terovesalainen - stock.adobe.com

Exploring the top 20 biopharma companies Q1 2024 market cap growths

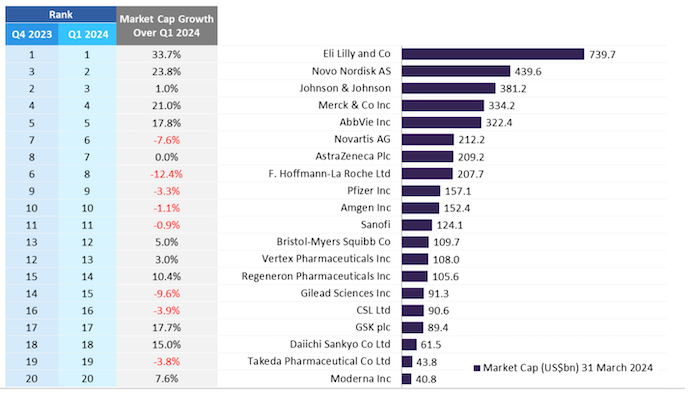

Of the top 20 biopharmaceutical companies to see a profitable Q1 in 2024, Lilly leads with a 33.7% increase, with Nordisk in second, outperforming Johnson & Johnson.

In the midst of economic uncertainties, fluctuating interest rates, and evolving Medicare Drug Price Negotiation policies, the top 20 global biopharmaceutical companies have achieved a promising start to the year. According to a GlobalData report, these companies collectively witnessed a notable increase in market capitalization during the first quarter, with a rise of 9.6% from $3.67 trillion as of December 31, 2023, to $4 trillion as of March 31, 2024.

Capitalization Growth

More than half of the top 20 pharmaceutical companies experienced positive growth in market capitalization throughout Q1 2024. Seven of these companies, namely, Eli Lilly, Novo Nordisk, Merck & Co, AbbVie, GSK, Daiichi Sankyo, and Regeneron Pharmaceuticals, achieved growth rates exceeding 10%, with Lilly leading the pack with an impressive market capitalization growth of 33.7%. Novo Nordisk closely followed with a growth rate of 23.8%, surpassing the performance of Johnson & Johnson.

"Lilly's market capitalization experienced the most substantial growth at 33.7% during Q1 2024, closely trailed by Novo Nordisk, which achieved a market capitalization growth of 23.8%, surpassing that of Johnson & Johnson," said Ophelia Chan, MSc, Business Fundamentals Analyst, GlobalData.

Comparing the Market Cap in Q1 2024 to Q4 2023

Lilly's market capitalization growth can be attributed to the strong sales performance of Mounjaro, their glucagon-like peptide 1 (GLP-1) drug designed for treating type 2 diabetes. Furthermore, the FDA approval of Zepbound in November 2023, which contains the same active ingredient as Mounjaro but is intended for obesity treatment, has also contributed to Lilly's growth. GlobalData's Drugs Database Pharma Intelligence Center reports that Mounjaro achieved global sales of $5.3 billion in 2023, with a projected revenue of $12.3 billion for 2024.

Similarly, Novo Nordisk, a competitor in the GLP-1 agonist market, has experienced remarkable market capitalization growth due to the success of their diabetes and obesity drugs, Ozempic and Wegovy. These drugs generated sales of $13.5 billion and $4.4 billion, respectively, in 2023.

Merck & Co's market capitalization growth of 21% can be attributed to the United States FDA's approval of Winrevair, a treatment for pulmonary arterial hypertension (PAH). This approval marks a significant milestone as it is the first FDA-approved activin-signaling inhibitor therapy for PAH.

AbbVie's market capitalization growth of 17.8% in Q1 2024 is driven by strategic acquisitions. The acquisition of ImmunoGen, valued at $10.1 billion, and the definitive transaction worth $8.7 billion to acquire Cerevel Therapeutics, will enhance AbbVie's oncology and neuroscience portfolios.

GSK has witnessed a 17.7% market capitalization growth, fueled by a 12% revenue increase in 2023 (excluding COVID-19 solutions) and substantial progress in its pipeline. GSK approved four major products: Arexvy RSV vaccine, Apretude for HIV prevention, Ojjaara for myelofibrosis, and Jemperli for endometrial cancer. These advancements aim to mitigate the impact of the upcoming loss of exclusivity for GSK's HIV blockbuster drug, Dolutegravir, starting in 2028.

Capitalization Decline

On the other hand, eight biopharmaceutical companies experienced a decline in market capitalization in Q1 2024, with Roche leading with a 12.4% decrease. Reduced demand for COVID-19-related products was the primary reason for this decline. However, Roche's Vabysmo, approved for wet macular degeneration in 2022, saw a significant increase in sales, tripling to $2.5 billion in 2023.

Gilead Sciences reported a 9.6% market capitalization decline in Q1 2024, primarily due to its drug Trodelvy (sacituzumab govitecan) failing to meet the primary endpoint of overall survival (OS) in the Phase III EVOKE-01 trial for previously treated advanced non-small cell lung cancer (NSCLC).

Impact of Drug Price Negotiations

In addition to these market dynamics, the biopharmaceutical industry is bracing itself for the impact of the Inflation Reduction Act and the International Reference Pricing (IRP) model, which is set to take effect in September 2024. The IRP model, a part of the Medicare Drug Price Negotiation policies, aims to align drug prices in the US with those in other developed countries using an international pricing benchmark.

The implementation of the IRP model has raised concerns within the biopharmaceutical industry. Companies worry that adopting international reference pricing may reduce revenue, potentially impacting their ability to invest in research and development for new drugs. Some industry leaders believe the lower prices set by the IRP model could hinder innovation and limit patients' access to cutting-edge treatments.

However, proponents of the IRP model argue that it will help address the issue of high drug prices in the US, making medications more affordable for patients. By benchmarking prices against other developed countries with lower drug costs, the IRP model aims to create a more equitable pricing system.

Once implemented, the full extent of the IRP model's impact on drug pricing and the biopharmaceutical industry will become clearer. Biopharmaceutical companies closely monitor developments and assess strategies to adapt to the changing pricing landscape. They may explore options such as diversifying their product portfolios, pursuing cost-saving measures in manufacturing, or engaging in value-based pricing models to maintain profitability while complying with the new regulations.

“In response to the evolving regulations, the industry is shifting its focus toward increasing drug prices as biopharmaceutical companies prepare for the Medicare negotiated prices set to take effect in September 2024. Additionally, companies are strengthening their portfolios to address impending patent cliffs,” concluded Chan.