Getty Images

The Future of Medicare Advantage Risk Adjustment Data Validation

Blue Cross Blue Shield Association, Humana, Avalere, and MedPAC address the impacts of the finalized Medicare Advantage Risk Adjustment Data Validation rule.

Around four years passed between when CMS proposed the new rule on Medicare Advantage risk adjustment and when the Medicare Advantage Risk Adjustment Data Validation final rule was published. As stakeholders review the long-awaited final rule, the controversy around this CMS decision and its future impacts is just as fresh as in November 2018.

In brief, the final rule contained two key changes to Medicare Advantage risk adjustment.

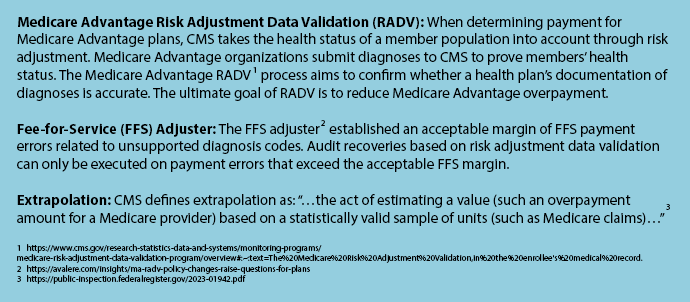

First, it introduced extrapolation as its primary method of estimating error rates. CMS will use a statistically valid sample of diagnostics to assess the error rate across a Medicare Advantage contract. The extrapolation technique will apply to diagnostics from 2018 onward.

Second, the rule will not employ a fee-for-service (FFS) adjuster. CMS found that the FFS adjuster did not have a systematic effect on risk scores or Medicare Advantage payments. Instead, the adjuster resulted in improper payments that were arbitrarily higher for some plans and lower for others, so the final rule eradicated the adjuster.

The rule strikes at the heart of industry contentions. Watchdog organizations called for greater government oversight to enforce payment integrity, citing the millions of dollars in overpayments to Medicare Advantage plans. Payers argued that the system is biased toward fee-for-service Medicare without an adjuster and that CMS did not have the authority to conduct audits via extrapolation.

With these powerful interests at play and many factors to consider, the four-year hesitation between CMS’s proposal and the finalization may appear less surprising.

Stakeholders are still assessing the final rule, but experts from Blue Cross Blue Shield Association (BCBSA), Humana, Avalere, and MedPAC disclosed complex initial reactions and shared their projections for the future.

Viewpoints on using extrapolation, eliminating FFS adjuster

Stakeholders expressed nuanced views on extrapolation, upholding some facets of the rule but not supporting it entirely.

Humana was still reviewing the newly released final rule when it held its 2022 fourth quarter earnings call, but the payer’s leadership shared high-level commentary.

The major payer viewed positively the decision not to apply extrapolation to the years before 2018 and, overall, supported the agency’s choice to audit for payment integrity.

“The strength and support of MA is an important backdrop as we talk about a long-awaited final RADV rule,” Bruce Dale Broussard, president, chief executive officer, and director of Humana Inc., said in his prepared remarks for Humana’s 2022 fourth quarter earnings call.

“I'd like to reiterate Humana's core belief when it comes to RADV. Namely, we believe risk adjustment is an important element of the program and incentivizes plans to cover all individuals regardless of health status. We have long supported CMS' desire for greater transparency through auditing, and we'll continue to partner with CMS to promote program integrity.”

While the payer agreed with the principle of auditing, executives opposed certain aspects of the final rule. Susan Marie Diamond, chief financial officer of Humana Inc, called the elimination of a fee-for-service adjuster one of the primary issues in the rule. The payer will continue to assess the impact of excluding the fee-for-service adjuster.

“We are disappointed CMS’s final rule did not include a fee-for-service adjuster in the process, which we believe is necessary to determine appropriate payment amounts to an MA organization. We are considering all of our options to address or challenge this omission and obtain clarity about our compliance obligations,” Broussard said.

