Getty Images

86% of Payers Fail to Deliver Readable Medicare Communications

The vast majority of payers are producing Medicare and Medicare Advantage documents that are nearly impossible for most members to understand.

Most documents intended for Medicare and Medicare Advantage members do not meet accessibility standards for the average reader, according to a new report from VisibleThread, a text analysis company.

More than 86 percent of payers offering Medicare products share information with beneficiaries that does not meet federal guidelines for clear, accessible communication as mandated by the Plain Writing Act of 2010.

The law, which started to apply to health insurance providers in 2013, is intended to ensure that entities use plain language, defined as being at or below a 6th grade reading level, to share information with consumers.

According to national statistics from 2003, more than half of Medicare-aged adults (aged 65 or older) are at a “basic” or “below basic” reading level, rendering them unable to understand the typical instructions for taking a prescription medication, for example.

And more than one-third of the United States’ illiterate population is aged 65 or older, equating to 10.6 million elderly adults.

Most documents and communications from health insurance companies, however, are far too complex for these individuals to understand.

Close to 90 percent of documents examined by VisibleThread hovered between a 6.2 and 10.6 grade reading level.

Only 6 out of the 30 payers met recommended standards for plain language communications. Amerigroup, Kaiser Permanente, AARP, Emblem Health, Health Markets, and Aetna all managed to keep their readability scores at or below the optimal threshold.

Poor performers adopted an overly-academic tone and used long sentences, passive construction, and other tactics that result in difficult-to-understand documentation.

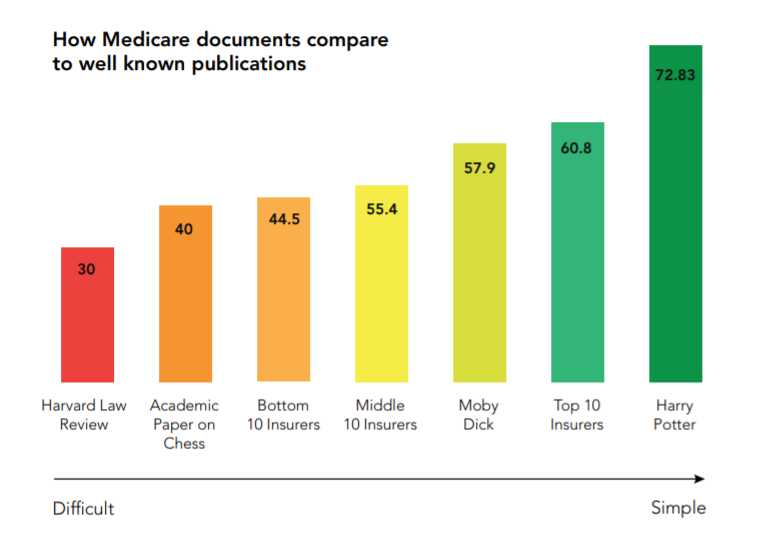

Two-thirds of the communications coming from Medicare payers were more difficult to understand than Moby Dick by Herman Melville, and only marginally less complex than the Harvard Law Review.

"Trust in the health insurance industry in the US is declining, according to the Edelman Trust Barometer," says Fergal McGovern, CEO of VisibleThread.

"This is alarming as trust isn't a 'nice to have'. Lack of trust means less customer loyalty. And that means customers take their business elsewhere. Acquiring new customers becomes more difficult and expensive for organizations."

The bottom five companies – American National Insurance, State Farm Accolade, the US Government, High Mark, and Liberty Mutual – used twice as many run-on sentences as recommended.

One-third of companies overused the passive voice, which can obscure the meaning of sentences. The recommended level for passive voice is 4 percent. Two companies exceeded 12 percent in their Medicare communications.

High Mark scored lowest across the categories, with a 14.7 percent passive voice score and an overall 10.6 grade reading level.

“Most industries struggle with content quality and clarity,” the report acknowledged. “Insurance is among the worst offenders. The causes can vary, but culture is often a large influence. For instance, content creators may assume complex content is desirable because that’s what they encounter elsewhere.”

“Culture can create a preconception that regulations and compliance matters must be complex. And because they are highly educated, industry employees overestimate the average customer’s sophistication. This is a more pronounced issue when the audience is disadvantaged or, in the case of this study, elderly.”

Improving communication with Medicare and Medicare Advantage beneficiaries has become a top priority for payers as more potential members age into the highly lucrative market.

Most beneficiaries are not at all satisfied with the way their health plans share information, provide reminders, or engage them in chronic disease management tasks.

JD Power recently noted that customer satisfaction in the Medicare Advantage market was on the decline between 2017 and 2018. Beneficiaries only received one piece of communication from their plans per year, on average, contributing to a sense that plans are not available and eager to help beneficiaries make the most of their dollars.

Forrester’s US Health Insurers Customer Experience Index, 2018 agreed with that assessment. Just 56 percent of customers felt that they could get help when they need it from their insurance carriers, citing poor customer service and confusing interactions as factors in disengagement and dissatisfaction with payers.

And in July of 2018, HealthMine found that a mere 10 percent of Medicare Advantage and Medigap members receive chronic care management reminders from their health plans. Just 16 percent receive follow-up communications about whether or not their chronic care needs are being met.

A few months later, another survey from HealthMine added that 60 percent of Medicare Advantage members do not feel adequately engaged by their health plans. Three-quarters only receive generalized wellness advice instead of meaningful, personalized communications.

Ensuring that health plans communicate at an appropriate frequency, with the right communications at an accessible and understandable reading level, could be the key to increasing engagement among members and fostering better health outcomes.

Emerging natural language processing (NLP) and machine learning tools can assess content for reading level and clarity before publication, the researchers suggest, but health plans also need to set the right tone internally and periodically assess their member-facing content for overly complex language.

“Leadership needs to define what quality means,” the report stressed. “Teams should be outfitted with the tools to efficiently enforce the standards.”