While there are some similarities to enterprise technology purchasing, factors driving Healthcare Tech purchasing decisions, and especially those who participate in them, can be quite different. Based on TechTarget’s knowledge and expertise from more than a decade of covering this market, we dive into the unique aspects of the Healthcare Tech (and Healthcare Tech-adjacent solutions) purchase process and share how new sources of prospect-level intent data and insight now available can help B2B sales & marketing teams find and influence healthcare tech buyers more effectively.

While there are some similarities to enterprise technology purchasing, factors driving Healthcare Tech purchasing decisions, and especially those who participate in them, can be quite different. Based on TechTarget’s knowledge and expertise from more than a decade of covering this market, we dive into the unique aspects of the Healthcare Tech (and Healthcare Tech-adjacent solutions) purchase process and share how new sources of prospect-level intent data and insight now available can help B2B sales & marketing teams find and influence healthcare tech buyers more effectively.

How Healthcare Tech purchasing decisions are made

Healthcare is a highly specialized industry with many unique factors that shape healthcare tech purchasing patterns. To thrive in this environment, obviously, tech vendors must understand and adjust their GTM approaches accordingly. Healthcare Tech decisions are almost always made with physician workflow and patient experience in mind – there’s a holistic focus on improving the “quality of care”. This impacts a broad range of technology solutions, from cloud or storage, to revenue/billing, tele health, etc.

As you can imagine, this means there are many different players and significant touchpoints in tech purchases. For example, when looking at a system like EHR (Electronic Healthcare Records) Management that might also do patient portals and integrated billing components, there are both back-office and front-line practitioners intimately involved. And success in selling the solution in may require understanding the needs not only of a central hospital, but also of all its related outlying delivery points, whether that’s an individual physician practice, an outpatient center, and so on. Contrast all this with the abundant simple cases like a small physician practice with limited infrastructure where there are one or two people typically making that decision. They may simply be looking for something that’s Cloud-based that can handle many of the daily tasks that prevent them from spending more time with patients.

Layered into this are the complexities arising from solutions developed specifically for a specialty area, be it mental health, oncology, cardiology, pharma and so on. In larger hospital systems, there are buying teams responsible for purchasing across the group, but there are also heavy influencers within each specialty or division that vendors must navigate.

The buying committee for Healthcare Tech is very different

While like all enterprise technology decisions, healthcare buying decisions are made in groups, the makeup of that group is very different. In the case of hospitals and health systems, it includes an expanded buying team that differs considerably from traditional large enterprise technology purchases.

While they do involve IT, in contrast to general enterprise technology buying patterns, buying teams for Healthcare Tech involve much more clinical (practitioner) and business function involvement. Quality of care concerns (among other elements) drive the former, while factors like strict regulatory and privacy requirements, insurance practices and applicable government (most prevalent with public health institutions) drive BDM involvement.

To help illustrate this dynamic, we can look more closely of the makeup of our Xtelligent Healthcare Network (acquired by TechTarget in 2021) audience. As a leading provider of original decision-based content, tips and data for B2B healthcare, we have an opt-in audience of more than 400,000 healthcare technology purchase decision-makers and influencers, covering 90% of the healthcare system in the US. The breakdown of functions closely matches what typical healthcare buying teams consist of:

- 39% Business (C-Level Executives and other Administrative Management)

- 32% Clinical management and practice (including Chief Medical Officers, Department Heads and Doctors and Nurses)

- 16% IT

- 13% Finance/Legal

Unlike in enterprise tech as a whole, in this market, if you are targeting IT only, you’re really missing the mark: 84% of Healthcare Tech buyers and influencers are in non-IT roles. Many of the tech vendors we work with have a great deal of difficulty identifying the right players to influence and engage. Such targeting issues can easily snowball into costly problems prioritizing GTM activity for optimum outcomes.

The implications of intent data for engaging Healthcare Tech buyers

Until now, most of the available intent data has been from 3rd party sources only, derived using some combination of:

Until now, most of the available intent data has been from 3rd party sources only, derived using some combination of:

- Firmographics and contact data for hospital and health system personnel

- Trade show attendee data

- Activity “surges” from Healthcare organizations on the open web

- Contracts, claims (Medicare, malpractice, etc.) for hospitals and physicians, revenue and patient losses organized in a way to provide useful information when targeting organizations and assessing business opportunity.

