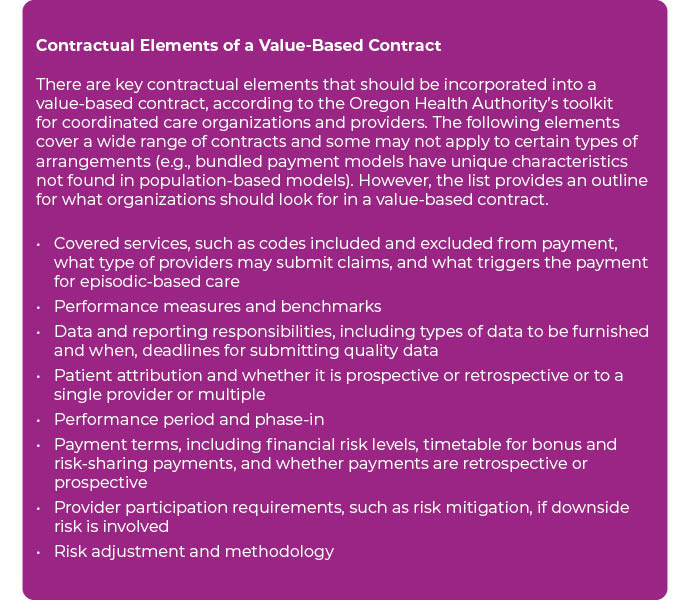

To view the contractual elements of a value-based contract in detail, visit the Oregon Health Authority's Value-based Payment Toolkit for CCOs here.