Getty Images

COVID-19 Projected to Drive Increased Costs for Consumers, Employers

COVID-19 costs could lead to significant increases in premiums and out-of-pocket expenses for consumers.

A new report warns of rising premiums and out-of-pocket expenses for beneficiaries resulting from healthcare spending to combat the COVID-19 pandemic.

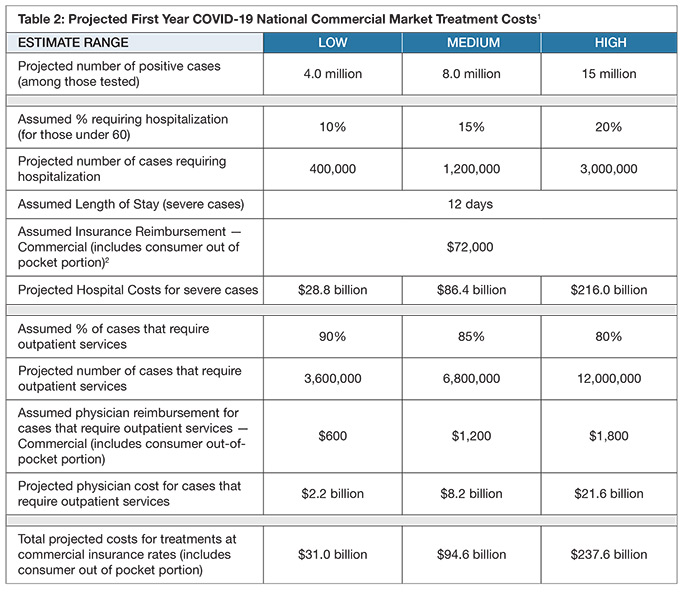

Covered California, the state’s health insurance marketplace, released a policy/actuarial brief projecting between $34 billion and $251 billion will be spent on testing, treatment, and care for COVID-19. The brief is the first national projection of costs tied to the coronavirus pandemic.

For more coronavirus updates, visit our resource page, updated twice daily by Xtelligent Healthcare Media.

The organization, an independent part of the state government, warns that a lack of federal intervention could have significant financial consequences for the American healthcare industry in the coming year.

“Covered California’s analysis shows the impact of COVID-19 will be significant, and that absent federal action, consumers, employers and our entire health care system may be facing unforeseen costs that could exceed $251 billion,” said Covered California Executive Director Peter V. Lee. “Consumers will feel these costs through higher out-of-pocket expenses and premiums, as well as the potential of employers dropping coverage or shifting more costs to employees.”

Prepared by chief actuary John Bertko, the findings are based on an analysis of commercial insurance markets, expert clinical reviews, and interviews with leaders of health plans.

Beyond one-year projected costs, the report projects premium increases of 40 percent or more barring federal action, noting that premiums in the individual and employer markets for 2021 are currently in the process of being set. According to the analysis, premium hikes would come as a result of insurers seeking to “recoup unplanned losses from 2020 and budget for pandemic-related costs in 2020.”

“Given that insurers will be submitting 2021 rates in May and finalizing them around July 1, congressional action is needed very soon in order to affect 2021 premiums,” Bertko said. “While there is a lot of uncertainty with anything related to COVID-19, one thing we can be certain of is that the impact will be significant, and now is the time to take action.”

Covered California recommended Congressional actions to prevent cost increases:

- Enhance the federal financial assistance provided in the individual market to increase the level of tax credits for those earning under 400 percent of the federal poverty level (FPL) and expand subsidies to those earning more than 400 percent FPL as California implemented on a three-year basis in 2020.

- Establish a temporary program to limit the costs of COVID-19 for health insurers, self-insured employers and those they cover, which would directly benefit individuals and small employers for 2020 and allow for more certainty in their pricing for 2021.

- Establish a national special-enrollment period for the individual market, such as has already been adopted by 12 marketplaces representing 30 percent of Americans.

“These increased costs could mean that many of the 170 million Americans in the commercial market may lose their coverage and go without needed care as we battle a global health crisis,” Lee explained. “These are not ‘insurer’ costs — these are costs directly borne by individual Americans in the form of cost-sharing and premiums; these are costs to small and large businesses that are struggling; these are costs to individuals who may avoid needed care.”

The organization highlighted that reinsurance policies currently under Congressional consideration (i.e., federal funding to support the individual and employer markets and Medicaid managed care programs) could provide the funding necessary to stave off lasting financial consequences.

“As we have seen throughout this crisis, there is no time to waste. We must take action now to prevent the pain of this epidemic from becoming worse for hundreds of millions of Americans next year,” said Lee, who also called for a similar analysis of public programs to address rising costs.

Beginning last month, American’s Health Insurance Plans (AHIP) continues to maintain a list of actions taken by payers in response to the COVID-19 pandemic. Experts estimate that treatments for those with employer-sponsored health plans could amount to costs in excess of $1,300.

Dig Deeper on Medicare, Medicaid and CHIP

-

![]()

What is the Patient Protection and Affordable Care Act (PPACA, ACA or Obamacare)?

-

![]()

ARPA Reduced Fiscal Challenges on CA Affordable Care Act Marketplace

-

![]()

Health Insurance Is Expensive, But Americans Intend to Keep Their Plans in 2023

-

![]()

AHA: CBO Report Inaccurately Assessed Commercial Insurance Premium Drivers