Much of this data is actually static, or “cold”, it’s not purchase intent at all. The behavioral elements are either few and far between or very generalized or both. Most of the approaches do not actually provide the precision visibility into buying teams that sellers truly need.

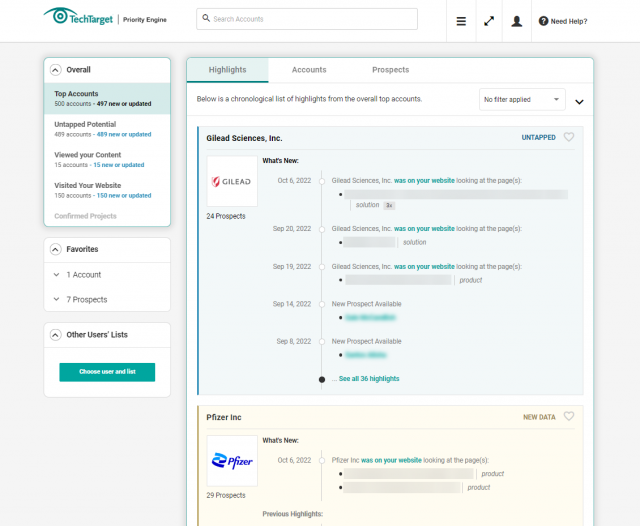

To address this, TechTarget recently rolled out Priority Engine for Healthcare. Our intent data platform now integrates thousands of new Healthcare accounts and more than 400,000+ contacts. This allows us to provide our own 1st party intent data based on real-time interactions of real buyers across the TechTarget, BrighTALK and Xtelligent Healthcare networks, so tech vendor teams that sell into these markets can now:

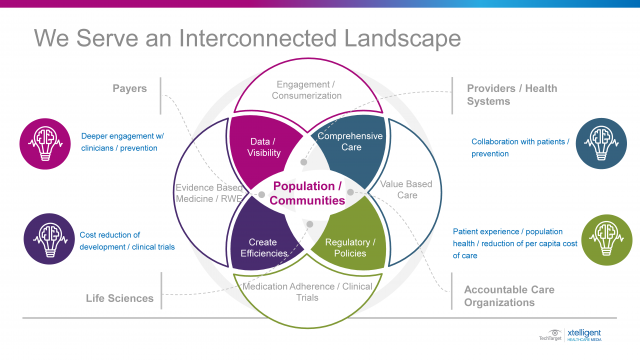

- Get better visibility into their target accounts and create more engagement with real buying teams across interconnected healthcare ecosystems, including: Providers, Health Systems, Payers, Pharmaceuticals, Life Sciences, Accountable Care Organizations and Federal/State Healthcare Agencies, etc.

- Gain direct access to opt-in people who are directly involved with healthcare tech purchasing at organizations of all sizes.

- Pinpoint different buying teams responsible for purchases across multiple specialties in larger organizations.

- Utilize highly relevant, customized intent-based insights on topical interests, content consumption and vendor engagement of healthcare technology buyers to accelerate opportunities with better informed, personalized and timely outreach.

TechTarget helps technology GTM teams navigate the nuances of the healthcare market

As with all the tech categories and audiences we serve, we know this market very well. Across our network, we cover every aspect of the interconnected healthcare landscape. Our in-depth content is designed to provide actionable intelligence and problem-solving insight on the issues that matter most to healthcare tech buyers. This helps us to continuously grow our audience of buyers – the people that tech vendors must connect with. Purchase intent data directly from Priority Engine helps vendors like you identify when accounts and buying team members are active so that you can reach out directly to them with relevance or leverage our portfolio of marketing and sales services to engage them on your behalf.

As with all the tech categories and audiences we serve, we know this market very well. Across our network, we cover every aspect of the interconnected healthcare landscape. Our in-depth content is designed to provide actionable intelligence and problem-solving insight on the issues that matter most to healthcare tech buyers. This helps us to continuously grow our audience of buyers – the people that tech vendors must connect with. Purchase intent data directly from Priority Engine helps vendors like you identify when accounts and buying team members are active so that you can reach out directly to them with relevance or leverage our portfolio of marketing and sales services to engage them on your behalf.

To learn more about TechTarget’s Healthcare Tech data and GTM services, contact us today.