The hype meter is redlining on the subject of B2B purchase intent, and for good reason. Intent data promises to give you a new way to rifle-target prospects showing a strong predisposition to buy from you, with practical applications ranging from prospect scoring and nurturing campaigns to programmatic advertising, ABM and more. Used effectively, purchase intent can improve conversion rates, expedite deal velocity and create stronger synergies between marketing and sales.

The hype meter is redlining on the subject of B2B purchase intent, and for good reason. Intent data promises to give you a new way to rifle-target prospects showing a strong predisposition to buy from you, with practical applications ranging from prospect scoring and nurturing campaigns to programmatic advertising, ABM and more. Used effectively, purchase intent can improve conversion rates, expedite deal velocity and create stronger synergies between marketing and sales.

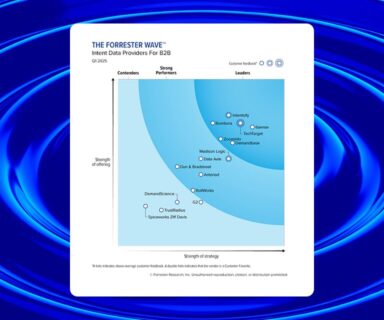

With all this potential, it’s no wonder the intent marketplace has exploded in recent months. Providers of external intent data include mature online media companies such as TechTarget as well as startups like Bombora, The Big Willow, MRP/Prelytix and others.

But intent data is not without its share of gotchas, which may require a huge leap of faith on your part when investing in lists of accounts these providers claim are heating up. When deciding whether to buy from any of these vendors, make sure to ask tough questions and push for maximum transparency.

Example: Acme Corp.

Let’s say an external intent data provider is telling you “Acme Corp.” is showing strong or increased intent activity around Flash Storage solutions. Ask them these questions:

Question 1: “You say Acme is investigating Flash Storage. How do you know it’s Acme?”

Challenge: For intent data to be useful you have to be confident the provider has accurately identified who’s truly behind the activity. Many providers rely on reverse IP lookup to identify “active” companies. That’s problematic because IP lookup can only resolve a fraction of IP addresses into accurate domain names, and even fewer outside of North America. Moreover, since IP addresses tend to change often, IP mapping tools easily go out of date, further undermining accuracy. In the end, the impact of all this is wasted spend, wasted effort and squandered internal momentum.

Recommendation: Look for providers who offer techniques beyond IP lookup for identifying accounts, such as direct user input into registration forms.

Question 2: “How do you know Acme’s interested in Flash Storage?”

Challenge: Since this data is being used to pinpoint real purchase intent, you also need to trust that the content used to produce the activity is actually related to your solution. Many providers “crawl the Web” searching for content with keyword tags associated to the market segment you specified (Flash Storage). When their machines locate such content, they’ll then do IP lookups on the accounts visiting the associated pages.

Challenge: Since this data is being used to pinpoint real purchase intent, you also need to trust that the content used to produce the activity is actually related to your solution. Many providers “crawl the Web” searching for content with keyword tags associated to the market segment you specified (Flash Storage). When their machines locate such content, they’ll then do IP lookups on the accounts visiting the associated pages.

This all sounds super cool – machines finding relevant material for us all across the Web’s great blue ocean – until you consider that across the entire Web there simply isn’t that much highly focused, in-depth content on topics like Flash Storage, and even less that shows up high enough on search engines to drive material traffic volumes.

Recommendation: Ask providers for a specific understanding of the content sources (Web sites, Social Networks) they’re using to derive intent in your market area. Beware of solutions that don’t reveal the source of the content and user/account activity – it’s a warning sign they may be associating intent where none actually exists.

Question 3: “Who at Acme Corp. is investigating Flash Storage?”

Challenge: Assuming you can get to a place of confidence about the provider’s account list, think through how you want to leverage this data. A list of active accounts without named contacts restricts its usefulness to volume-oriented marketing activities like programmatic ad targeting. And while gains in ad performance are a good thing, for external intent data to deliver dramatic results it needs to have deeper, down-funnel applications. For that you need a corresponding list of the individual contacts — and not just any contacts, but those in tech decision roles with recent activity or expressed interest. (Of course, these contacts must also have opted in to being contacted by you!).

Recommendation: Ask the provider if they provide contact lists for the accounts they identify as active/in market. If they do, ask them the source of the contacts, and whether those contacts are “just names” or whether they are the actual people who generated the intent signals in the first place.

To learn more about how real purchase intent insight can significantly improve marketing efforts, fuel your pipeline and deliver better sales and marketing alignment, contact us today at [email protected].