Chinnapong - stock.adobe.com

Senate Report Exposes Big Pharma's Profiteering at Americans’ Expense

US Senate HELP Committee's 2024 report exposes J&J, Merck, and BMS for prioritizing profits over Americans' well-being with exorbitant drug prices.

On February 6, 2024, the United States Senate's Health, Education, Labor, and Pensions (HELP) Committee published a Majority Staff Report highlighting the issue of exorbitant drug prices in the United States. It focuses on the business practices of three major pharmaceutical companies — Johnson & Johnson (J&J), Merck, and Bristol Myers Squibb (BMS). The report reveals how these companies have prioritized profits over the well-being of the American people by charging excessively high prices for prescription drugs.

Key Findings

In 2022, the pharmaceutical industry's top players, including J&J, Merck, and BMS, amassed a staggering profit, underscoring concerns about prioritizing financial gains over patients' well-being. These companies employed unethical pricing strategies, relentless price hikes, manipulative patent tactics, and extensive lobbying efforts, exacerbating affordability issues and raising questions about their influence on policymaking.

Enormous Profits

The report paints a vivid picture of the pharmaceutical industry's financial gains, with J&J, Merck, and BMS emerging as major profit powerhouses. Merck made $52 million in total compensation in 2022. Collectively, these companies gained an astonishing $112 billion in profits that same year. Such staggering figures reflect the industry's profitability and highlight the immense wealth generated at the expense of patients' financial well-being.

Unfair Pricing

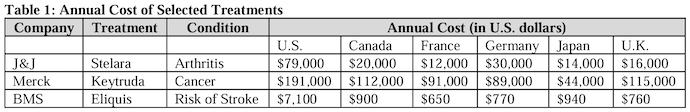

The report uncovers the exploitative nature of the pharmaceutical business model, revealing how J&J, Merck, and BMS prioritize exorbitant profits over affordable access to medication. By charging significantly higher prices for prescription drugs in the US compared to other countries, these companies have created a deeply concerning pricing disparity. This practice not only burdens American patients but also raises fundamental questions about the ethical responsibilities of pharmaceutical companies.

As shown in Table 1, Merck's Keytruda is priced at $191,000 in the US, compared to $112,000 in Canada and $44,000 in Japan. Similarly, J&J's Stelara costs $79,000 annually in the US but is priced significantly lower at $16,000 in the United Kingdom. BMS’ Eliquis follows a similar trend, with a price of $7,100 in the US compared to just $900 in Canada.

The median launch prices for innovative drugs have skyrocketed, with a staggering increase from $14,000 between 2004 and 2008 to $238,000 in recent years. These relentless price hikes strain the overall healthcare system and burden patients, who often face the choice of shouldering exorbitant costs or forgoing essential treatments.

Patent Strategies

The report exposes the manipulative tactics employed by J&J, Merck, and BMS to maintain their market dominance. These companies utilize complex patent strategies to build patent thickets, creating barriers to entry for generic competitors and prolonging their monopolies. By filing additional patents even after receiving FDA approval for their drugs, they further extend their control over the market, stifling competition and limiting patients' access to more affordable alternatives.

For instance, Merck's Keytruda has 168 patents — half related to manufacturing processes rather than the drug itself.

Additionally, BMS has filed lawsuits to prevent two approved generics from entering the US market. Similarly, J&J's autoimmune medication, Stelara, also lacks low-cost alternatives in the US due to lawsuits filed by the company to block them.

Lobbying and Influence

The report sheds light on the significant influence exerted by J&J, Merck, and BMS through extensive lobbying efforts and campaign contributions. Over the past two decades, these companies have spent $351 million on lobbying and contributed $34 million to political campaigns.

This substantial investment in lobbying activities raises concerns about their undue influence over policymakers, potentially impacting legislation and regulations related to drug pricing and industry oversight.

Government Action

The report highlights that the federal government has taken steps to address the issues of high drug prices and corporate greed in the pharmaceutical industry. One significant action is the newfound ability of Medicare to negotiate drug prices through the Inflation Reduction Act (IRA).

This means that Medicare, which provides healthcare coverage for seniors and specific individuals with disabilities, can now negotiate prices with pharmaceutical companies to secure more affordable drug prices for its beneficiaries. This is a significant shift from the previous policy that barred Medicare from negotiating drug prices.

In addition to allowing negotiation, the government has also required manufacturers to pay rebates to Medicare if they increase drug prices at a rate higher than the inflation rate. This measure aims to hold pharmaceutical companies accountable for excessive price hikes and discourage them from continuously raising prices without justification. The government intends to create a more transparent and fair pricing system that benefits patients and taxpayers by imposing financial penalties on companies that engage in such practices.

Industry Implications

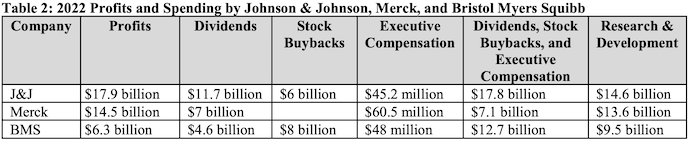

The report sheds light on J&J, Merck, and BMS’ practices and implications of the pharmaceutical industry's business model. Despite making substantial profits, these companies have allocated a significant portion of their earnings toward dividends, stock buybacks, and executive compensation rather than investing adequately in research and development (R&D) for new drug treatments, as shown in Table 2.

In 2022, J&J allocated $17 billion toward stock buybacks and dividends while only dedicating $14 billion to R&D efforts. The company’s CEO, Joaquin Duato, also received $13.1 million in total compensation that year. Merck's CEO Rob Davis’ total yearly compensation is $18.65 million, with 8.2% as salary and 91.8% as bonuses, including company stock and options.

Meanwhile, BMS’ CEO Chris Boerner, appointed in November 2023, earned a total yearly compensation of $6.88 million last year, comprised of 15.5% salary and 84.5% bonuses, including company stock and options. Boerner also owns 0.004% of the company's shares, worth $4.11 million.

The Majority Staff Report findings call for greater accountability and ethical conduct within the pharmaceutical industry, urging companies to adopt fair pricing strategies and prioritize patient well-being. As the government takes action to address these issues, pharmaceutical companies must adapt to a changing regulatory landscape and invest in research and development to meet societal expectations and regain public trust.