Getty Images/iStockphoto

How Payers Can Make Medical Billing More Streamlined, Transparent

Payers can use simplified billing formats, customizable payment models, and technology to untangle the medical billing process.

Medical billing is notoriously complicated and taxing for members and providers alike. But payers have the ability—and, some might argue, the responsibility—to clarify and simplify the medical billing process.

In 2020, policymakers and healthcare leaders focused on ensuring that consumers can predict their costs upfront and that they do not end up with medical bills they could not foresee. That was the goal of the surprise billing and price transparency legislation that passed through Congress in the form of the most recent COVID-19 stimulus bill.

However, while preventing unexpected healthcare costs before members receive care is crucial, it is just as important to address the cost complexities that occur after a member has been treated.

It is important that member can understand what their medical bills cover in order to build trust in their payers and providers. The responsibility for providing that level of clarity rests largely on payers, although it is not an easy task.

The diversity of contracts between payers and providers complicates the matter. Payers traditionally charge per provider, not per visit. Thus, if a member sees multiple providers in one visit, it can be difficult to incorporate the cost of each provider’s service into one, simple medical bill.

This challenge is particularly common when a provider visit requires laboratory work, as witnessed during the pandemic.

“For a member, it's not their problem, but it's become their problem,” Shayna Schulz, senior vice president of transformation and operations at Blue Shield of California, told HealthPayerIntelligence. “We've got to simplify and make it easier for patients to understand what is happening as it relates to the cost associated with their care.”

Members also struggle with paying for their medical bills, particularly large ones.

A member could max out her entire deductible in one or two trips to the emergency room or in the first few months of cancer treatment, for example. In such situations, the member may receive a hefty bill that she cannot immediately cover.

Not only could this leave members exposed to more medical debt, but unpaid or lagged reimbursement can leave providers in a financial rut as well. Providers shoulder a higher administrative burden as they pursue patients for payment.

Blue Shield of California started its Member Payment pilot program to address these problems. The pilot program brought together Blue Shield of California, several California hospitals in the CommonSpirit Health system, and a software start-up. A year and a half after the program launched, it had expanded to include a total of 26 hospitals across California.

Blue Shield of California’s pilot program uses a simplified billing format, a more flexible payment model, and digital advancements to achieve greater transparency and simplicity in medical billing.

Streamlining the medical billing process

In the Member Payment pilot program, Blue Shield of California members receive a monthly, simplified medical bill from hospitals in the CommonSpirit Health system.

“One of the things that we have worked very hard to do in this program is to simplify the billing process in general,” Schulz explained.

When creating this new bill format, Blue Shield of California sought to incorporate lab, x-ray, and anesthesiologist costs, among other services that typically fall under “additional follow-up.”

