Navigating Medigap Plans: How Payers Can Lead the Way

Payers can play a key role in helping consumers understand their Medigap benefits and policy options through greater benefit and price transparency.

Bonnie Burns, a training and policy specialist at California Health Advocates, has been advocating for consumers in the Medicare space for over four decades, including in the area of Medigap benefits. She was involved in the lawsuit that initiated standardization of Medigap policies in the 1990s.

Her job, she told HealthPayerIntelligence, is to help consumers understand their Medicare coverage options.

“I'm coming at this from a very different point of view,” Burns explained. “Our goal is to make sure that people understand what those benefits are and how to use them and what it's going to cost.”

She plays a crucial role because, for the average consumer, understanding Medigap policy options is no simple task.

As consumers navigate decisions about Medicare coverage, payers can support them by understanding why consumers choose Medigap, the challenges that consumers face in comprehending their coverage options, and by actively moving toward greater benefit and price transparency.

What are Medigap policies and what do they cover

Medigap policies provide coverage for areas of care that Original Medicare does not cover. For modern-day policies, according to Medigap rules, Medigap coverage includes:

Part A hospital coinsurance for days 61 through 90

Part A hospital lifetime reserve coinsurance for days 91 through 150

365 lifetime hospital days beyond Medicare coverage

Parts A and B three-pint blood deductible

Part B 20 percent coinsurance

These benefits were the result of a law passed by Congress in the early ‘90s that called for the standardization of Medigap policies in 1992, largely in reaction to marketing abuses.

Standardization meant that each type of Medigap policy would cover its own list of services, independent of what state the consumer lived in when they purchased it or what payer sold the plan to the consumer.

Massachusetts, Minnesota, and Wisconsin also enforce their own Medigap standardization requirements specific to each state. These states have four “rider” packages that encompass broad categories of special benefits which payers can add to their Medigap policies.

Elsewhere in the nation, payers can also offer innovative benefits, available as a rider or embedded in their Medigap policies.

Payers use a variety of names to distinguish these policies, but ultimately offer a broad range of benefits—including social determinants of health benefits—without much standardization regarding benefit amounts, copays, source providers, or how consumers access them.

Unlike Medicare Advantage, there is no ratings system for Medigap policies since these policies are supposed to be largely the same across payers.

The main distinction between Medigap policies lies in the price.

Medigap policyholders pay a Medigap premium, which goes to the payer, on top of the Part B premium. Most plans also require policyholders to cover the Part B deductible, however, plans C and F cover the Part B deductible.

Payers set their own premiums using one of three methods or “ratings”: issue-age-rated policies, attain-age-rated policies, and community-rated policies.

Issue-age-rated policies and attain-age-rated policies center on the policyholder’s age. For the former, premiums are settled based on the policyholder’s age when they start the policy—the younger the starting age, the lower the premium—and they do not change after that.

Attain-age-rated policies are like issue-age-rated policies in that young age equates low premium. These premiums rise with each passing year, as the policyholder grows older.

Both issue-age-rated and attain-age-rated policies’ premiums are also impacted by inflation.

In contrast to these age-related ratings, community-rated policy premiums stay the same across all ages, year after year. However, this does not protect consumers from increases. The price could still fluctuate based on inflation.

Payers are not obligated to offer Medigap policies. However, if they are going to offer a Medigap policy, they must also offer Medigap Plan A and Plan C or F.

Medigap policies are not available on HealthCare.gov. Instead, consumers access these plans by going to payers and insurance companies directly. That being said, Medicare does offer a Medigap policy search engine to help consumers compare policies and identify payers or insurers to contact.

In order to have a Medigap policy, the consumer must already have Medicare Part A and Part B. Medigap policies are automatically renewed every year if policyholders pay their premiums. A Medigap policy can only cover one person.

There are currently ten basic Medigap policies and two high-deductible policies for consumers to select.

Consumers choose Medigap policies over MA for budgeting, network

Consumers may not have many Medigap options like they do with Medicare Advantage, but people want the policies to help budget their healthcare expenses, according to Burns.

“They never have to worry about co-payments. They never have to worry about an annual limit and whether or not they're going to meet it. They just go to get their healthcare expenses, Medicare pays, the Medigap pays, and normally they would never see a bill,” Burns said.