“We are committed to working with CMS to ensure the integrity of the program is maintained and beneficiaries do not face higher costs and reduced benefits as a result of this rule.”

BCBSA appreciated and supported the need for government oversight, but Kris Haltmeyer, vice president of policy analysis and federal policy at BCBSA, expressed dissatisfaction with the rule’s treatment of Medicare fee-for-service errors.

“CMS should have incorporated new methodology to account for errors in fee-for-service claims as well as not change and apply a new extrapolation methodology retroactively without specifying how they will identify the plans they will subject to audit and how the extrapolation will be conducted,” Haltmeyer told HealthPayerIntelligence in an email interview.

MedPAC did not criticize extrapolation or eliminating the FFS adjuster directly but indicated that the final rule did not align with the commission’s goals.

MedPAC has been vocal on the issue of Medicare Advantage payment integrity and reducing overpayment, to such an extent that some stakeholders have labeled the commission as anti-Medicare Advantage.

The commission’s goal is to ensure the fiscal integrity of the Medicare program, said Jim Mathews, executive director of MedPAC. While the commission did not issue an official stance on the rule, Mathews did compare the rule’s themes to MedPAC’s recommendations and found that CMS failed to heed the commission’s counsel.

“MedPAC does not have an official position on the specifics of this rule per se. So in terms of the decision not to extrapolate based on the findings from the 2011 to 2017 audits and the specific decision to proceed with that methodology beginning with the 2018 audit, we don't have reactions specific to this rule,” Mathews told HealthPayerIntelligence.

“From a philosophical perspective, again without weighing on the specifics of this rule, this notion of not collecting all of the overpayments that have been identified through audits is somewhat inconsistent with the position that MedPAC has taken going back as far as 2016.”

Uncertainty around extrapolation methodology

While the payer upheld the CMS decision to audit, Humana executives indicated the need for greater clarity about the extrapolation methodology, citing the influence that methodology can have over projected and actual error rates.

“The error rate that you might expect is going to be highly dependent on audit methodology and extrapolation that they ultimately define. And so that is one of the things that we look forward to working with CMS on, to better understand to fully assess what might be expected going forward,” Diamond explained in the 2022 fourth quarter earnings call.

Extrapolation is not the only factor influencing error rates. Certain trends can have a positive impact. Diamond shared that increased value-based care penetration and greater uptake of in-home assessments paired with typical Medicare risk adjustment payer activities have improved error rates over time. Going forward, these trends will continue to be important to error rates.

“We look forward to working with CMS to learn more about the methodology, including contract selection, sampling and extrapolation as the rule did not provide the details needed to fully understand the potential impact of the future audience,” said Broussard.

Another aspect of the finalized auditing process that has exacerbated stakeholders’ confusion its application to the Office of Inspector General (OIG), Avalere experts indicated.

“The rule also introduces uncertainty because it extends not just to CMS audits, but to OIG audits, meaning that there are now essentially two enforcement bodies doing the same set of work with no indication from CMS or OIG as to the extent of these audits, how they're going to coordinate the audits, or how they're going to align their methodologies and rules for conducting the audits,” Sean Creighton, managing director at Avalere, told HealthPayerIntelligence.

Impact of final rule on bidding rates, pricing

Lack of certainty on the extrapolation methodology could force changes to the bidding process and resulting prices.

“Because of the uncertainty in the rule around which plans will be selected and the methodology under which audits are conducted, plans will have no choice but to assume that they are going to be audited every year and have no choice but to use currently available information to estimate the cost to the plan of that audit,” said Creighton.

If insurers build auditing costs into their prices and bidding using currently available information, Creighton estimated that payers would have to account for at least 2.5 percent in overpayment.

Not all health plans will be able to incorporate that rate into their bidding and prices, since for some it will raise their bids too high to remain competitive. Still, even with some plans declining to account for this potential cost, the CMS estimate is significantly below the mark, Creighton said.

Diamond did not anticipate that the final rule would have an immediate impact on Humana’s bids for the following year.

