Nobi_Prizue/istock via Getty Ima

FTC interim report reveals PBMs' role in rising drug costs

An FTC interim report exposes how pharmacy benefit managers (PBMs) inflate drug prices, significantly impacting healthcare costs.

The Federal Trade Commission (FTC) released an interim staff report this month that highlights a critical issue plaguing the pharmaceutical sector: the role of pharmacy benefit managers (PBMs) in inflating drug prices. This revelation is particularly alarming given the substantial financial burden it places on insurers and patients, ultimately driving up healthcare costs across the board.

Pharmacy benefit managers were originally established to streamline drug pricing and reimbursement — acting as intermediaries between pharmacies and insurance companies by handling the logistics of drug claims and payments. However, legal changes and industry consolidations have transformed these entities into powerful middlemen controlling a significant portion of the pharmaceutical market.

The FTC report titled “Report on Pharmacy Benefit Managers: The Powerful Middlemen Inflating Drug Costs and Squeezing Main Street Pharmacies” highlights a stark example with Gleevec, a groundbreaking treatment for blood cancer. When Gleevec was first approved in 2001, it was hailed as a miracle drug, enabling patients to resume normal activities and dramatically improving their quality of life. However, its cost was steep, initially priced at $26,000 per year and escalating to $132,000 annually by the time its patent expired in 2015. Despite introducing generic versions that reduced the drug’s National Average Drug Acquisition Cost by 99%, the cost to payers, including Medicaid systems and insurers, did not see a corresponding decrease.

The reason for this discrepancy lies with the PBMs. These organizations, which are supposed to facilitate the efficient reimbursement of pharmacies, have been found to inflate drug prices significantly. The FTC report reveals that three major PBMs control the pricing of pharmaceuticals and have been redirecting substantial funds to themselves. This has prevented the expected drop in the cost of generic drugs like Gleevec from reaching consumers and payers.

As noted in the report, an internal communication from an executive at a health insurance company, the parent company of one of these PBMs, underscores the extent of this issue. The executive expressed concern not about the inflated prices but the potential legal ramifications and negative public perception. He highlighted that the cost of Gleevec through the PBM’s mail-order pharmacy was $19,200, compared to $9,000 at Walgreens and just $97 at Costco. This price manipulation by PBMs has led to an added revenue of $902.1 million over a few years just for Gleevec, with similar inflation seen in other drugs like Zytiga, resulting in an additional $685 million in costs.

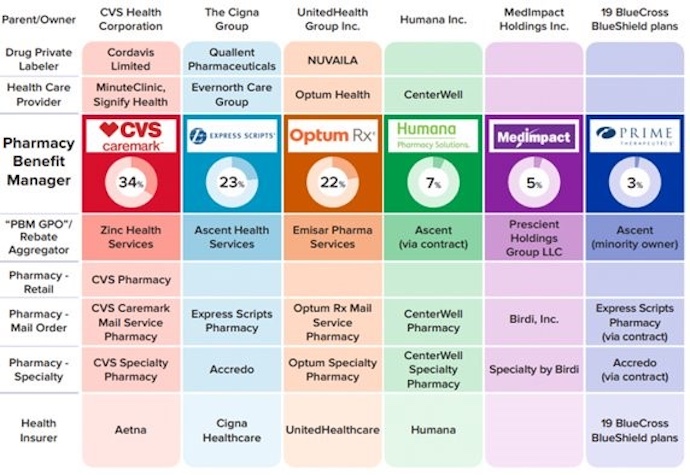

The consolidation of PBMs has further exacerbated this problem. Major healthcare conglomerates such as CVS, Cigna, and UnitedHealth Group (UHG) now own the largest PBMs, as shown in the figure below. This vertical integration allows them to set reimbursement rates for their pharmacies and their competitors, creating a monopolistic control over drug pricing. For instance, UHG, one of the top PBMs, also employs 10% of doctors in the US, operates the largest health insurer, runs a significant payment network for hospitals and pharmacies, and owns a bank through which Covid bailout funds flowed.

Legal changes, particularly the 1987 exemption to a Medicare Anti-Kickback statute, have allowed PBMs to accept rebates from drug manufacturers, fostering a system of secretive pricing. This exemption, along with other regulatory shifts, has created a conflict of interest in which PBMs are incentivized to favor higher-priced drugs that offer greater rebates rather than seeking the lowest-cost options for patients and insurers.

The FTC’s report not only outlines the problematic practices of PBMs but also indicates that the commission may sue these entities over the high prices they have fostered for essential drugs like insulin. This legal action could potentially reform the entire drug claims system, making it more transparent and cost-effective.

Historically, PBMs were designed to act as claims processors, much like Visa and Mastercard in the credit card industry. They were responsible for creating drug formularies, managing pharmacy networks, and designing strategies to encourage the use of cost-effective medications. However, over the decades, they have evolved into entities that prioritize their profits over the financial well-being of patients and insurers.

The consolidation of PBMs and the legalization of price discrimination have allowed these organizations to dominate the market. For example, CVS’s acquisition of Aetna and Express Scripts’ purchase of Medco have concentrated power in the hands of a few corporations. This consolidation has led to situations where PBMs own both the pharmacies and the mechanisms that set reimbursement rates, creating conflicts of interest and opportunities for price manipulation.

The FTC report’s findings have sparked a significant political debate. FTC Chair Lina Khan, with support from Republican Commissioner Andrew Ferguson, has pushed for transparency and accountability in the PBM sector. However, there is opposition from other commissioners, reflecting the complex and contentious nature of addressing these monopolistic practices.

The implications of this report are profound. The PBM industry, which controls nearly 4% of the US GDP through healthcare expenditures, plays a crucial role in the overall cost of healthcare in America. The FTC’s potential legal actions against PBMs could lead to significant reforms, ensuring that the savings from generic drugs and negotiated rebates benefit patients and insurers rather than being siphoned off by middlemen.

The FTC’s groundbreaking report on PBMs has shed light on the opaque and often exploitative practices that inflate drug prices. As the healthcare industry grapples with rising costs, addressing the role of PBMs could be a critical step toward making prescription drugs more affordable and healthcare more equitable for all Americans. The future actions of the FTC and the industry's response will be pivotal in shaping a more transparent and fair pharmaceutical market.