private 5G

What is private 5G?

Private 5G is a wireless network technology that delivers fifth-generation (5G) cellular connectivity for private network use cases. Private 5G works in the same way as a public 5G network, but enables the owner to provide restricted access. Private businesses, third-party providers and municipalities use private 5G networks. Private 5G is an alternative to Wi-Fi, along with other wireless options, like public Long-Term Evolution (LTE) and public 5G.

Cellular technologies require costly, licensed spectrum to operate. Large national carriers in the U.S. -- such as AT&T, T-Mobile and Verizon -- have the means to purchase spectrum, build nationwide networks and lease out network access for individual customer use. An organization that owns or rents a portion of the 5G spectrum is able to take advantage of 5G speeds while also keeping the security and granular control of a private network.

How does private 5G work?

A private 5G network is considered private if an organization owns or rents 5G spectrum and infrastructure.

Private 5G networks are deployable as either a service, wholly owned, hybrid or sliced private networks:

- In wholly owned private 5G networks, an organization owns all the equipment and infrastructure needed for the 5G connection and manages the network itself.

- In hybrid private 5G networks, an organization leases the equipment needed for the 5G connection and uses a cloud service to host parts of the network.

- In sliced private 5G networks, an organization virtualizes wireless network infrastructure, logically dividing their network in slices -- each slice for a different use case.

- In private 5G as-a-service, an organization partners with a vendor that is in charge of deploying, operating, managing and scaling the private mobile network.

In the past, private organizations typically couldn't build their own cellular networks for private use because the costs of licensing and purchasing carrier-grade equipment were too high. This changed when the Federal Communications Commission introduced the Citizens Broadband Radio Service (CBRS) in 2015. CBRS is a 150 megahertz band of spectrum that operates in the 3,550 MHz to 3,700 MHz range.

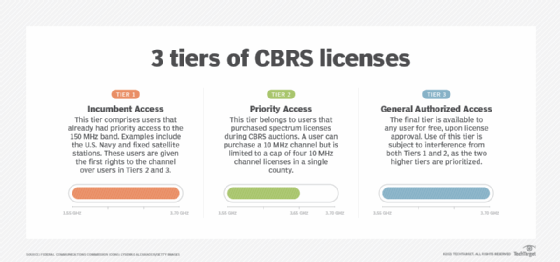

CBRS uses a three-tier priority concept with the following licenses:

- Incumbent Access installations reserved for government and fixed satellite installations;

- Priority Access for purchased and reserved channel access; and

- General Authorized Access tier, which is unlicensed and free to use where available.

Enterprise private 5G primarily uses the General Authorized Access tier. Organizations can acquire spectrum easily and freely, as well as eliminate a major cost hurdle that traditionally plagued private cellular use cases.

With the introduction of CBRS, established 5G equipment vendors and several startups focused on enterprise private 5G use cases. Most vendor architectures use downsized technology and hardware to meet private 5G enterprise scenarios. Vendors design their private 5G architectures to be simpler to install and operate compared to carrier counterparts. This design enables lower build-out and ongoing operational costs, which makes private cellular a viable option for private ownership.

Private 5G networks function identically to publicly accessible 5G networks. Private 5G networks provide the same low, mid and millimeter wave bands.

Endpoints must be cellular-capable, and connect to the private wireless network via physical subscriber identity modules, or embedded SIMs. This gives private 5G operators tremendous control over which devices can connect to the network.

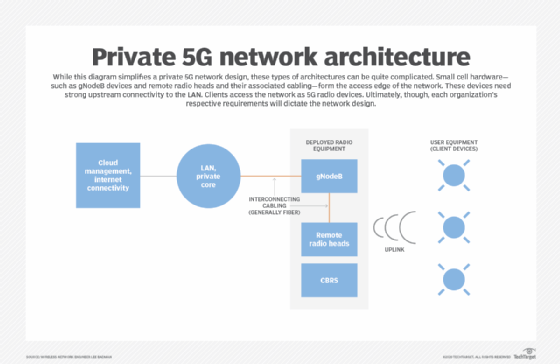

In most use cases, a private 5G network attaches to a corporate local area network (LAN) -- similar to how Wi-Fi operates. Once connected, private 5G endpoints can communicate with other devices on the private 5G radio access network (RAN) itself, as well as other IP-connected devices on the corporate LAN or wide area network.

Private 5G use cases

Some top private 5G industry use cases are the following:

- Industrial plants, manufacturing plants and warehouses are rife with interferences that require reliability and complete indoor and outdoor coverage.

