Getty Images

Fundamentals of the Pharmaceutical Supply Chain

The complex pharmaceutical supply chain poses challenges requiring efficient solutions to deliver vital medications.

The pharmaceutical supply chain poses risks and challenges to both providers and consumers. But in the context of a health-conscious society, managing pharmaceutical supply chains presents several complexities because it involves many key components and stakeholders to efficiently deliver life-saving medicines that are vital to patients.

The pharmaceutical supply chain involves the process of sourcing raw materials, manufacturing, distributing, and delivering medications to patients. Because the pharma supply chain network comprises various stakeholders, it requires careful coordination and adherence to regulatory guidelines at every stage to ensure patients receive safe and effective medications.

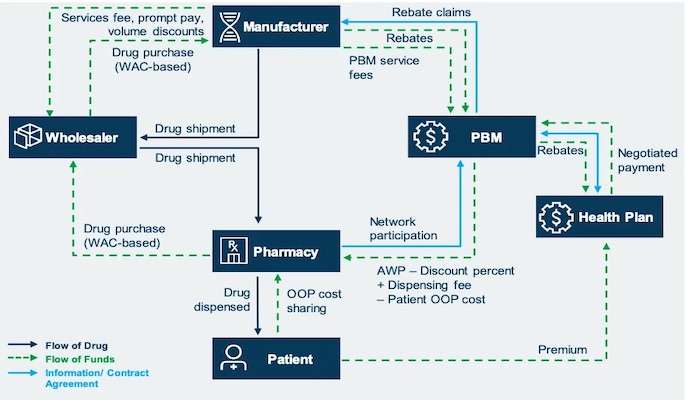

The following Avalere diagram depicts the general path a prescription drug usually takes through the drug supply chain in a standard retail pharmacy distribution. It is important to note that this chart does not consider the nuances of physician-administered drugs or specific products or entities.

Who Are Pharma Supply Chain Stakeholders?

The key stakeholders in the pharmaceutical industry supply chain include raw material suppliers, drug manufacturers, regulatory agencies, wholesale distributors, pharmacies and pharmacy benefit managers (PBMs), healthcare providers, and patients. Each stakeholder plays a crucial role and proper coordination between them is essential.

In such a complex process, the stakes are high for pharmaceutical companies. Incorrectly distributed drugs can harm their reputation, customer satisfaction, and potential profits. According to a Kaiser Family Foundation report, an ineffective supply chain can also disrupt patients' healing processes and have adverse effects on public health.

The pharmaceutical supply chain faces several challenges, including supply chain visibility, drug counterfeiting, cold-chain shipping, and rising prescription drug prices, which can significantly increase out-of-pocket patient costs.

In this article, PharmaNewsIntelligence breaks down the fundamentals of the pharmaceutical supply chain to uncover strategies for overcoming the most common challenges and ways to get patients consistent access to current and new drugs.

How Does the Pharmaceutical Supply Chain Work?

As noted in a 2005 Kaiser Family Foundation report, the following five pharmaceutical supply chain strategies ensure that drug inventory is readily available for distribution to providers and patients:

- Drugs are manufactured at production sites.

- They are then transferred to wholesale distributors.

- The pharmaceuticals are stocked at various types of pharmacies, including retail and mail-order.

- Pharmacy benefit management companies negotiate prices and process drugs through quality and utilization management checks.

- Finally, pharmacies dispense the drugs to patients, who take them as prescribed.

Researchers note there are many variations on this basic structure of the pharmaceutical supply chain, mainly due to the constantly evolving players. The vital players of the pharmaceutical supply chain network allow it to run smoothly and efficiently. Those players include manufacturers, wholesale distributors, pharmacies, and PBMs.

What Are Pharmaceutical Manufacturers?

Pharmaceutical manufacturers aim to supply a number of finished products that match the demand from the pharmaceutical sector. These manufacturers are responsible for distributing drugs from their facilities to drug wholesalers or directly to various types of pharmacies, including retail chains, mail-order and specialty pharmacies, hospital chains, and certain health plans.

Notably, pharmaceutical manufacturers have the most influence over pharmaceutical prices, assessing expected demand, future competition, and projected marketing cost to establish the wholesale acquisition cost (WAC), according to researchers.

What Are Pharmaceutical Wholesale Distributors?

Wholesale distributors purchase pharmaceutical products from manufacturers and distribute them to various customers, including pharmacies. While some wholesalers cater to a wide range of clients, others specialize in the sales of specific products like biologics or cater to particular types of customers. Common pharmaceutical wholesale distributors include McKesson, Cardinal Health, and AmerisourceBergen Corp., among others.

What Are PBMs?

Although not a direct link in the physical supply chain for pharmaceutical products, PBMs are intermediaries that work with health insurers, employers, and government programs to manage prescription drug benefits for patients. PBMs negotiate drug prices with drug manufacturers, determine which drugs are covered by a patient's insurance plan, and manage formularies (lists of covered drugs).

They also negotiate drug prices with pharmacies, process claims, and provide medication therapy management services to patients. Ultimately, PBMs play a critical role in controlling prescription drug costs and ensuring patients have access to safe and effective medications. In the United States, roughly two-thirds of all prescriptions written are processed by a PBM.

What Are Pharmacies?

Pharmacies are the final step in the supply chain before drugs reach the patient — arguably the most vital step because they serve as the information link between PBMs, drug manufacturers, and wholesale distributors. Pharmacies purchase drugs from wholesalers or directly from manufacturers. After purchasing products, pharmacies must maintain an ample stock of drug products and provide information to consumers about the safe and effective use of prescription drugs.

Prescription Drug Costs

The pharmaceutical supply chain plays a significant role in determining drug costs. Without good partnerships, oversight, and supply chain management, consumers face higher out-of-pocket expenses and health plans deal with higher drug spending.