Plan G policyholders are an exception to this, the policy specialist noted. Plan G policyholders will see a bill for the initial deductible. But otherwise, as with other policyholders, they will not be charged for anything that Medicare covers.

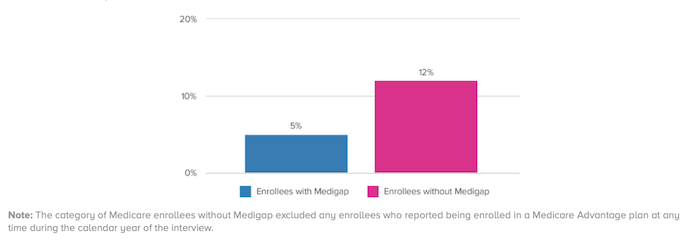

Despite the fact that Medigap policyholders tend to be lower income, only five percent of Medigap policyholders struggled to pay their bills in the past year in 2017, a study from America’s Health Insurance Plans (AHIP) found. Among other Medicare enrollees, 12 percent struggled to meet their bills.

This is one of the primary reasons that individuals switch from a Medicare Advantage plan to a Medigap policy, Burns said.

Furthermore, individuals might switch from a Medicare Advantage plan if they find the provider network too restrictive or if their provider leaves the plan’s network. In a Medigap policy, the provider network encompasses any provider that accepts Medicare.

“Individuals with high medical costs or chronic conditions who select FFS Medicare can be subject to significant risk given the cost-sharing and benefit limitations under FFS,” David Allen, an AHIP spokesperson, agreed in an email interview with HealthPayerIntelligence.

“Medigap helps fill those gaps, which is especially important for vulnerable, low-income enrollees so that their out-of-pocket costs are more predictable throughout the year.”

Why consumers find Medigap benefits confusing

Consumers tend to be confused about Medigap benefits, particularly when it comes to innovative benefits.

“These benefits are all over the board that it takes some drilling down for people,” Burns explained. “There are limits built into these benefits in a variety of different ways that people don't see.”

A payer will often state that it offers innovative benefits in hearing, vision, or dental care through a certain Medigap plan, but the actual details of those benefits are often vague, convoluted, or not explored in payers’ marketing materials, according to Burns.

For example, some benefits can only be used once a year. A hearing benefit may offer access to hearing aids but only a specific brand from one provider.

“It's all of those variations on a theme that are really difficult for people to figure out,” Burns shared.

Medigap policies’ marketing is subject to review by states’ Departments of Insurance, Allen pointed out.

“From a Medigap perspective, materials that are seen by/given to insureds/prospective applicants must comply with state and federal requirements related to marketing/advertisements,” he explained.

“They must clearly delineate what an ‘innovative’ benefit is and specify the associated rate. It’s important for agents, consumers, and the Departments of Insurance to ensure they review the outlines of coverage in detail.”

Another confusing challenge that policyholders may face in a Medigap policy, Burns noted, is the inability to switch policies.

If a policyholder cancels her plan, replacing the plan could be impossible for a variety of reasons.

When an American turns 65, she automatically becomes eligible for Medicare coverage. In the first six months after her 65th birthday, payers must offer her the best rate for their policies and they cannot deny her coverage if she chooses one of their policies.

After the first six months, however, payers can deny potential policyholders based on pre-existing conditions. And if a policyholder has cancelled a previous policy, it is possible that she will not be allowed to buy another Medigap policy under state law or that she may have to pay a higher premium based on his health conditions.

Only under certain circumstances, including losing an employer-sponsored health plan that covered Medicare cost-sharing, can a policyholder once again be eligible for a Medigap policy without the possibility of being rejected.

This can leave policyholders exposed to higher healthcare spending.

Recent changes in policies, future changes in cost

Part of consumers’ confusion also stems from recent adjustments made to long-standing, highly popular Medigap policies—Plans C and F.

The Medicare Access and CHIP Reauthorization Act of 2015 (“MACRA”) eliminated the ability for Medigap policies to fully cover Medicare Part B, which Medigap Plans C and F cover completely. As a result, only those who enrolled in Medicare before January 1, 2020, have access to Medigap Plans C and F. For anyone else, Plans C and F have, in effect, become Plans D and G.

