ICS cybersecurity: The missing ingredient in the IoT growth equation

The IoT market is not as large, or growing as fast, as once thought. While the internet of things is an undeniable trend with monumental implications for global businesses, industries and governments, the technology phenomenon has a few blind spots that have slowed customer adoption and integration, especially within industrial operational technology (OT) networks.

The missing ingredient

There’s a lot to be gained by adopting connected IoT or IIoT technologies within OT networks and industrial control systems (ICS) environments. By using common internet protocols combined with the cost-savings of using connected terminals, industrial operations can utilize real-time analytics and multisite connectivity to improve efficiencies across numerous industrial verticals. So, why have ICS practitioners and stakeholders not adopted these new technologies? One word: security.

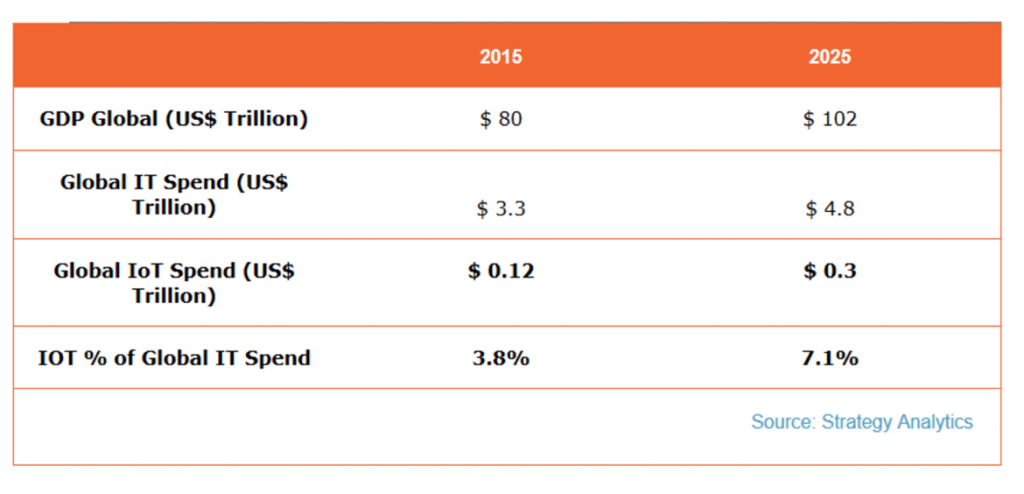

As OT networks begin to integrate more intelligence, such as intelligent human-machine interface and cloud SCADA, ICS practitioners are now unable to reconcile the new security risks that have been created as a result. Since OT networks control critical infrastructure and processes, network failure inherently comes at a greater consequence than in typical IT networks. The potential for substantial financial loss, environmental damage and even loss of human life resulting from a security breach is a real possibility in the industrial realm. According to a 2017 study from Strategy Analytics, the impact of lagging cybersecurity investments is evident.

The findings

In the 2017 study, Strategy Analytics interviewed IT decision-makers across nine vertical markets in the U.S., UK, France and Germany, and found that investment and growth in IoT/IIoT systems have been less than once thought or hoped. For example, over 70% of current IoT deployments in the United States involve less than 500 devices. And around 66% of businesses in the survey spent less than $100k on IoT/IIoT projects in 2016.

From a global perspective, 35% of firms with IoT/IIoT deployments, reported less than 100 devices connected. This reality was not a reflection of what has been forecasted by many leading technology companies servicing the IoT market over the last few years. This may lead one to ask — why is there such as large disparity between expectations and reality?

Another very interesting detail in the study was the vertical distribution of Strategy Analytics’ findings. The three largest represented verticals in the study were primary processing, security and utilities — representing about half of all IoT/IIoT market spend in 2016. By 2025, automotive, security and primary processing are projected to each generate $50 billion annually in IoT/IIoT revenue. In a very literal sense, modernizing OT/ICS with connected systems, as well as spend, drives much of innovation activity. In other words, industrial IoT is on the path to becoming the largest market for connected and automated systems under the greater IoT umbrella.

Clearing the path

IoT/IIoT concepts have progressed from experimental to mainstream. Now, general IoT/IIoT technologies must compete for a share of IT/OT budgets, which isn’t always easy to do. Businesses and public sectors are implementing general IoT/IIoT systems, but they’re doing so cautiously due to associated cybersecurity concerns and consequences of systems failures, especially at the OT level. Until investment in ICS cybersecurity technology parodies investments in connected and automated systems, IoT/IIoT growth will be challenged.

All IoT Agenda network contributors are responsible for the content and accuracy of their posts. Opinions are of the writers and do not necessarily convey the thoughts of IoT Agenda.