- Healthcare clinics and hospitals that keep track of sensitive data and require seamless mobility to connect hundreds to thousands of wireless endpoints.

- Modern smart buildings that integrate large numbers of internet-of-things (IoT) devices and face difficulties, such as signal propagation.

- School and university campuses that require large indoor and outdoor deployments for staff or student use.

- City and metropolitan connectivity for smart city IoT, emergency responder data access and private citizen use.

- Entertainment venues and stadiums where large numbers of users congregate in condensed and crowded areas.

What are the benefits of private 5G?

Private 5G supports the following capabilities:

- Secure access through SIM-based controls and encrypted network slices.

- Radio access quality of service (QoS) controls on a per-application basis.

- Seamless handoffs between access points (APs) for improved mobility.

- Speed, throughput and latency performance are comparable to the latest Wi-Fi standards.

- Low-power compatibility with battery-operated endpoints.

- Mass connectivity on a per-AP basis.

- Significant improvements in range and coverage compared to Wi-Fi.

- Security is improved because of stronger encryption, authentication, and network slicing.

- The organization has more control over its network infrastructure, security and coverage.

Organizations should consider control, reliability and mobility as they evaluate these factors.

What are the drawbacks of private 5G?

Although private 5G has a lot of benefits, it also comes with some potential downsides, such as:

- Private 5G is expensive to set up and maintain. Smaller organizations might not be able to afford the cost incurred by the network design and implementation, the needed hardware, software and spectrum.

- Private 5G requires expertise in setting up, development and later maintenance.

- Regular maintenance and updates are needed, which can be challenging.

- Spectrum use for private networks might face regulations in some regions.

What is the difference between private 5G and public 5G?

A public network is a type of network that the general public has access to, whereas a private network is a network that has specified restrictions to secure the environment as private.

The biggest difference between public and private 5G networks is in ownership. Private 5G networks are either owned, operated or leased by individual businesses. Organizations also have much more granular control over the network in a private 5G Network when compared to public 5G.

Private 5G networks also have more security than public networks, as private 5G networks are owned by individual organizations that have more control over the security of the network.

With greater control over the placement of 5G architecture, private 5G also typically has better network connectivity than public 5G.

Businesses contract with public carriers to connect 5G-capable devices, such as smartphones, tablets, IoT sensors and wireless routers. This is an expensive endeavor. As the number of cellular devices required for a business project climbs, it becomes unaffordable to access public networks.

A private 5G network is more affordable in large-scale use cases. Enterprises build and maintain their private 5G networks, so the cost of adding additional cellular endpoints is a fraction of the cost compared to public carrier services.

Private 5G vs private 4G LTE

Private 4G LTE can be used as an alternative to private 5G. Although it is not capable of as high speeds as 5G, LTE can still offer low-band 5G speeds. 4G LTE might still provide sufficient speeds and bandwidth for organizations, and as such, it remains a viable alternative for organizations that don't need all the advantages of private 5G.

Private 5G, though, has faster data transmissions, lower latencies and connects to more devices within range.

Private 5G vs. Wi-Fi: What are the differences?

Wi-Fi is another potential alternative to private 5G. Private 5G operates similarly from an end-user perspective when compared to Wi-Fi. However, distinct differences exist between the two technologies in areas useful for specific use-case deployments.

Some major differences between private 5G and Wi-Fi are the following:

- Private 5G can transmit signals at a higher power rating, approximately five to 10 times higher, so it requires fewer APs to cover the same physical area.

- Roaming between private 5G APs uses a soft handoff mechanism with no data loss compared to Wi-Fi, which breaks one connection first before attempting to connect to another.

- A single private 5G AP can handle more active connections than Wi-Fi.

- Private 5G network slicing capabilities enable more speed and throughput and guarantee QoS granularity and control on a per-application basis.

- Unlicensed Wi-Fi spectrum is more susceptible to external interference compared to private 5G, which operates in CBRS.

- Wi-Fi 6E latency and throughput standards remain slightly superior, but private 5G is comparable in most situations.

Private 5G isn't a replacement for Wi-Fi. Most enterprises deploy private 5G in situations where Wi-Fi can't operate reliably. While Wi-Fi is functional in many scenarios, it suffers from several deficiencies that create usability headaches for network professionals who work with and manage wireless endpoints.

Private 5G and other private wireless networks take time and expertise to implement. Learn if a private wireless network is worth the investment for your company here.