Some payers responded to this change by bolstering Plan G as the “new” Plan F for recent enrollees. Blue Shield of California was the first health payer to start offering a Plan G Extra, much like Plan F Extra, which is a Medigap Plan G with innovative benefits.

Although payers have quickly pivoted, the changes left many consumers—as well as agents and brokers—baffled, contributing to the general chaos of the 2019 open enrollment season.

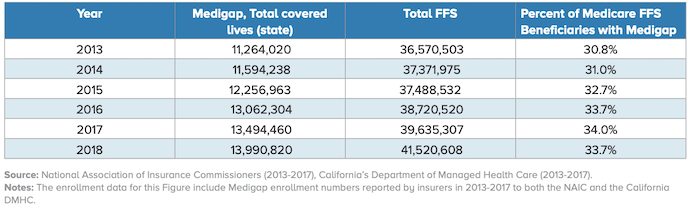

A more positive development for Medigap policies is the rise in enrollment. In recent years, payers have seen increased enrollment in Medigap Plans G and N, an AHIP report uncovered.

While Burns expressed confidence in Medigap as a stable, valuable product, as a consumer advocate, she is concerned that increased enrollment will lead to higher prices for consumers.

“It may be that the cost of the service itself doesn't go up, but the numbers of people who use that benefit go up and that affects pricing,” Burns explained. “There's not a lot of data about how these benefits are used in relation to the cost and to the premium that's being charged. We won't know that for a while.”

To Burns, introducing innovative Medigap benefits is causing the industry to return to pre-1992, de-standardized problems. Instead of marketing abuses against consumers, however, the fallout of this de-standardization is confusion amongst consumers, leading to potentially poor consumer choices.

More regulation would necessarily play a role in standardizing these benefits again and breaking through consumers’ confusion, Burns said. However, she is also personally familiar with the pace of that kind of regulatory reform.

“I was part of that lawsuit back in the late '80s against insurance agents and brokers that led to the standardization. I was part of the group that designed these plans and I've been part of every change since then. I've been through that battle and I know it well,” Burns stated.

As a result, she said, it will take widespread consumer dissatisfaction before Medigap policies can become more regulated.

Actions payers can take

Much of the responsibility for dissolving consumer confusion around Medigap policies rests on agents and brokers. However, there are still actions that payers can take to help consumers make more informed choices about Medigap policies.

One of the key things that payers can do to help consumers make informed decisions is to be more transparent about their innovative benefits’ costs and limitations, Burns recommended. Payers would need to clearly display whether a benefit is restricted to usage once a year, for example, or what the extra cost associated with an innovative benefit would be.

“Medigap carriers strive for transparency in pricing and benefits,” said Allen.

“Our plans work diligently to ensure the consumer knows what they are purchasing and how the product will assist them in the future. Insurers want a long-lasting, positive relationship with the consumer, so they are careful to ensure that marketing materials mitigate any potential confusion about pricing and benefits,” he emphasized.

Additionally, helping consumers distinguish between the value of Medigap and the value of Medicare Advantage is critical to bolstering their confidence and accuracy in decision-making. This is another area in which payers can take the lead.

Some payers offer both Medicare Advantage and Medigap policies. As a result, they end up marketing for both products, aiming to attract consumers to both. But when payers are equally promoting both types of coverage, they make it challenging for consumers to determine which would be the best choice for their health condition and priorities.

“The other piece of this is that the advertising for MA plans is very misleading because the extra benefits that are being promoted cannot be used by most people,” Burns added. “You have to qualify for those benefits.”

Consumers tend to see the Medicare Advantage benefits and assume that they will receive free access to those benefits upon enrollment, when in reality they often have to meet certain health conditions in order to exercise those benefits. This leads to confusion around what the consumer is actually receiving through their health plan.

Consumers need to be informed about the flexibility and the protections against higher costs in Medigap policies and the value that they will receive for the higher premium.

Medicare Advantage plans are subject to review, just like Medigap policies, Allen stressed.

“Medicare Advantage marketing materials must comply with federal marketing and communications regulations, including submission of marketing materials to CMS for review and approval,” he explained.

Both Allen and Burns agreed that payers have a duty to offer benefits and price transparency to potential Medigap policyholders. The main question is whether payers are fulfilling that role.