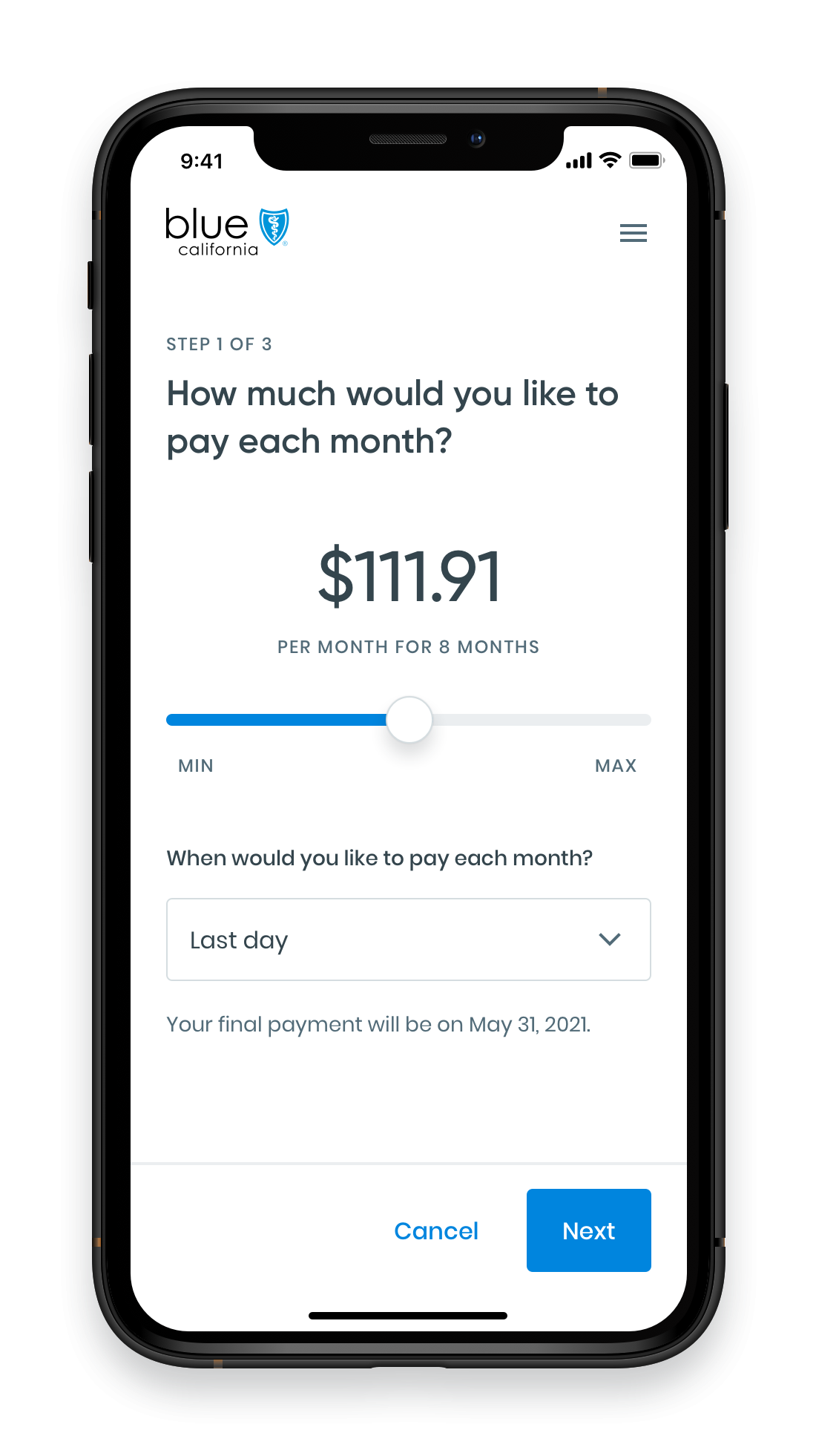

The bill also gives Blue Shield members more options regarding how and when to pay. They can choose whether to cover the bill with a flexible spending account, a credit card, check, or an ACH direct deposit.

Furthermore, members can either pay the bill in full or in installments. If they choose the latter, there is zero interest on the bill.

When a member receives her monthly medical bill, she gets a text message from Blue Shield of California which directs her to log into her Blue Shield of California online account. There, the member will find her monthly bill. Following the steps, she can indicate how she would like to pay for it.

“For our members, it’s a much more friendly, human experience,” Schulz said.

Early data may support that assertion: as of January 2021, the program enjoyed a 92 percent member satisfaction rate.

Lowering providers’ billing-related administrative burden, costs

Apart from helping members understand and cover their medical bills, the program aimed to lower administrative costs and burden for providers.

When it came to the support that this program offered to providers, Schulz said it was a “win, win, win conversation” for payers, providers, and members.

“We front the member’s portion of the payment and then we work with the member to arrange for that payment. We take on that liability,” she explained.

“Not only does it create revenue guarantees for the providers at the level that they're used to receiving, but it also reduces administrative costs because you don't need the same people doing that. They can be doing more high-value work.”

With the payer working out payment, providers can focus on building strong relationships with their patients.

“Providers don't want to be in the business of going after their patients to collect funds,” Schulz said.

Plus, this strategy reinforces trust between payers and providers, she asserted.

Providers have reported low trust in payers, according to an Insights report from Xtelligent Healthcare Media. For example, 17 percent of primary care providers did not trust their public payer partners and 18 percent did not trust their private payer partners.

But with Blue Shield of California taking on the liability for members’ costs, providers have guaranteed revenue and lower administrative costs, Schulz argued.

In order to bring down administrative costs, the payer implemented automation and other digital strategies, often looking to examples outside of the healthcare system.

“We have certainly looked at other highly digitized industries like retail and financial services that have made that transition and started to look to them for more cues,” Schulz shared.

“In terms of reducing administrative work overall, we’re starting to look at things like very basic robotics in order to remove fingers off keyboards and to do things that are repetitive over and over again. We're also starting to explore utilization of machine learning and artificial intelligence to a degree.”

Schulz noted that Blue Shield of California is increasingly leaning on automation to support their administrative processes, joining an industrywide trend. Competitors have been leveraging mergers and acquisitions in order to enable greater automation, such as UnitedHealth Group’s recent announcement that it would acquire Change Healthcare.

Looking to the future, Blue Shield of California plans to partner with more clinicians in order to work toward a bill that represents all of the member’s services.

The payer also will aim to achieve real-time claims settlement. In 2020, Blue Shield of California shortened its claim settlement timeframe from a maximum of 30 days down to six days, but in 2021 the company plans to reduce that timeframe further.

“For us, ‘real-time’ claims settlement means anywhere from three to nine seconds,” Schulz explained.

“We have a proof of concept that we've already done where we’ve been able to process one claim—but it starts with one—in nine seconds. We’re highly optimistic that we can rapidly scale this in 2022. And that's going to be a game-changer for many hospitals.”