“From a 2024 bidding perspective, based on what we know today and given that the '24 bids are due in just a few months, I would say it's unlikely that there would be any impact to '24 bids,” Diamond predicted.

“But we'll certainly need to look to see if CMS provides any guidance in the advanced notice and bid instructions given just the uncertainty that exists regarding how the contract selection and audit methodologies will be defined in the future.”

However, in the long term, Haltmeyer expected that the rule might impact payers’ bids.

“Plans need to consider both the initial payment rate and risk adjustment when developing their bids,” Haltmeyer explained.

“The initial payment rates are based on fee-for-service data, which is unaudited and will not be actuarily sound without the fee-for-service adjuster. Going forward, plans may project decreased revenue and add a risk premium.”

Mathews underscored that the actual outcomes of this rule are hard to predict, largely due to the financial incentives which still support high quantities of diagnoses.

“In an ideal world, we would expect that plans would have to devote a bit more effort in terms of ensuring that diagnoses submitted for purposes of risk adjustment through the encounter data are indeed adequately and appropriately documented in the medical record,” Mathews said.

“But it's hard to anticipate the degree to which that happens given the tension between the financial incentives for plans to document as many of these diagnoses as they can versus the relatively limited resources that CMS has to pursue program integrity efforts.”

Impact of final rule on beneficiaries, providers

From the government’s perspective, the rule accomplishes its goal in that it gives CMS the authority to audit and enforce payment integrity. But the rule seriously underestimates what that authority will cost, not just insurers, but beneficiaries and providers as well, Creighton said.

The rule requires changes to diagnostic practices among providers. As a result, the documentation burden on providers—which is already a leading cause of provider burnout—will increase.

“It is possible that, in the medium-run, the health plans will also seek to not just incentivize providers to increase the level of accuracy in their documentation, but may also seek to enforce coding accuracy provisions,” Creighton suggested.

Increased documentation burden could result in greater staffing shortages and higher costs.

In addition to impacting the administrative burden for providers, the rule could result in higher costs for beneficiaries.

Haltmeyer indicated that new trends in Medicare Advantage plan bidding behavior could lead to three main outcomes, all of which directly impact members. Members might see higher out-of-pocket healthcare costs, their premiums might rise, and their plans’ supplemental benefits might diminish.

Uncertainty around payer next steps, lawsuits

Humana did not offer comments to HealthPayerIntelligence regarding whether payers would sue CMS and Broussard’s projections in the 2022 fourth quarter earnings call were general. However, in previous comments during the JP Morgan healthcare conference, Diamond indicated that the industry’s response to CMS eliminating the fee-for-service adjuster likely would be litigation.

BCBSA likewise did not commit to any specific course of action now that the rule has been finalized.

“BCBSA is still analyzing the rule and discussing it with members to understand the appropriate course of action,” Haltmeyer explained.

CMS will maintain its secrecy regarding the extrapolation methodology, apart from minor revelations, Creighton expected.

“As a courtesy, [CMS] will share some of the operational details through subregulatory guidance, but it is clear from the tenor of the final rule that these are aspects of the auditing that CMS wants to reserve complete authority over and not to make transparent,” Creighton said.

Going forward, MedPAC would like to see CMS act on some of the recommendations that MedPAC has emphasized in the past. Prohibiting exclusive reliance on health risk assessments and calibrating the model by using two years’ worth of fee-for-service and Medicare Advantage data are two recommendations that CMS has the authority to execute, Mathews said.

“Given the financial difficulties facing the Medicare program going forward, particularly with respect to the looming insolvency of the Part A trust fund, as well as the continued pressure on general revenues faced by Part B spending, Medicare does have an obligation to be as prudent a payer as possible,” Mathews explained.

“The program is currently paying roughly 106% of fee-for-service for MA enrollees, where MA plans are now bidding at 83% of fee-for-service on average to provide the A/B benefit. And so that gap is contributing to the financial insustainability of the program, and it's one source of policy changes that could help put Medicare on a more sustainable fiscal footing.”