A report from the Pharmaceutical Research and Manufacturers of America (PhRMA) found that the complexity and number of players involved in the drug supply chain may be one of the main reasons prescription drug costs are making headlines.

According to the report, prescription drugs greatly depend on several negotiations and procurement strategies between wholesalers, pharmacies, PBMs, and insurers. The authors also noted that rebates have increased over the past few years, but out-of-pocket patient costs are soaring.

Another factor that can impact drug costs is the cost of production. Because manufacturers must cover the costs of research and development, clinical trials, and regulatory approval before they can bring a drug to market, those costs are often passed on to consumers in the form of higher drug prices.

The supply and demand of the drug are also other factors that control drug pricing. If a drug is in high demand and there is a limited supply, the price may be higher. If there are few competitors producing a particular drug, this can lead to higher prices as well.

A Time article suggests that the cost an individual incurs for a brand-name medication is contingent upon several factors, including their insurance policy, the drugs included in its coverage, the deductible amount, and the agreement reached between the insurance company and the manufacturer of the drug.

Researchers note that a rise in high-deductible or coinsurance health plans has resulted in an increased number of patients facing higher out-of-pocket expenses. Consequently, these patients may not benefit from negotiated prices, as their co-payment is based on the listed price of the medication rather than the negotiated cost.

The study highlighted several instances where intricate supply chain operations can lead to higher costs for patients. For instance, the study cited an example where a patient was prescribed an HIV medication with a listed price of $3,000. Despite receiving a 20% rebate, the patient had to pay a coinsurance amount based on the listed price, which amounted to $612. In this case, the patient had to pay an additional $100 than they would have if the coinsurance had been based on the negotiated price.

As per a study by the National Community Pharmacists Association (NCPA), elevated prices of generic drugs have had negative consequences for almost all stakeholders in the pharmaceutical supply chain. Consumers are experiencing a surge in co-pays and prices, while health plans are grappling with escalated drug spending. Physicians are compelled to prescribe alternative drug therapies, and in some cases, consumers are refusing medication due to the soaring prices.

TOP 10 PHARMACEUTICAL SUPPLY CHAIN CHALLENGES

By conducting numerous interviews and surveys with professionals in the global health supply chain, researchers from Operations Research for Health Care have outlined the 10 most significant challenges faced by the pharmaceutical supply chain, including (1) coordination issues, (2) inventory management, (3) inadequate demand information, (4) reliance on human resources, (5) order management, (6) avoiding drug shortages, (7) drug expiration, (8) warehouse management, (9) temperature control, and (10) shipment visibility.

The pharmaceutical supply chain encounters multiple other challenges that may result in delays, shortages, and wastage if not efficiently handled. Efficiently managing all challenges necessitates effective communication, collaboration, and meticulous inventory and resource management throughout the supply chain.

What Is the Forrester Effect?

The “Forrester Effect” or the “Bullwhip Effect” is a vital business analysis technique that shows the relationship between the increase of the variability of the client demand and the length of the supply chain. This supply chain phenomenon refers to the demand variability amplification that can occur as orders move up the supply chain from the end customer to the manufacturer.

However, because this effect is most often seen at the primary manufacturing site, which is the least responsive part of the supply chain, it can result in significant inefficiencies — including excess inventory, stockouts, and higher costs. This makes it difficult for businesses to adequately address healthcare system challenges such as supply shortages, tenders for national supplies, and epidemics.

Researchers from Northeastern University and MIT Sloan School of Management also recently noted ways to tackle drug shortages. The research article published in Complexity stated that one common solution was to keep more inventory to ensure that more products are available to treat patients in the event that products are recalled.

According to a report from researchers at the Imperial College of Science, Technology, and Medicine, all businesses with an efficient supply chain strategy follow a four-step process:

1. Demand management

2. Inventory management and distribution

3. Secondary production planning and scheduling

4. Primary manufacturing

Additionally, the researchers noted some tactics for eliminating the effects of disruptions, including financial mitigation, operation mitigation, and operational contingencies.

“Mitigation tactics are those in which the firm takes an action in advance of a disruption and correspondingly incurs the cost of the action regardless of a disruption’s occurrence. Operational tactics, such as inventory management, multiple sourcing, and flexibility in production, are also studied in the literature on supply chain disruptions,” researchers said.

More specific challenges reported by researchers at the Imperial College of Science, Technology, and Medicine included uncertainty in the pipeline of drug development and new products — specifically, which drugs will be successful in clinical trials and what sort of drug administration and dosages are optimal.

Digitizing the Supply Chain

The utilization of technology in supply chains has become increasingly crucial due to the combination of a more digitalized world and ongoing operational disruptions. Using digital tools helps reduce costs, enhance efficiency, and strengthen resilience but also aids in managing risks and tackling environmental, social, and governance (ESG) concerns.

In PwC's 2023 survey on Digital Trends in the Supply Chain, over 300 industry leaders recognized the benefits of digitizing their supply chains. However, 83% noted that their supply chain technology investments haven’t fully delivered the expected results. This indicates that there are still many obstacles to overcome, and businesses must do more to upgrade their supply chain operations in the increasingly digital era.

In the past, PwC also noted that — to meet the growing marketplace's demands — the pharmaceutical supply chain must undergo a “radical overhaul.” The radical overhaul, according to researchers, includes more diverse product types and therapies with shorter lifecycles, new ways for assessing, approving, and monitoring medicines through the FDA, increasing emphasis on outcomes, new models of delivering healthcare, and various other changes.

Overall, the pharma industry and its supply chain are vital for patients to receive the medications they need without dealing with stress or roadblocks. Although the supply chain faces various challenges, companies can take the necessary steps to ensure a smooth process from the manufacturing of products to the delivery to patients.